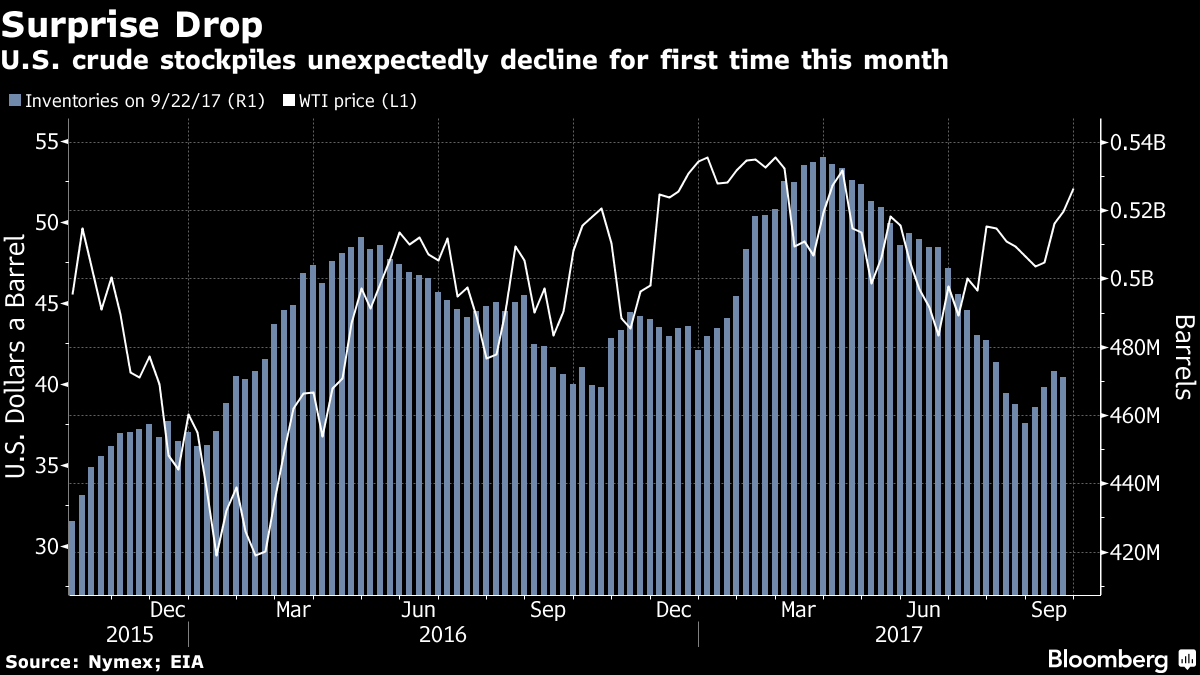

Oil prices dipped, stalling a bull-market rally, as traders weighed whether rising output from U.S. shale fields will dash OPEC’s effort to trim a worldwide glut of crude.

Futures fell as much as 1.6 percent in New York after earlier reaching a five-month high. U.S. government data released Wednesday showed American drillers lifted output almost 9 percent during the past three weeks, the biggest three-week increase in half a decade. The exuberance of U.S. explorers may offset supply curbs by OPEC and allied producers such as Russia.

“If we see signs of U.S. production levels rising, the market is really vulnerable to a turnaround right now,” said Gene McGillian, a market research manager at Tradition Energy in Stamford, Connecticut. “We’re probably going to see a softening here until we can see a real indicator that supply has come down.”

Oil has risen more than 20 percent since late June, the classic definition of a bull market, amid forecasts for improving demand, the return of U.S. Gulf Coast refiners after Hurricane Harvey, and Turkey’s threat to halt Kurdish crude shipments through its territory. The Organization of Petroleum Exporting Countries and Russia are urging fellow oil producers to honor promises to cut output, although the group has yet to decide on any extension of those curbs beyond March.

Even with some drillers idling rigs in U.S. oil fields, explorers have large backlogs of drilled wells that have yet to be turned on, McGillian said.

“At these levels, today’s action is an indicator that the market needs to be fed steady, positive information to really continue the rally,” he said.

See also: Exxon a Standout at Brazil’s First Oil Auction in Two Years

West Texas Intermediate for November delivery fell 84 cents to $51.30 a barrel at 12:40 p.m. on the New York Mercantile Exchange. Total volume traded was about 13 percent above the 100-day average.

Brent for November settlement fell 91 cents to $56.99 a barrel on the London-based ICE Futures Europe exchange. The global benchmark crude traded at a premium of $5.69 to WTI.

Oil-market news:

- Iraq said Turkey agreed to deal exclusively with its central government over exports of Kurdish crude oil, a step that could disrupt shipments from the independence-seeking Kurd region.

- Libya’s oil output is rising again after disruptions ended at its biggest field, with production reaching about 950,000 barrels a day even as OPEC and allied suppliers step up efforts to contain a global glut.

--With assistance from Ben Sharples and Rakteem Katakey

To contact the reporters on this story: Meenal Vamburkar in New York at mvamburkar@bloomberg.net, Jessica Summers in New York at jsummers24@bloomberg.net.

To contact the editors responsible for this story: Carlos Caminada at ccaminada1@bloomberg.net, Joe Carroll

©2017 Bloomberg L.P.