Offerpad Solutions Inc. (NYSE:OPAD) closed at $4.98 on Wednesday, down 2.54% for the day, continuing the real estate technology company’s volatile trading pattern amid shifting investor sentiment and ongoing speculation around potential Federal Reserve rate cuts.

Check out the current price of OPAD stock here.

Fed Policy Expectations Drive iBuyer Rally

The California-based online real estate company saw gains similar to its competitor, Opendoor Technologies Inc. (NASDAQ:OPEN), as expectations of upcoming Fed rate cuts lifted investor confidence in iBuyer stocks. Since both companies rely heavily on home sales and affordable mortgages, they tend to react strongly to changes in interest rates.

See Also: Peter Thiel-Backed Bullish Is Trending Overnight: Here’s Why

Big investment banks like Morgan Stanley, Goldman Sachs, and JPMorgan Chase expect the Federal Reserve to cut interest rates several times between now and 2026.

Recent Stock Volatility Highlights Sensitivity

Over the past year, OPAD has staged a dramatic turnaround. It closed at just 91 cents on June 30 with only 82,000 shares traded. By August 28, the stock had surged to a high of 6.23 dollars on a massive volume of 112 million shares. Although it pulled back slightly, it remained well above its earlier lows, closing yesterday at $4.98, according to Benzinga Pro data, with a solid trading volume of 7.6 million shares, showing continued investor interest.

Although the volume was strong, it's still much lower than the average of 324.25 million shares, showing that trading activity can vary a lot for this stock.

Retail Interest Amplifies Movement

The stock has posted gains exceeding 315% over the past month, driven partly by retail investor interest following similar momentum in Opendoor shares, which surged 108.54%. Lower borrowing costs from potential Fed cuts would directly benefit companies dependent on housing market activity

OPAD trades within a 52-week range of $0.91-$6.35 with a market capitalization of $152.31 million.

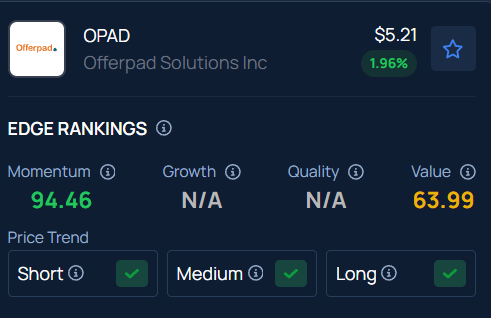

With a strong Momentum in the 94th percentile, Benzinga’s Edge Stock Rankings indicate that OPAD has a positive price trend across all time frames. Know how its momentum lines up with other well-known names.

Read Next:

Photo: Around the World Photos / Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

.jpg?w=600)