Oklo Inc (NYSE:OKLO) shares are rebounding Wednesday morning, trading higher after a volatile, two-day slide. Here’s what investors need to know.

- OKLO is delivering impressive returns. Check the fundamentals here.

What To Know: Oklo stock fell on Monday and Tuesday as a recent sector-wide rally, initially sparked by an $80 billion deal involving Cameco and the Trump administration, began to fade. Investors have been re-evaluating the nuclear startup's "fundamental risks," particularly its high valuation while the company remains in pre-revenue status.

The stock’s decline Tuesday is also linked to weakness in the broader AI sector. Palantir’s sharp drop Tuesday following third-quarter results created negative sentiment that is weighing on growth stocks.

Oklo is considered an AI-related stock because it aims to solve AI’s massive energy-demand crisis by building compact nuclear reactors to provide clean, reliable power directly to data centers.

Read Also: Earnings Are So Good It Hurts: Why This Market Rally Suddenly Feels Tired

What Else: Recent pressure was also linked to a Form S-3 filing, which allows Oklo to sell up to $3.5 billion in securities to fund future operations, raising concerns over potential dilution.

All eyes are now on the company’s upcoming third-quarter earnings report, scheduled for release after the market closes on Nov. 11. Analysts are forecasting a consensus loss of 13 cents per share.

Wall Street ratings on the stock remain mixed, with recent downgrades from firms like BofA Securities and Seaport Global contrasting with Buy initiations from Canaccord Genuity and Barclays.

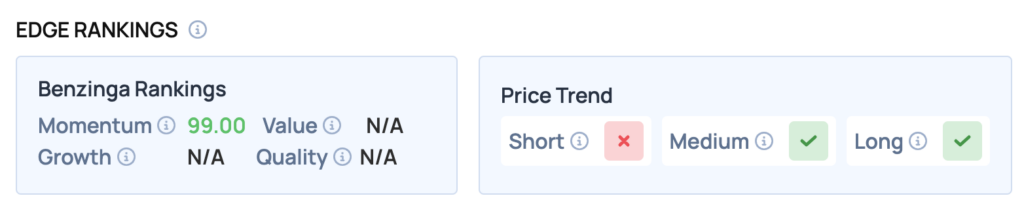

Benzinga Edge Rankings: According to Benzinga Edge, Oklo stock has a Momentum score of 99, suggesting the stock has been moving on strong tailwinds.

OKLO Price Action: Oklo shares were up 7.17% at $119.60 at the time of publication on Wednesday, according to Benzinga Pro data.

Read Also: Stock Market Today: Dow, S&P 500, Nasdaq Futures Slip But McDonald’s Rises After Q3 Beat

How To Buy OKLO Stock

By now you're likely curious about how to participate in the market for Oklo – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock