/NVIDIA%20Corp%20video%20chip-by%20Antonio%20Bordunovi%20via%20iStock.jpg)

There appears to be no stopping Nvidia (NVDA). After skeptics raised concerns about elevated valuations and Chinese startup DeepSeek at the start of the year, Nvidia's shares have climbed those walls of worry to not only become the most valuable company in the world with a market cap of $4.5 trillion, but NVDA stock is also up 40.7% on a year-to-date (YTD) basis, marking another period of outperformance when compared to the S&P 500 ($SPX).

Now, after Nvidia's $100 billion investment in OpenAI, the naysayers are creating a clamor about vendor financing for Nvidia. Well, OpenAI just became the most valuable startup in the world with a valuation of $500 billion. I think they have enough resources and avenues to fund their purchases and not be dependent on Nvidia for it.

With that out of the way, another leading broker has come out with a bullish note on Nvidia (and Broadcom (AVGO)). KeyBanc Capital Markets has raised the price target on Nvidia to $250 (from $230), with analyst John Vinh highlighting the strength of Nvidia's supply chain. The note said:

“NVDA is now revising up its [chip-on-a-wafer-substrate] demand modestly this year to 370K interposers, which represents over 90% growth, and for next year, has revised up its [chip-on-a-wafer-substrate] supply to 530K interposers, which is 10% higher than its prior capacity and over a 40% increase over 2025. With EMS GB rack manufacturing yields improving to over 85%, we believe NVDA is on track to ship ~30K racks this year and at least 50K racks in 2026.”

Thus, this makes the case for investing in Nvidia even stronger, and here are the other reasons why this company should be a part of an investor's portfolio.

Solid Financials

When you look at the books, Nvidia’s financial record is truly phenomenal. Over the last decade, the company has pulled off growth rates for revenue and earnings that are eminently laudable—compound annual growth rates (CAGRs) sitting at 42.52% and 66.59%, respectively. And analysts aren't slowing down their expectations; they're calling for future revenue and earnings growth to hit 65.17% and 72.20%. That absolutely crushes the sector averages, which are typically hanging around 7.48% for revenue and 11.29% for earnings.

Further, in their most recent quarter, Nvidia didn't just meet estimates; they blew past them. They reported $46.7 billion in revenue, which is a whopping 56% increase compared to the same time last year. Earnings per share (EPS) landed at $1.05, comfortably beating the street’s forecast of $1.01 and marking a 54% jump year-over-year. Unsurprisingly, the data center division remains the company's main powerhouse, bringing in $41.1 billion in revenue. That figure was up 5% sequentially and an enormous 56% from twelve months prior.

Meanwhile, cash flow from operations also got stronger, climbing to $15.4 billion from the $14.5 billion they had the previous year. With zero short-term debt and a huge cash cushion of $56.8 billion, the company closed the quarter looking incredibly solid on the liquidity front.

Looking ahead, the company is guiding for next-quarter revenues to land somewhere near $54 billion. This forecast tracks very closely with the $53.14 billion that Wall Street is currently expecting.

AI & Nvidia Are Inseparable

Nvidia's deeply established position within the AI revolution means that any comprehensive discussion of this profoundly transformative technology must necessarily include the corporation. This market prominence is demonstrably justified by its actions.

The company refrains from complacency, consistently driving innovation across both its fundamental hardware design and its proprietary software stack. Furthermore, Nvidia is currently entering the initial phase of revenue generation from several newly established verticals, including its Omniverse digital collaboration platform, its automotive AI systems, and various deployments in edge computing solutions.

The primary factor ensuring sustained demand is the company’s aggressive product lifecycle: Nvidia routinely introduces new models every 8 to 24 months, typically yielding performance gains of 200% to 300% over the preceding generation. This rapid introduction rate ensures older data centers quickly become financially untenable, effectively mandating a perpetual "update and upgrade cycle" rather than allowing demand to be driven by a single, temporary burst of market enthusiasm.

Crucial strategic alliances have also opened entirely new commercial paradigms. Its recent collaborations with Intel (INTC) and OpenAI are highly significant. The partnership with Intel provides an avenue into the x86 CPU market, enabling the deployment of integrated, AI-optimized CPU-GPU solutions that are forecast to substantially bolster data center and PC revenues. Concurrently, the collaboration with OpenAI, centered around a $100 billion infrastructure project, is pioneering an AI infrastructure-as-a-service model. This structural shift is positioned to deliver highly predictable, high-margin subscription revenues, potentially scaling into the tens of billions.

Fundamentally, the explosion of AI technologies caused Nvidia's graphics processing units (GPUs) to experience a complete redefinition of purpose. They have evolved from being specialized accelerators for gaming and commercial graphics applications into the most pivotal technological component underpinning the modern computing landscape. As a direct consequence, the combination of Nvidia's foundational architecture and its proprietary CUDA software ecosystem has become the mandatory standard engine employed by the world's most critical hyperscalers for operating large language models, generative AI platforms, and extensive enterprise-scale machine learning applications.

Analyst Opinion on NVDA Stock

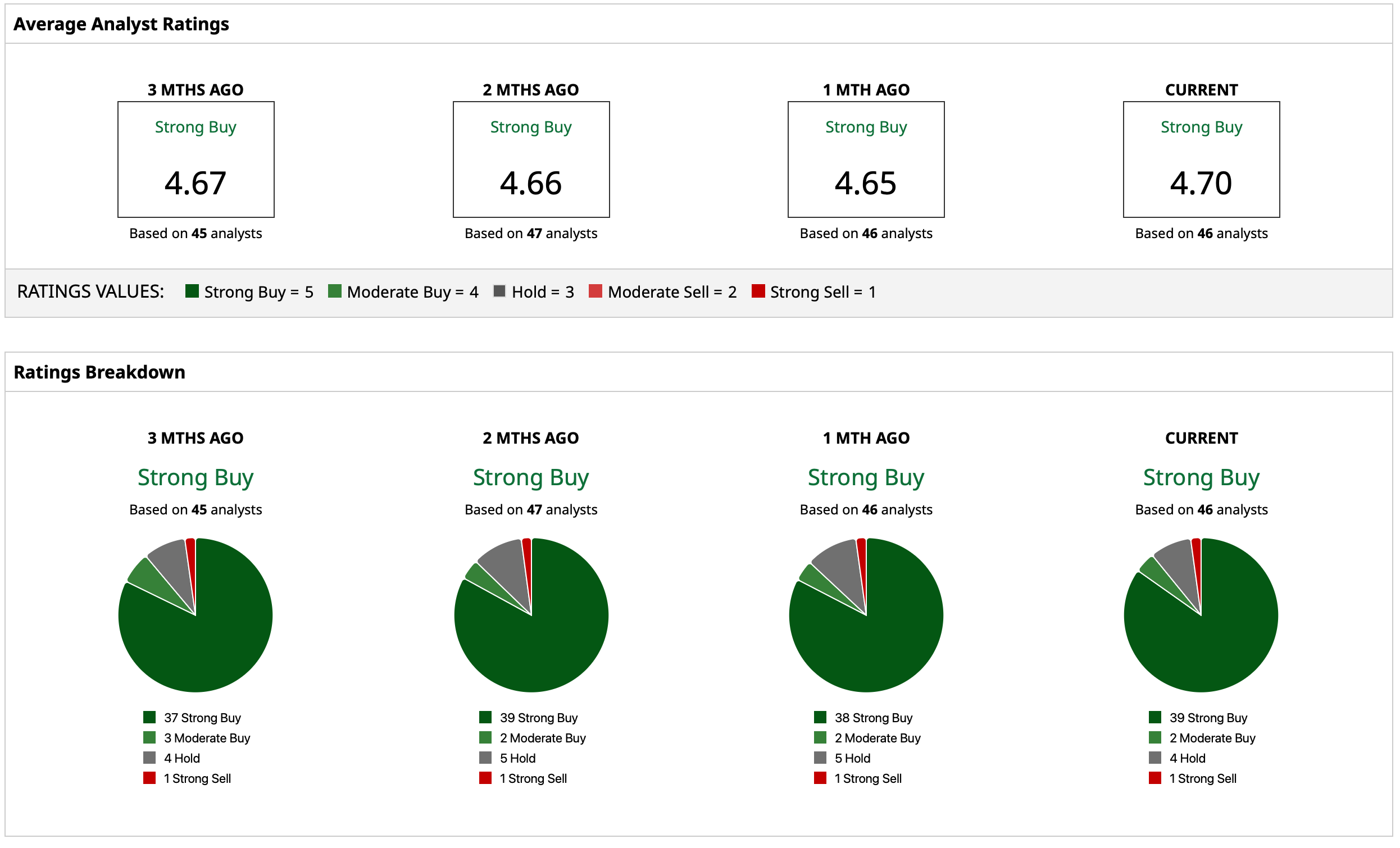

Thus, analysts are still upbeat about the NVDA stock, attributing to it a rating of “Strong Buy” with a mean target price of $215.98. This indicates upside potential of about 14.3% from current levels. Out of 46 analysts covering the stock, 39 have a “Strong Buy” rating, two have a “Moderate Buy” rating, four have a “Hold” rating, and one has a “Strong Sell” rating.