Nuclear and next-generation energy stocks have been hot topics as investors hunt for clean-power winners, but many names remain speculative and prone to big swings on headlines and sentiment.

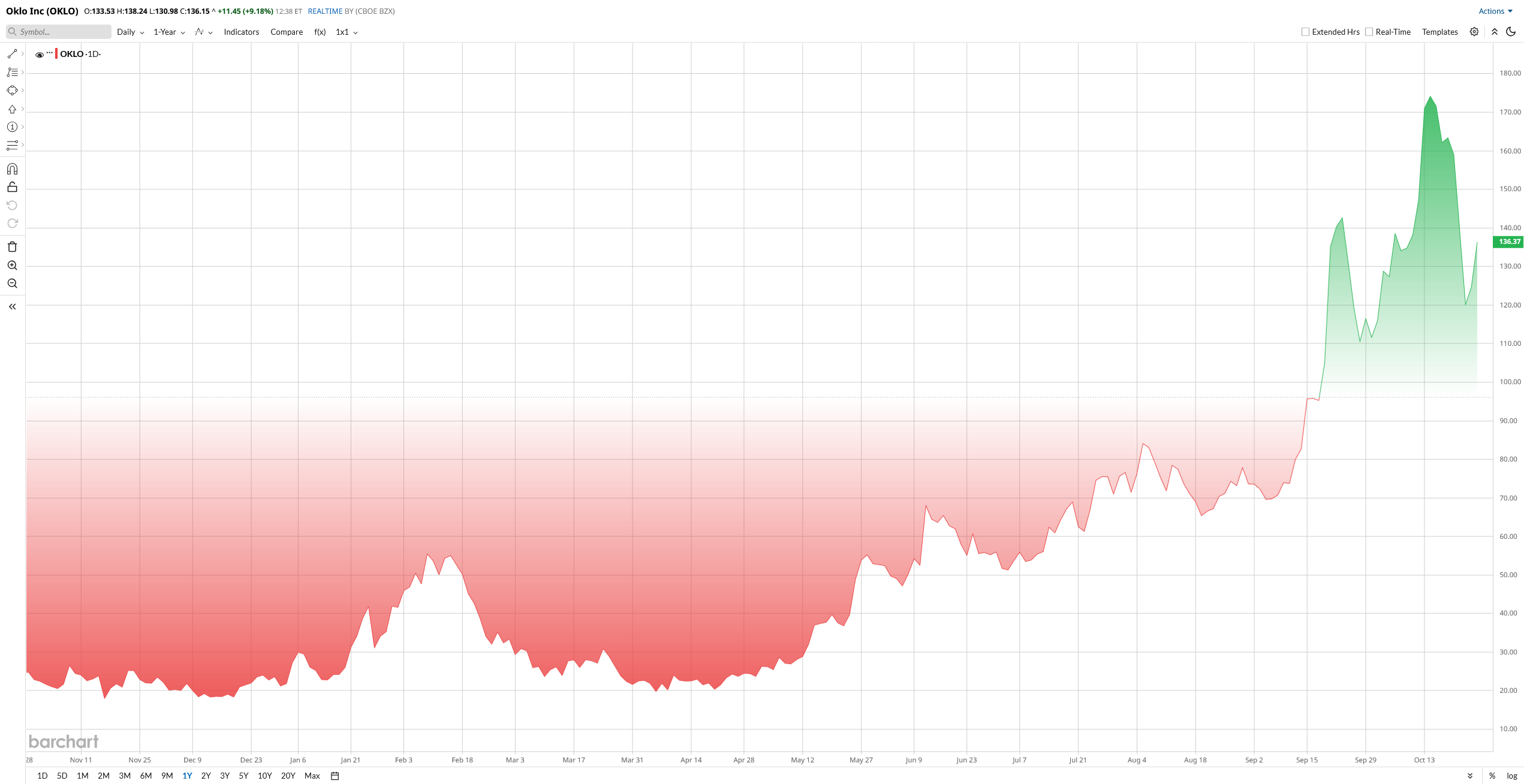

One of the most watched players, Oklo (OKLO), is having a rough week, with shares down more than 15% amid renewed questions about its valuation and pre-revenue status. Cathie Wood’s ARK Autonomous Tech ETF (ARKQ) trimmed about 53,353 OKLO shares, roughly $8.5 million, which added to selling pressure.

Oklo develops advanced fast reactors that aim to produce more fuel than they consume and can run on recycled nuclear waste, features that could make the technology efficient and appealing for data center power needs.For investors, the key is whether regulatory progress and concrete contracts arrive to justify holding through the volatility.

About OKLO Stock

California-based Oklo is a developer of advanced nuclear microreactors. Its flagship design, the Aurora Powerhouse, is a modular 75 MWe fast reactor engineered with passive safety features and fueled by recycled nuclear waste. Oklo aims to commercialize Aurora by 2027–2028, targeting data centers and other customers seeking reliable clean energy.

Valued at $18.5 billion by market cap, OKLO stock has been a market outlier in 2025. After trading in the low tens earlier in the year, the shares soared through the summer, up roughly 260% by July and on the order of 529% year-to-date (YTD) by now. Investors have been betting on nuclear’s role in the clean energy transition and the “AI boom.” Oklo touts Aurora as an “AI data center’s soul mate,” a small, 24/7 power source that could meet heavy computing loads. Government policy has also been a tailwind: broad bipartisan support and new federal nuclear initiatives helped fuel interest. In short, rising enthusiasm over Oklo’s future prospects created a huge momentum run.

Following the bull run, Oklo appears richly priced relative to its sector. Oklo’s price-to-book (P/B) ratio is on the order of 24x, vastly higher than the typical electric utilities' 2x median and slightly higher than its peer NuScale Power's (SMR) 20x.

Latest Quarterly Results

On Aug. 11, Oklo reported Q2 2025 results in which the company missed the bottom-line estimate. As expected, revenue was $0 (pre-revenue stage). The company posted a net loss of $24 million, compared with a loss of about $17.7 million in Q2 2024. Operating loss was $28 million (including $11.4 million of stock-based compensation), yielding an EPS of roughly –$0.18. That EPS loss narrowed from –$0.27 a year ago, reflecting a larger share count after its SPAC merger.

Cash burn remained high also; high management said $30.7 million was used in operating activities YTD, ending the quarter with about $683 million in cash and marketable securities. There were no revenue segments to report and no product customers yet.

Oklo reiterated its commercialization timeline: it still targets the first commercial operation of Aurora in late 2027/early 2028. Management offered no sales guidance (none is expected for 2025) but emphasized continued R&D and licensing expenses. As CEO Jake DeWitte noted on the call, “Nuclear power is already the most land and material efficient energy source,” reflecting confidence in the Aurora technology despite current losses.

Recent News and Developments

The mood of investors shifted on non-core operations-related news. On the downside, Oklo managed to pull the trigger this week, where, in line with a regulatory filing, ARK Invest sold its stake in Oklo.

Meanwhile, Oklo has also been making milestones; in early October, it declared a strategic alliance with Newcleo and Blykalla of Italy to construct U.S. fuel fabrication infrastructure. The agreement will include up to $2 billion in investment to back Oklo fuel recycling and the reactor program. The partnerships enable such partnerships in this area, as Oklo puts it, to work in strengthening energy innovation, leadership, and dominance in the United States, which has led to an increase in industrial interest. Other positives are that Oklo has been a qualified vendor to one of the advanced nuclear programs of the U.S. Defense Department and signed HALEU fuel supply contracts.

Overall, the news has been positive lately. In the short term, Cathie Wood's selling pressure is the opposite of energy partners' and policymakers' endorsements (and cash commitments). Licensing of the company is also being pursued. Phase 1 pre-application of Aurora at the DOE's Idaho National Lab is in process, and an NRC license application will probably be established by the end of 2025.

Longer-Term Outlook and Competitive Positioning

Oklo’s future hinges on successful tech execution in a growing clean-energy field. The company is positioned in the advanced nuclear segment (small modular and fast reactors). Its Aurora design aims for niche applications, e.g., data centers, hospitals, and defense installations that need 24/7 carbon-free power. This differs from peers like NuScale (water-cooled SMRs) or TerraPower (larger Natrium reactors), potentially giving Oklo a unique role. Emerging federal and state support for nuclear innovation, including recent executive orders and incentives, underpins the sector.

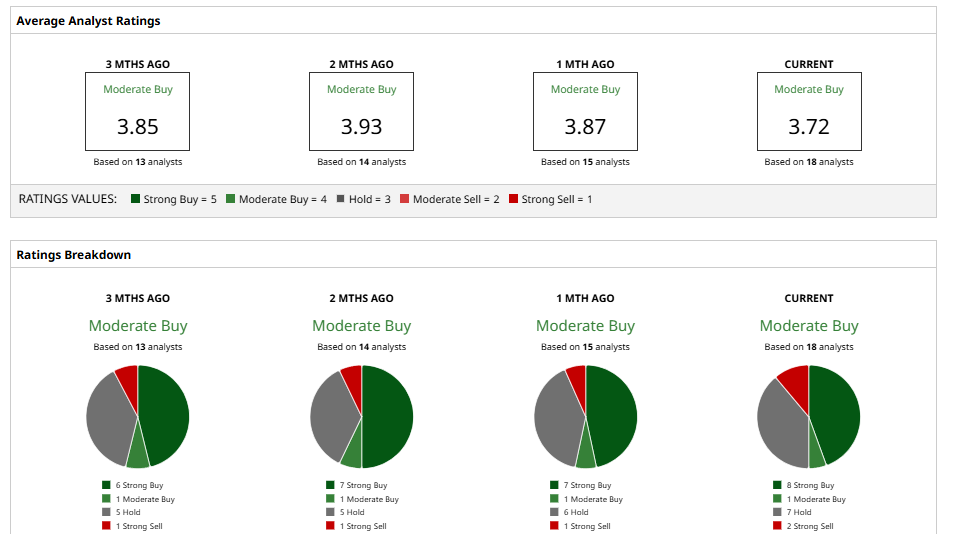

What Do Analysts Say About OKLO Stock?

On Wall Street, the consensus rating is a “Moderate Buy” with an average target of $93, implying about 30% downside.

Citi’s Vikram Bagri remains cautious, citing valuation risks despite raising his target to $68. Similarly, Bank of America’s Dimple Gosai downgraded the stock to “Hold,” calling its valuation “ahead of reality,” while Goldman Sachs echoed a “Neutral” stance at $117.

Meanwhile, H.C. Wainwright and Mizuho maintain “Buy” ratings, highlighting Oklo’s long-term potential despite short-term losses.

I think Oklo’s recent drop may look tempting, but it’s still a high-risk, pre-revenue bet with no regulatory approvals yet. The tech is promising, but years of spending and delays lie ahead before profits appear. For now, only long-term, risk-tolerant investors should consider buying this dip.