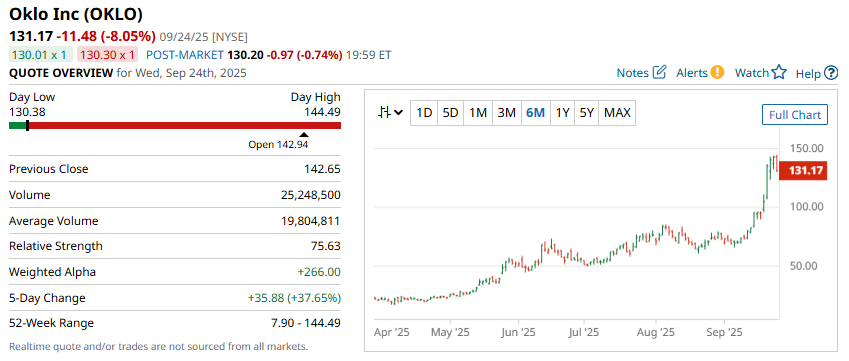

Oklo Inc. (OKLO) stock has gone parabolic in the last two weeks rising from $70 to $140 in that time. Volatility has also gone through the roof with implied volatility sitting at 120.83%.

I’m willing to bet that the stock won’t rise too much further, and today we’re going to look at a Bear Call spread trade that assumes OKLO won’t rise above 180 in the next three weeks..

A Bear Call spread is a bearish trade that also can benefit from a drop in implied volatility.

The maximum profit for a Bear Call spread is limited to the premium received while the maximum potential loss is also capped. To calculate the maximum loss, take the difference in the strike prices of the long and short options, and subtract the premium received.

OKLO BEAR CALL SPREAD

To create a Bear Call spread, we sell an out-of-the-money call and then by another call further out-of-the-money.

Selling the October 17 call with a strike price of $180 and buying the $180 call would create a Bear Call spread.

This spread was trading for around $0.50 yesterday. That means a trader selling this spread would receive $50 in option premium and would have a maximum risk of $450.

That represents a 11.11% return on risk between now and October 17 if OKLO stock remains below $180.

If OKLO stock closes above $185 on the expiration date the trade loses the full $450.

The breakeven point for the Bear Call spread is $180.50 which is calculated as $180 plus the $0.50 option premium per contract.

COMPANY DETAILS

The Barchart Technical Opinion rating is a 100% Buy with a Strengthening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Relative Strength just crossed below 80%. The market has dropped from extreme overbought territory, indicating a possible trend reversal.

Oklo Inc. is a clean power technology and nuclear fuel recycling company.

It involved in developing power plants to provide clean, reliable and affordable energy. Oklo Inc., formerly known as AltC Acquisition Corp., is based in NEW YORK.

Conclusion And Risk Management

One way to set a stop loss for a Bear Call spread is based on the premium received. In this case, we received $50, so we could set a stop loss equal to the premium received, or a loss of around $50.

Another stop loss level could be if the stock broke above $150.

Betting against stocks in a parabolic move is risky and is not for the faint hearted.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.