A Lanarkshire businessman took out a £50,000 taxpayers-backed loan and withdrew the cash before the company was wound up.

Thomas Whyte's firm had just £203 in its bank account when he applied for and received the Bounce Back Loan for the dormant Fortress Restructuring Ltd.

The company's only asset at that time was £100 share capital and less than £1,000 had been paid into the account in the year before the 76-year-old applied for the money, designed to support businesses struggling to cope during the covid pandemic.

READ MORE: Barlinnie prisoner injured in shower room attack by Glasgow murderer

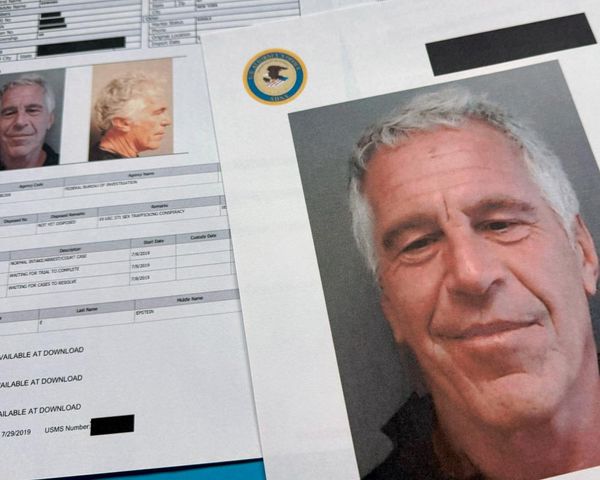

An investigation by the UK Insolvency Service discovered that Whyte, from Carluke, claimed the company had a turnover of £250,000 when he applied for the loan in May 2020.

In October that year the firm told the UK Government run service that it had no trading address, had never traded and was not currently trading.

Liquidators were appointed and details of Fortress' financial set up were unearthed

The Secretary of State for Business petitioned the Court of Session for the company to be wound up in the public interest. Four days after it was made public on February 1, 2021, a copy was emailed to Whyte.

He denied to the Insolvency Service that he had received the petition until late February, although he acknowledged receipt of the email on February 5. The balance on the company account reduced between February 5 and 16 from £28,150 to a little over £1,590 with payments made to Whyte, the company accountant and others.

The pensioner did not dispute that he had applied for the loan for his company that it wasn't entitled to and disposed of the money when he knew, or should have known, it was being wound up.

He has been banned from running a company for 10 years as a result of the investigation and £37,500 was later recovered by the liquidator.

Rob Clarke, chief investigator at the Insolvency Service, said: "Bounce Back Loans were for trading companies adversely affected by the pandemic and to be spent on legitimate business expenses.

"The fact that Fortress had filed dormant accounts, and only £949 had passed through its bank account should have made it abundantly clear to Thomas Whyte that his company was not entitled to a £50,000 loan, yet he took it anyway and used the majority of that money for his own benefit.

“We thank the liquidator for their efforts which have seen £37,500 recovered, and repeat that we will not hesitate to take action against directors who have abused Covid-19 financial support in this manner.”

READ NEXT:

On the run gangster questioned over Dumbarton mum's murder 'may never be found'

Dead mum's stolen ashes returned by thief who dropped them off at back door

Stalker sexually assaulted pregnant young mum after following her from nursery

Missing Glasgow man is love rat crook who has been ripping off women for 30 years

Glasgow man saves stranger's life with perfect match stem cell donation