Offerpad Solutions Inc. (NYSE:OPAD) stock is trending on Friday.

Check out the current price of OPAD stock here.

iBuyer Stock Extends Volatile Trading Pattern

OPAD dropped 26.65% to $4.57 during after-hours trading on Thursday, following an 85.42% intraday surge.

Fed Policy Optimism Drives Initial Rally

OPAD’s morning surge mirrored moves in Opendoor Technologies Inc. (NASDAQ:OPEN), as Federal Reserve rate cut expectations boosted iBuyer sentiment. Both companies’ business models depend heavily on housing turnover and mortgage affordability, making them sensitive to interest rate policy.

See Also: Why Is Movano Stock Surging 68% In After-Hours Trading?

Investment banks, including Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and JPMorgan Chase (NYSE:JPM) have forecasted multiple Fed easing rounds through 2026. Lower borrowing costs would directly benefit companies relying on housing market activity.

Technical Resistance Triggers Selloff

The Californian online real estate company hit technical resistance near $4.85 mid-week, a level that has repeatedly triggered selling pressure over two years. The subsequent selloff cascaded to OPAD, with investors treating it as a “high-beta version” of Opendoor.

OPAD has surged over 310% in two months, driven partly by retail investor frenzy surrounding Opendoor’s 821% rally.

Price Action: According to Benzinga Pro, Offerpad closed at $6.23 on Thursday.

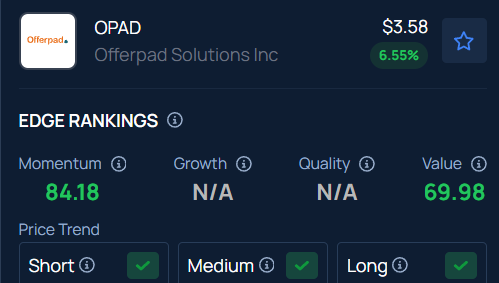

OPAD is showing strong momentum, ranking in the 84th percentile according to Benzinga’s Edge Stock Rankings, with a positive price trend across all time frames. See how its momentum compares to other well-known stocks.

Photo: Around the World Photos / Shutterstock

Read Next: