/Jen-Hsun%20Huan%20NVIDIA)

Nvidia’s (NVDA) share price has been on a tear this year as the company dominates the booming artificial intelligence (AI) market. In mid-August 2025, however, a new rumor sparked investor jitters: a Taiwanese research note from Fubon Research claimed Nvidia’s upcoming “Rubin” AI GPU (codenamed “Vera Rubin”) might be delayed due to a redesign aimed at countering AMD’s planned MI450 accelerator. According to the report, the first Rubin silicon had already taped out in late June 2025, and Nvidia was allegedly pausing production to tweak the design, a change that could push volume shipments into late 2026. Nvidia quickly rejected this narrative. Company spokespeople told Barron’s and other outlets that the report was “incorrect” and that Rubin remains on track per the existing roadmap.

In short, Nvidia insists its Rubin architecture is still expected in second-half 2026, following its annual product cadence.

About NVDA Stock

Based in Santa Clara, California, Nvidia builds the processors and software that power modern artificial intelligence, most famously its GPUs and the full software stack (CUDA/CUDA-X) that many AI developers use.

Nvidia’s business now centers on a few high-growth pillars, gaming GPUs, professional visualization, automotive solutions, and, most important lately, data center AI. The company briefly became the world’s first publicly traded company to reach a $4 trillion market capitalization in July 2025, a market achievement that reflects investor expectations about persistent AI-driven demand.

NVDA shares have been one of the top performers in tech in 2025, up about 29% year-to-date (YTD), versus the S&P 500 (SPY) Information Technology sector’s ($SRIT) roughly 12% YTD gain in the same period.

Following the robust rally, NVDA's valuation has reached an elevated level, with its Price-to-Sales (P/S) at 30, markedly higher than the sector median of 3. This suggests the stock is priced at a premium compared to its peers.

NVDA Set to Report Its Q2 Earnings

Nvidia’s Q2 report, which is due on Aug. 27 will be less about a single beat-or-miss and more about proof that the AI demand engine keeps humming despite geopolitics and inventory noise. Management already guided Q2 revenue to roughly $44 billion, give or take 2%. The company also warned that its profit margins could be a little tighter this quarter because of costs tied to unsold China-focused chips.

The big question for Q2 is whether demand for Nvidia’s chips is expanding beyond just the big cloud providers and into regular enterprise customers. Investors will also be looking to see if profit margins hold steady in the low-to-mid 70% range, as management hinted. If Nvidia beats Wall Street’s revenue and earnings estimates while keeping free cash flow strong, the bullish story stays intact, showing the company can handle short-term export setbacks while still investing heavily and buying back stock.

On the flip side, any cautious remarks about Rubin’s timing, China sales, or weaker orders could spark volatility, since the stock is already priced for perfection.

In short, the market’s reaction will likely depend on guidance, margin trends, and what management says about supply and demand over the next few quarters.

What Do Analysts Say About Rumored Rubin Delays?

Wall Street analysts have mostly taken Nvidia’s side in this debate. For example, Morgan Stanley reaffirmed an “Overweight” rating on NVDA, noting the Rubin project shows no signs of delay. The bank expects final design work to complete by March 2026, with tapeout and mass production scheduled for the second quarter of 2026 and full system ramp by the third quarter of 2026.

In Morgan Stanley’s view, the Rubin timeline is unchanged despite the rumor, and investors should “remain calm” rather than overreact. Other firms have echoed this message. As one market commentator put it, Nvidia “denied that its next-gen Rubin GPU architecture was delayed.”

Despite the chatter, analysts still expect Nvidia’s upgrade cycle to continue powering growth. Rubin will eventually succeed the current Blackwell architecture, and a subsequent “Rubin Ultra” is slated for 2027.

Even if Rubin were to slip a few months, Nvidia would have an enormous backlog and an ongoing demand for existing GPUs (the Hopper/Blackwell line) to sustain near-term revenue. In other words, the baseline assumption is that there is no meaningful delay to Rubin, and the stock should not be punished on rumor alone.

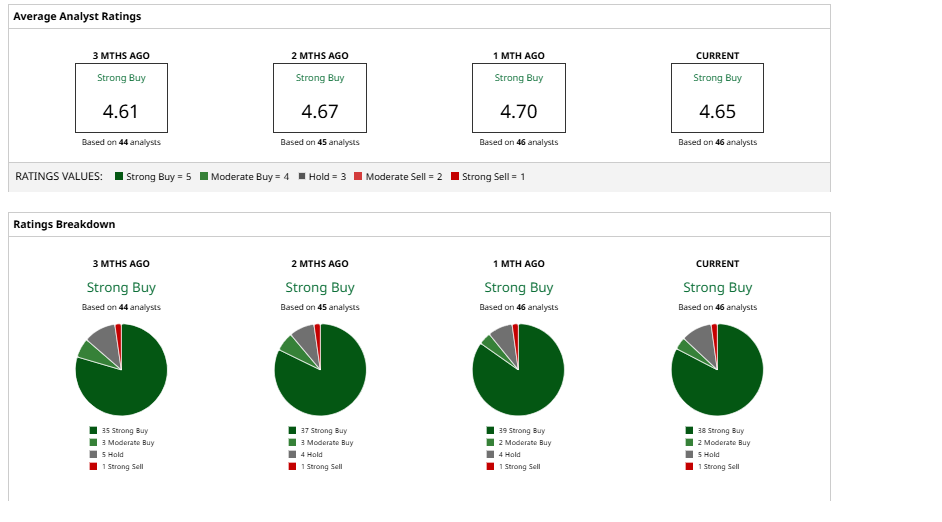

Overall, Wall Street analysts maintain a consensus ‘Strong Buy’ rating on NVDA stock, with a mean price target of $187.67, implying an upside potential of about 6.87% from current levels.