While semiconductor giant Nvidia Corp. (NASDAQ:NVDA) has easily ranked among the elite players in artificial intelligence, the company's upcoming second-quarter earnings report — scheduled for release on Aug. 27 after the closing bell — may arguably be its most consequential so far. As usual, expectations are sky-high thanks to Nvidia's blistering success in feeding the generative AI machinery. At the same time, consistent victories can ironically become a headwind due to the bar being raised unrealistically high.

Indeed, the technical case for NVDA stock lays out the dilemma perfectly. For the first few months of the year, NVDA struggled as the global economy wrestled with the policy implications broadcast by President Donald Trump. However, as it became clear that the White House wasn't willing to go full bore with punishing tariffs, the somewhat conciliatory attitude helped bolster the security.

Still, NVDA stock may be at a technical crossroads. Yes, on a year-to-date basis, it has gained roughly 36%. But the problem now is whether NVDA can sustain earlier momentum. In the trailing month, the equity gained only about 5%. In the business week ending Aug. 15, NVDA slipped nearly 1%. Naturally, a lot rides on the tech juggernaut's upcoming earnings report.

Heading into the second-quarter disclosure, Wall Street analysts are targeting earnings to land at $1 per share. In the year-ago period, Nvidia managed to post earnings of 68 cents per share. On the top line, experts are looking for $45.73 billion. That's a massive leap from one year ago, when the company rang up $30.04 billion in sales.

Certain analysts are even more bullish than the consensus. One example is BofA Securities analyst Vivek Arya, who maintained a Buy rating with a share price target of $220. Arya re-rated NVDA stock ahead of earnings, citing strong sales momentum and long-term earnings potential. The analyst sees second-quarter revenue hitting $47 billion, which would be a 56.46% jump from the year-ago period's result.

While Nvidia has witnessed demand growth for its flagship processors like Blackwell and Blackwell Ultra, there are also concerns about blistering fundamental premiums. For example, the semiconductor industry has an average price-to-sales ratio of 4.48. NVDA stock tips the scale at just over 30.

It's also worth mentioning that Arya — who is otherwise bullish on NVDA stock — cited near-term volatility risks, in part due to the security's strong run this year.

The Direxion ETFs: With ample opportunities for traders on both sides of the aisle to consider, Nvidia presents an intriguing story ahead of its key financial disclosure. To serve its audience's diverse needs, Direxion introduced two NVDA-focused exchange-traded funds. For the optimist, the Direxion Daily NVDA Bull 2X Shares (NASDAQ:NVDU) seeks the daily investment results of 200% of the performance of NVDA stock. On the other end, the Direxion Daily NVDA Bear 1X Shares (NASDAQ:NVDD) seeks 100% of the inverse performance of the namesake equity.

While these products offer many practical applications, a key driver of Direxion ETFs is flexibility. Usually, traders interested in leveraged or short positions must engage the options market. However, financial derivatives carry complexities that may not be suitable for all investors. In contrast, Direxion ETFs can be bought and sold much like any other publicly traded security, thus mitigating the learning curve.

Still, traders interested in these funds must recognize their unique risk profile. First, leveraged and inverse ETFs typically incur greater volatility than funds tracking benchmark indices, such as the Nasdaq Composite index. Second, Direxion ETFs are designed for exposure lasting no longer than one day. Holding these ETFs longer than recommended may expose traders to value decay due to the daily compounding effect.

The NVDU ETF: Since the start of the year, the Direxion Daily NVDA Bull 2X Shares has gained over 37%, and appears to have struggled due to heavy volatility earlier in the year.

- At the moment, NVDU's technical profile appears robust, with the price action above the 20-day exponential moving average and the longer-term 50 DMA.

- Since June, the NVDU ETF's volume level has been noticeably fading, which means that it's not confirming the rising price action, a potentially concerning sign.

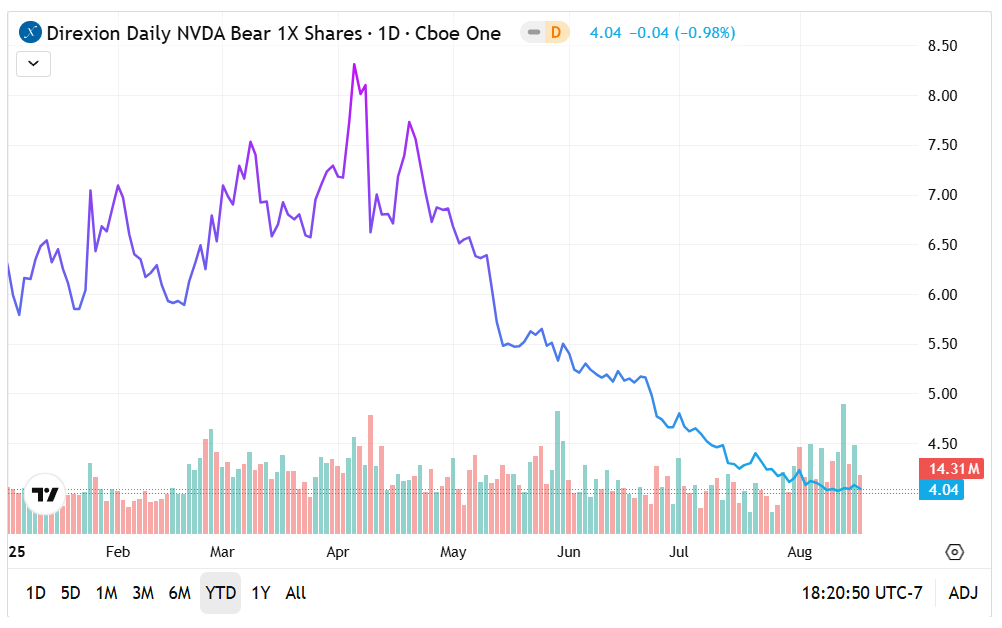

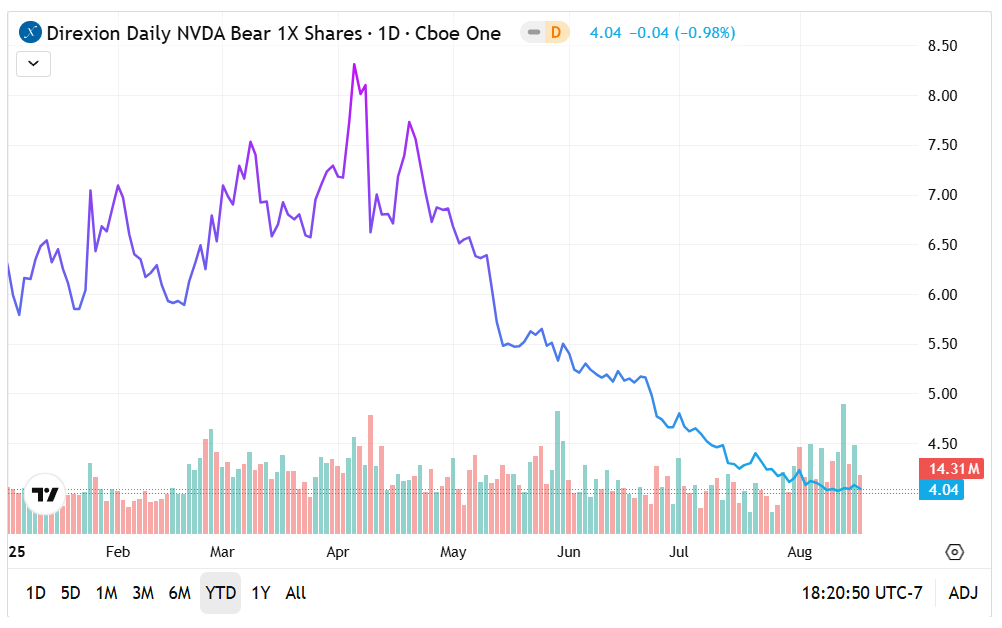

The NVDD ETF: As one might expect, the Direxion Daily NVDA Bear 1X Shares hasn't fared well in 2025, losing about 38% year-to-date.

- On the opposite end of the spectrum, the NVDD ETF has struggled for traction, trending below both the 20-day EMA and 50 DMA.

- What's interesting, though, is that volume has picked up, with accumulation being particularly heavy during the Aug. 13 session. This is something of a rarity for inverse ETFs.