Goldman Sachs has issued a warning regarding potential “circular revenue” for Nvidia Corp. (NASDAQ:NVDA) stemming from its strategic investments and partnerships, even as the investment bank raised its price target for the semiconductor giant.

This caution comes as another major financial institution, Barclays, offers a more conservative outlook on Nvidia’s future revenue potential compared to CEO Jensen Huang‘s ambitious projections, commonly dubbed “Jensen’s Math.”

Know all about NVDA’s fundamentals here.

Goldman Sachs Raises PT On NVDA, But Has This Warning

According to an Investing.com report, Goldman Sachs raised its price target for Nvidia shares to $210 from $200, maintaining a Buy rating.

However, the firm highlighted concerns that “potential ‘circular revenue’ from strategic investments could be dilutive to Nvidia's multiple.”

This refers to situations where Nvidia, as a supplier, also makes equity investments in its customers, necessitating “additional scrutiny” due to its dual role as both investor and vendor.

The concern is particularly pertinent given the massive infrastructure spending anticipated from partners like OpenAI, which could require up to $75 billion by 2026. Social media observers like Mike Zaccardi and Zerohedge also amplified this “circular revenue” concern from the Goldman Sachs report.

Barclays Projections Challenges ‘Jensen’s Math’

In a separate analysis, Barclays delivered a reality check to what’s been termed “Jensen’s Math,” which is its CEO’s aggressive revenue projections for AI factories.

As detailed by Benzinga earlier, Huang has previously estimated that a single one-gigawatt (GW) AI factory could generate $40 billion to $50 billion in “compute cost” – essentially Nvidia’s potential revenue.

However, Barclays’ own “AI capacity tracker” estimates a more conservative range of $32.5 billion to $42 billion per GW for compute-related spending, based on its conversion of $50 billion to $60 billion in total spend per GW.

NVDA Still The ‘Most Attractive' Despite Barclays Calculation

This divergence means Huang's baseline vision for Nvidia's revenue starts at the ceiling of Barclays' most optimistic scenario.

While Barclays upgraded its own price target on NVDA to $240 and labeled it the “most attractive name in our space,” its detailed bottom-up analysis suggests a more grounded view of the immense market opportunity.

Both critiques—Goldman’s on financial structure and Barclays’ on market sizing—emerge within a context where analysts are generally optimistic about Nvidia’s role in the AI revolution, albeit with a degree of careful examination.

Price Action

Shares of NVDA fell 0.70% to end at $187.62 per share on Friday, and rose by 1.16% in premarket on Tuesday. It has risen 35.65% year-to-date and 46.90% over the past year.

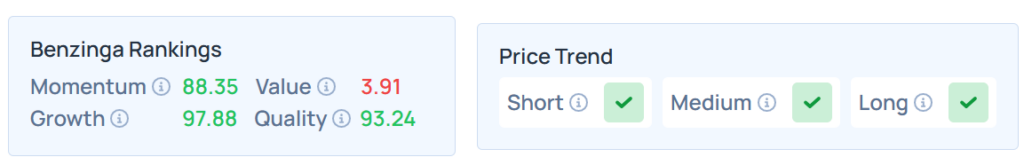

Benzinga's Edge Stock Rankings indicate that NVDA maintains a stronger price trend in the short, medium, and long terms. However, the stock's value ranking is relatively poor. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Monday. The SPY was up 0.26% at $670.98, while the QQQ advanced 0.45% to $605.87, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Hepha1st0s on Shutterstock