/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

Nvidia (NVDA) once again delivered solid quarterly numbers, highlighting its dominance in the artificial intelligence (AI) space. It reported $46.7 billion in revenue, beating expectations, with data center sales leading the way at 56% year-over-year growth. Notably, the momentum in Nvidia’s data center business continued even in the absence of Chinese H20 shipments.

NVDA’s Data center revenue also grew sequentially despite a $4 billion drop in H20 sales. This indicates that Nvidia’s growth isn’t tied to a single market. Instead, demand for its AI technology is broad-based, spanning multiple industries and regions worldwide.

Despite its strong quarterly numbers and upbeat outlook, which point to continued sequential top-line growth, the market’s response was underwhelming. NVDA stock slipped in after-hours trading as investors focused on one key detail: data center sales. While the division reported massive revenue of $41.1 billion, it fell just shy of the $41.34 billion consensus estimate.

However, for long-term investors, this should hardly be viewed as a setback. The dip in shares looks more like market noise than a meaningful signal. Nvidia’s underlying story remains intact as demand for its GPUs continues to outstrip supply, and the secular shift toward AI, cloud computing, and accelerated workloads provides the company with a multi-decade runway of growth. With a robust product pipeline and solid competitive positioning, Nvidia is still the top beneficiary of the AI era.

Nvidia’s Growth Drivers Remain Intact

Looking ahead, the structural drivers of Nvidia’s growth remain intact. Management estimates that global AI infrastructure investment will reach $3 trillion to $4 trillion by the end of the decade, creating a multi-year growth opportunity for Nvidia, thanks to its leadership in GPUs and networking systems. The company’s innovative products translate into monetizable gains for data center operators, in turn supporting its growth.

Nvidia’s Blackwell platform has emerged as a key growth catalyst for the company. Its revenue reached record levels in Q2, growing 17% sequentially. Production shipments of the GB300 began during the quarter, while demand across cloud providers, enterprises, and government-backed AI initiatives helped fuel momentum.

Notably, adoption of the NVDA’s GB200 NVL system is already widespread among hyperscale cloud operators and consumer internet companies. Moreover, the new Blackwell Ultra platform has seen solid demand, generating tens of billions of dollars in revenue.

Importantly, the transition from the GB200 to the GB300 has been seamless. Manufacturing has scaled quickly, with factories now producing roughly 1,000 GB300 racks per week, a rate expected to increase further as new capacity comes online in the third quarter, helping to capture demand.

Networking has also become a critical growth pillar. Revenue from this segment nearly doubled year-over-year, reaching a record $7.3 billion. Nvidia’s Spectrum-X Ethernet, InfiniBand, and NVLink technologies are now key to building the massive AI factories that power today’s largest models. New solutions, such as Spectrum-XGS, are poised to further strengthen the company’s hold on data center networking by enabling even larger and more unified AI clusters.

At the same time, Nvidia is widening its growth footprint beyond hyperscale adoption. Sovereign AI initiatives are bringing its technology into national projects, while enterprise RTX Pro servers are extending its reach into corporate infrastructure. Robotics platforms like Jetson Thor and advancements in autonomous driving, powered by the new Thor SoC, demonstrate the versatility of Nvidia’s innovations across multiple industries. These efforts span healthcare, automotive, and manufacturing, building a diversified revenue base for the company.

Even Nvidia’s gaming segment, traditionally viewed as cyclical, has proven remarkably resilient. The division reached record revenue of $4.3 billion, powered by the launch of next-generation Blackwell GPUs and a significant upgrade to the company’s GeForce NOW cloud gaming service.

Nvidia’s Outlook Suggests Solid Growth

Nvidia’s outlook is equally encouraging. Nvidia expects revenue of around $54 billion in Q3, representing more than $7 billion of sequential growth, even without factoring in potential H20 shipments to China. Those sales could add another $2 billion to $5 billion, further bolstering the results.

Is Nvidia Stock a Buy-the-Dip Play?

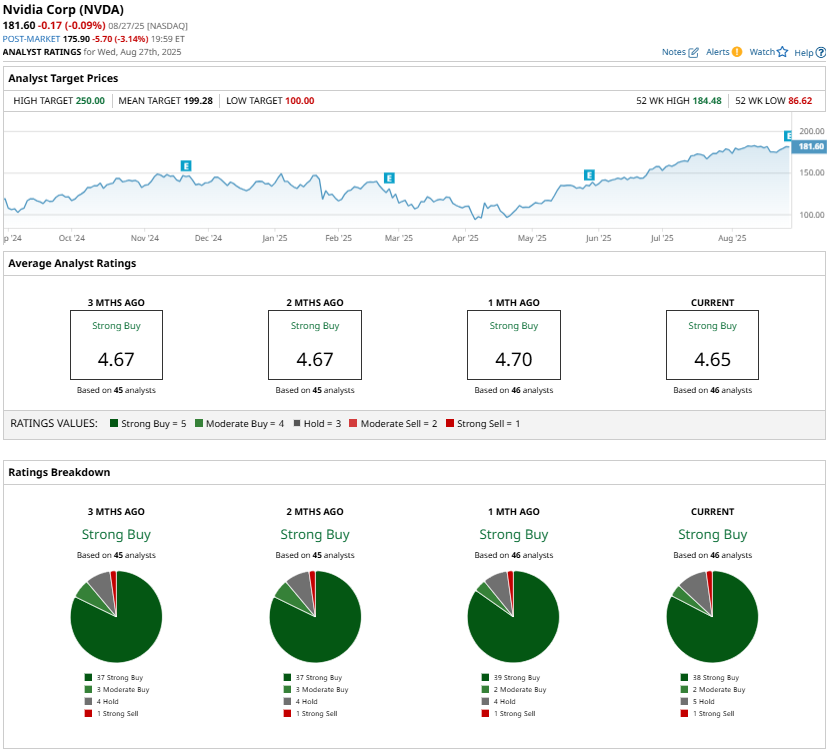

Nvidia’s leadership in AI hardware, its robust pipeline of next-generation products, and solid demand across industries and geographies, provide the company with a multi-year growth opportunity. Wall Street analysts are also bullish about NVDA stock and maintain a “Strong Buy” rating post Q2 earnings.

In short, Nvidia remains the top AI play, and any dip in its stock is a buying opportunity for long-term investors.