Shares of advanced nuclear technology company Oklo Inc (NYSE:OKLO) hit a new all-time high of $92.48 Monday morning. The stock has has climbed over 1,300% in the past year.

Shares of uranium and nuclear-linked stocks rose ahead of a nuclear energy deal between the United States and the United Kingdom.

The US Nuclear Regulatory Commission signed a refreshed MoU with the UK’s Office for Nuclear Regulation to streamline regulation and accelerate the deployment of advanced nuclear reactors across the UK and US markets.

What Else: Oklo’s rally Monday follows a series of strategic announcements over the past six weeks that highlight the company’s progress toward commercialization.

On September 4, Oklo unveiled plans for a new $1.68 billion advanced fuel recycling center to be built in Tennessee, a move aimed at creating a stable and secure U.S. fuel supply.

This followed a busy August, where the company announced a collaboration with Lightbridge to develop advanced nuclear fuels and an agreement with ABB to commission a monitoring room for its Aurora powerhouse.

Capping off the month, Oklo and its subsidiary were selected for three projects under the U.S. Department of Energy's new Reactor Pilot Program, signaling strong federal support for its technology.

While the company reported a second-quarter earnings miss in mid-August, investors seem focused on these positive operational and regulatory milestones as Oklo advances toward its goal of commencing commercial operations for its first powerhouse by late 2027 or early 2028.

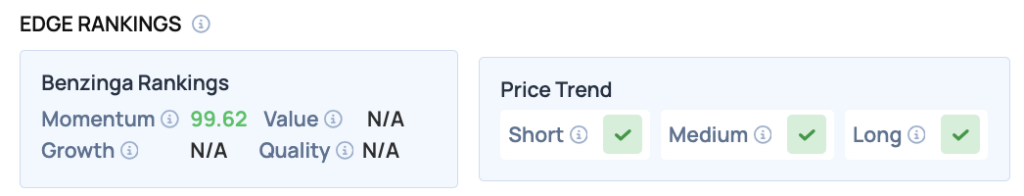

Benzinga Edge Rankings: The stock’s rally is underscored by its Benzinga Edge momentum score of 99.62, signaling exceptionally strong recent price performance.

Price Action: According to data from Benzinga Pro, OKLO shares are trading higher by 14.87% to $95.01 Monday afternoon. The stock has a 52-week high of $92.48 and a 52-week low of $6.08.

Read Also: What’s Going On With Nio Stock Monday?

How To Buy OKLO Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Oklo’s case, it is in the Utilities sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock