Two weeks after Nvidia issued a sales and margin warning, all eyes are on the quarterly guidance that’s expected in the company’s Wednesday earnings report.

Among analysts polled by FactSet, the consensus is for Nvidia to report July quarter (fiscal second quarter) revenue of $6.7 billion, GAAP EPS of $0.35 and non-GAAP EPS of $0.50. The revenue consensus matches the figure for the quarter given in Nvidia's August 8 pre-announcement.

For the October quarter -- Nvidia typically shares quarterly sales, margin and expense guidance in its reports -- the revenue consensus stands at $6.91 billion (down 3%).

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Nvidia’s earnings, which is expected at 4:20 P.M. Eastern Time, along with a conference call with management that’s scheduled for 5 P.M.

Please refresh your browser for updates.

6:14 PM ET: Nvidia's call has ended. Shares are down 4.5% after-hours to $164.47 after the company reported July quarter numbers that roughly matched what was expected following its Aug. 8 pre-announcement and guided for October quarter sales of $5.9B (+/- 2%), below a $6.91B consensus. Nvidia forecast Gaming and Pro Visualization segment sales will be down Q/Q, and that Data Center and Automotive sales will be up.

During the earnings call, CEO Jensen Huang said Nvidia thinks its sell-in of gaming GPUs to channel partners is well below end-demand (sell-through), and that it's looking to clear inventory ahead of upcoming gaming GPU refreshes. He also admitted the delayed rollout of Intel's next-gen server CPU platform (Sapphire Rapids) is disruptive, while adding server GPU sales to cloud clients remain supply-constrained and that Nvidia expects strong sales for its new H100 (Hopper) server GPU.

Thanks for joining us.

6:05 PM ET: Huang with some closing remarks. Reiterates Nvidia is seeing Gaming-related headwinds right now, while also saying demand for its Data Center products has never been stronger and that Automotive revenue is inflecting. Once more talks up the impact of things such as new AI models, Omniverse and autonomous driving, and notes Nvidia will be making announcements at its next GTC conference (set for Sep. 19-22).

6:01 PM ET: A question about gaming GPU pricing and how much Nvidia sees it normalizing amid softening crypto-related demand.

Huang says that without the crypto dynamic, gaming GPU mix would still go down. But adds the long-term trend is for ASP growth, and that Nvidia thinks GeForce ASPs should "drift towards" the ASP of a game console over time. Also notes GPUs used to support cloud gaming services tend to be high-end.

5:56 PM ET: A question about softening ProViz demand.

Kress notes workstation GPU sales were previously supply-constrained, and that OEMs are now looking to pare inventories that they've built up. Says end-demand is still solid.

Huang notes most of Nvidia's ProViz sales are driven by installed-base upgrades, and that this contrasts with AI-related deployments for server GPUs, which tend to involve brand-new deployments.

5:54 PM ET: A question about enterprise-related Data Center demand.

Kress says Data Center's split between enterprise and hyperscalers has traditionally been around 50/50, and that it was around there in FQ2.

5:53 PM ET: A question about whether Nvidia's FQ3 non-GAAP GM guidance of ~65% assumes any more write-downs. Also one about how much a mix shift towards Data Center provides a margin boost.

Kress says Nvidia's GM will benefit from a mix shift towards Data Center, while adding lower high-end gaming GPU sales and higher Automotive revenue will be headwinds. Indicates the guidance doesn't assume more inventory corrections.

5:51 PM ET: A question about how much of the inventory charge is related to Data Center vs. Gaming, and whether expectations have changed for its Ampere (A100) server GPUs.

Kress says the inventory charges cover both GPUs and memory, and suggests the size of its Data Center inventory has been larger than the size of its Gaming inventory. Charges are said to be for current-gen products rather than next-gen products. Reiterates Nvidia's Data Center expectations remain solid.

Huang reiterates Hopper was built with transformer models in mind, and that Nvidia expects it to be quite successful.

5:47 PM ET: Another supply-chain question.

Kress says Nvidia's supply-chain execution has been phenomenal. She says some supply arrived a little late in FQ2, which impacted Data Center.

5:45 PM ET: A question about networking product supply.

Kress says Nvidia has been working to improve networking supply, and that its networking sales grew strongly Q/Q and Y/Y in FQ2.

Nvidia is now down 4.7% AH. The Sapphire Rapids comments might be weighing.

5:44 PM ET: A question FQ3 puts and takes, and one about whether Hopper could re-accelerate Data Center growth.

Kress reiterates Nvidia's FQ3 sales expectations for various segments, and indicates Automotive revenue is expected to grow Q/Q in both FQ3 and FQ4.

Huang reiterates Gaming GPU sell-in is well below sell-through ahead of next-gen launches. Regarding Hopper, he notes it was designed with transformer model performance in mind, and expects strong uptake for it.

5:40 PM ET: A question about Data Center inventory charges. and whether a delayed ramp for Intel's next-gen server CPU line (Sapphire Rapids) is an issue.

Kress says Nvidia had high expectations for Data Center, and that its expectations are still high, but that it wanted to take the chance to right-size its inventory levels given the current environment.

Huang admits the Sapphire Rapids delay is disruptive, while noting Hopper also supports current-gen CPUs and that the delay won't impact Nvidia's ability to bring it to market.

5:35 PM ET: A question about whether Data Center revenue would be up Q/Q in the absence of any pull-in. Also one about U.S. and Chinese hyperscaler demand in FQ3.

Kress notes supply-chain issues (parts shortages, logistics issues, etc.) were a major challenge for Data Center in FQ2, and that this led Nvidia to work with customers to "optimize" supply and demand during the quarter.

Huang says Chinese hyperscalers have significantly slowed their spending this year, even as North American demand has remained strong. Says this slowdown "can't last forever," given their cloud needs.

He also says Nvidia is racing to up supply of its new H100 (Hopper) flagship server GPU, and that it expects to ship a "substantial" number of Hopper GPUs in FQ4.

5:30 PM ET: A question about when Nvidia sees Gaming revenue rebounding, and one about whether Data Center demand could weaken due to lower cloud capex.

Huang reiterates GeForce GPU sell-through is still solid, and that Nvidia's strategy is to keep sell-in "well below" its sell-through for a couple of quarters to bring down inventory.

Regarding Data Center, he says GPU supply remains short of demand in the cloud. Notes new workloads are boosting demand, and once more talks up the impact of new deep learning recommender systems and transformer models. Also notes that building high-performance AI systems also requires various other advanced components, and that shortages of them have contributed to supply-chain constraints.

Nvidia has pared its losses a bit: Shares are now down 2.8% AH.

5:23 PM ET: First question is about what normalized Gaming revenue looks like, and whether there could be additional inventory charges as Nvidia refreshes its gaming GPU lineup.

Kress says Nvidia "has likely undershipped" gaming demand in FQ2/FQ3 due to channel inventory corrections, and that Gaming sell-through for the quarters is likely around $5B. Regarding inventory write-downs, she says Nvidia did "a thorough assessment" of its supply needs during the quarter.

Jensen Huang says Nvidia's gaming GPU sell-through is off its early-2022 highs, but remains "very solid." Notes gaming GPUs are increasingly used by eSports gamers, content creators, etc. Suggests Nvidia is cutting gaming GPU prices to clear inventory ahead of the launch of its next-gen GPUs, and that the company is aiming "to be in good shape" heading into 2023.

5:18 PM ET: Kress says the FQ3 report will be posted on Nov. 16, and then opens the floor to analyst questions. Shares are now down 3.9% AH.

5:17 PM ET: She also says Nvidia has pared its spending plans on account of current headwinds. The company is guiding for FQ3 non-GAAP opex of $1.82B, up slightly from FQ2's $1.75B (opex had been growing faster in many recent quarters).

5:14 PM ET: Kress notes Nvidia's inventory charges are related to purchase commitments, while adding Nvidia thinks its long-term gross margin profile is intact.

5:13 PM ET: Kress goes over Nvidia's ongoing Data Center momentum with hyperscalers. Also highlights a recent AI inference win with Pinterest, an AI training win with Tesla, (which revealed its proprietary D1 Dojo AI training chip last year), and engagements with major server OEMs for its Grace Arm CPU (due in 2023).

5:09 PM ET: Regarding Automotive, Kress says self-driving solutions were a particular strong point, and that Nvidia thinks FQ2 was "an inflection point" for the segment. Notes Nvidia's Automotive design win pipeline stands at $11B.

5:06 PM ET: Kress notes registered users for the GeForce Now cloud gaming service now top 20M. Also says GeForce GPU sell-through remains 70% above pre-pandemic levels.

Regarding ProViz (workstation GPU) revenue, Kress says enterprise demand softened and that OEMs are paring inventory.

5:05 PM ET: Kress is talking. She starts off by going over current Gaming headwinds, noting both unit and ASPs fell for the segment during the quarter and that macro issues weighed on consumer demand.

She also says (in line with past remarks) Nvidia can't quantify the impact lower crypto-related demand had on Gaming revenue.

5:03 PM ET: Nvidia is going over its safe-harbor statement. Its call typically features prepared remarks from CFO Colette Kress, after which Kress and CEO Jensen Huang take questions from analysts.

5:01 PM ET: The call is starting. Nvidia's stock is down 2.8% AH going into it.

4:56 PM ET: The earnings call should kick off shortly. Here's the webcast link, for those looking to tune in.

4:55 PM ET: FQ2 free cash flow was $824M, down from $1.35B in FQ1 and $2.48B a year earlier. Nvidia ended the quarter with $17B in cash/equivalents and $10.9B in debt.

4:50 PM ET: Amid its inventory charges, Nvidia's inventory rose to $3.89B in FQ2 from $3.16B in FQ1 and $2.11B a year earlier.

"Gross inventory purchase and long-term supply obligations," a large portion of which are believed to involve foundry partners TSMC and Samsung, totaled $9.22B at quarter's end. That's up from $4.79B a year earlier, but down a bit from $9.59B at the end of FQ1.

4:48 PM ET: Of note: Nvidia says its FQ2 Data Center revenue +61% to $3.81B) "included $287 million for orders originally scheduled for delivery primarily in the third quarter that were converted to second-quarter delivery with extended payment terms."

At the same time, the company says "a number of second-quarter [Data Center] orders will be fulfilled in the third quarter given supply chain disruptions."

4:46 PM ET: Professional Visualization revenue (much of it involves workstation GPU sales) was down 20% Q/Q and 4% Y/Y to $496M. Notebook workstation GPU sales rose, but desktop sales fell, "particularly at the high end."

4:44 PM ET: Nvidia has pulled back a bit: Shares are now down 2.9% AH to $167.31.

4:42 PM ET: Automotive revenue, which rose 59% Q/Q and 45% Y/Y to $220M, benefited from higher demand for "self-driving and AI cockpit solutions," partly offset by lower "legacy cockpit" (infotainment SoC) revenue.

4:40 PM ET: On the bright side, Nvidia says Data Center segment sales to cloud giants (hyperscalers) nearly doubled Y/Y. Hyperscalers have been an area of strength for a while, thanks in part to the large AI training and inference investments they're making.

Sales to North American hyperscalers also rose Q/Q, while sales to Chinese hyperscalers fell Q/Q. Sales to "vertical industries" clients (i.e. enterprises) rose Q/Q and Y/Y by an unspecified amount.

4:36 PM ET: As indicated in its warning, Nvidia says gaming GPU sales were hurt by lower sell-in to channel partners (i.e. graphics card makers), as well as "pricing programs with channel partners to address challenging market conditions that are expected to persist into the third quarter."

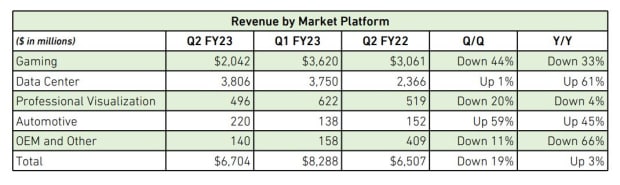

4:34 PM ET: Nvidia's CFO commentary is up. Here's a table within it that shows segment-level revenue:

4:30 PM ET: Nvidia notes it spent $3.44B on buybacks/dividends in FQ2, and says it plans to continue buybacks in FY23 (ends in Jan. '23).

The "payments related to repurchases of common stock" line in Nvidia's cash-flow statement shows $3.35B worth of buyback-related payments.

4:26 PM ET: Also perhaps helping: The company is guiding for an FQ3 non-GAAP gross margin of 65%, plus or minus 50 bps. That suggests it doesn't expect to take major inventory charges during the quarter.

4:25 PM ET: Perhaps helping out Nvidia's shares: The company says that while Gaming and Professional Visualization segment revenue is expected to be down Q/Q in FQ3, Data Center and Automotive revenue is expected to be up.

4:24 PM ET: The FQ3 sales guide is well below consensus. But investor expectations were low following Nvidia's warning. Shares are now up down just 0.6%.

4:22 PM ET: Shares are down 1.9% after-hours.

4:21 PM ET: Results are out. FQ2 revenue of $6.7B matches consensus. Non-GAAP EPS of $0.51 beats by $0.01.

Nvidia guides for FQ3 revenue of $5.9B, plus or minus 2%. That's below a $6.91B consensus.

4:11 PM ET: One thing to keep an eye on as Nvidia reports: Whether the company will be taking any more inventory-related charges in FQ3.

In its warning, Nvidia said it's taking $1.32B worth of charges (primarily inventory-related) for FQ2, with the company's GPU purchase commitments with foundries believed to be the main culprit. Due to the charges, Nvidia forecast an FQ2 non-GAAP gross margin of just 46.1% (+/- 50 bps), well below original guidance of 67.1%.

4:01 PM ET: Nvidia closed up 0.2%. The FQ2 report is expected at 4:20 PM ET.

4:00 PM ET: Along with its FQ3 sales guidance, any commentary Nvidia shares about demand trends for its Gaming and Data Center segments will be closely watched.

In its warning, the company estimated Gaming segment sales were down 33% Y/Y in FQ2, thanks to softer gaming GPU demand and channel inventory corrections. On the flip side, Data Center revenue was estimated to be up 61% Y/Y, thanks in part to strong server GPU demand from cloud giants.

3:56 PM ET: Ahead of the report, Nvidia's stock is up 0.7% today to $172.90. But shares are still down 41% YTD, thanks to broader tech-sector weakness and concerns about gaming GPU demand trends.

3:53 PM ET: The FactSet consensus is for Nvidia to report FQ2 revenue of $6.7B (in line with the number given in their warning) and non-GAAP EPS of $0.50.

The FQ3 revenue consensus stands at $6.91B, though it's possible (given Nvidia's warning) that informal expectations are lower.

3:51 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Nvidia's earnings report and call.