/O)

O’Reilly Automotive, Inc. (ORLY), headquartered in Springfield, Missouri, is a prominent player in the auto parts retail industry, offering a comprehensive range of aftermarket car parts, accessories, and service solutions.

With a market capitalization of $89.7 billion and over 6,400 stores operating in the U.S., Puerto Rico, Mexico, and Canada, the company services professional installers and consumers alike through a strong distribution model and an emphasis on recycling and diagnostic services. O’Reilly Automotive is set to report its third-quarter results on Wednesday, Oct. 22, after the market closes.

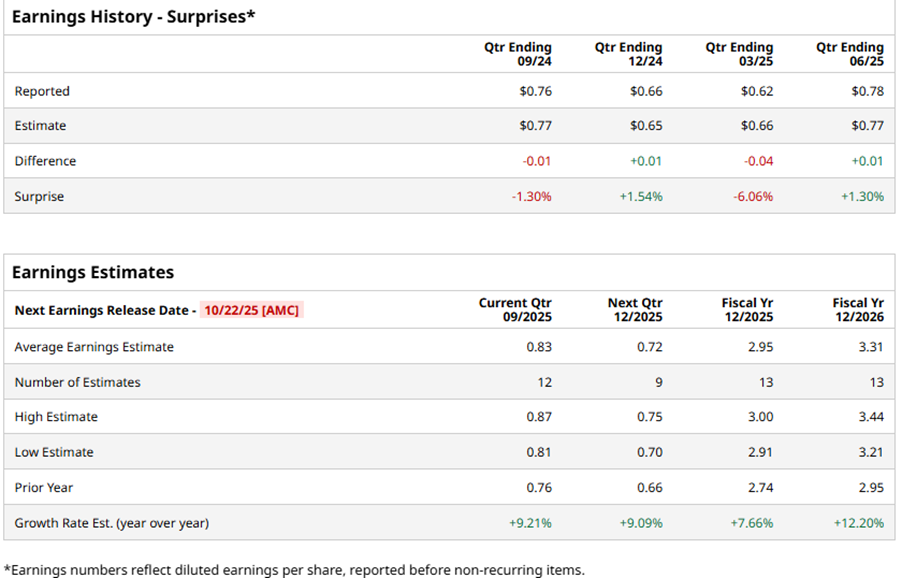

Ahead of the results, Wall Street analysts expect O’Reilly Automotive to report a profit of $0.83 per share on a diluted basis in Q3, up 9.2% year-over-year (YOY) from $0.76 per share in the prior year’s period. The company has a mixed earnings surprise history, having surpassed estimates in two of the last four quarters and missed them in two instances.

Analysts also expect the company to grow its bottom line for the current year. For the full fiscal year 2025, Wall Street analysts expect O’Reilly Automotive’s diluted EPS to grow by 7.7% YoY to $2.95, and then rise by another 12.2% annually to $3.31 in fiscal 2026.

O’Reilly Automotive’s shares have been outperforming the broader market over the past year. Over the past 52 weeks, the ORLY stock has gained 36.3%, while it is up 32.8% year-to-date (YTD). On the other hand, the broader S&P 500 Index ($SPX) has increased by 17.6% and 14.2% over the same periods, respectively.

The company is categorically placed under the consumer cyclical sector due to the discretionary nature of its business. The Consumer Discretionary Select Sector SPDR Fund (XLY) has gained 21% over the past 52 weeks and 6.7% YTD. Therefore, O’Reilly Automotive has also been an outperformer in its sector.

On July 23, O’Reilly Automotive reported better-than-expected second-quarter results. This led to the company’s stock surging 2.9% intraday on July 24. Its revenue increased 5.9% year-over-year (YOY) to $4.53 billion. This was in line with what analysts had expected. Its EPS was $0.78 for the quarter, up by 9.9% annually and higher than the $0.77 that analysts had expected.

The company’s store sales are working well. In the first half of this year, O’Reilly Automotive opened 105 net, new stores across 34 U.S. states, Puerto Rico, and Mexico. For the entire year, it has projected a target of 200 to 210 net, new stores.

Wall Street analysts have been bullish about ORLY’s prospects. Among the 28 analysts covering the stock, it has a consensus rating of “Strong Buy” overall. The configuration of the ratings is more bullish than it was a month ago, with 20 “Strong Buy” ratings now, up from 19. The stock also has two “Moderate Buy” ratings, and six analysts are recommending a “Hold.”

The mean price target of $110.65 indicates a 5.4% upside from current levels, while the Street-high price target of $125 implies that ORLY stock can surge as much as 19.1%.