A multi-billion-dollar gap has emerged in the estimated cost of powering the AI revolution, pitting a new bullish forecast from Barclays against Nvidia Corp. (NASDAQ:NVDA) CEO Jensen Huang's own ambitious projections.

In a note upgrading its price target on NVDA to $240, Barclays revealed its AI capacity tracker, which estimates over $2 trillion in planned AI-related spending.

NVDA Still The ‘Most Attractive’ Despite Barclays Calculation

The bank noted it uses a conversion of $50 billion to $60 billion in total spend for every one gigawatt (GW) of AI power. Within that, it attributes 65% to 70% to “compute & networking.”

This calculation results in an estimated range of $32.5 billion to $42 billion per gigawatt for compute-related spending. The $39 billion figure represents a key point within this range (specifically, 65% of the $60 billion total spend), highlighting a bullish forecast grounded in the bank’s tracking of over $2 trillion in announced projects.

This figure that led the bank to call Nvidia the “most attractive name in our space,” adding that Jensen Huang’s once lofty industry forecasts “don’t seem so outlandish anymore.”

Barclays Analysis Still Conservative Compared To ‘Jensen’s Math’

This detailed, bottom-up analysis, however, presents a more conservative figure than the one championed by NVIDIA's chief.

According to what is now being called “Jensen’s Math,” a 1 GW AI factory has a total cost of $60 to $80 billion, with the “compute cost”—NVIDIA's potential revenue—representing a staggering $40 to $50 billion of that.

The two forecasts barely overlap, highlighting a fundamental difference in expectations. The low end of Huang’s $40-$50 billion estimate starts at the ceiling of Barclays’ $32.5-$42 billion calculated range. This means Huang’s baseline vision for his company’s revenue requires a market reality that is at, or even above, the most optimistic scenario modeled by the bank.

Huang himself previously stated that “every gigawatt is about $40 billion, $50 billion to Nvidia,” underscoring the massive market opportunity his company is targeting. When applied to McKinsey’s projections of 156 GW of AI data centre demand by 2030, Jensen's figure points to a potential market exceeding $6 trillion.

Critiques Say The AI Factory Cost Projections Are Inflated

The astronomical figures from both parties have not gone without scrutiny. Famed short-seller Jim Chanos recently highlighted the discrepancy, arguing that Huang's base cost estimates for an AI factory are “well above what many AI data center companies are currently telling investors.”

This critique casts a shadow of financial reality over the industry's explosive growth narrative, leaving investors to weigh the difference between a bank's bullish analysis and a CEO's even grander vision.

Price Action

Shares of NVDA rose 2.07% to end at $181.88 per share on Monday, and it dropped by 0.42% in after-hours. It has risen 31.50% year-to-date and 49.77% over the past year.

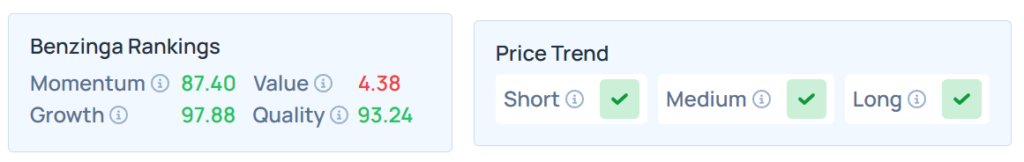

Benzinga’s Edge Stock Rankings indicate that NVDA maintains a stronger price trend in the short, medium, and long terms. However, the stock’s value ranking is relatively poor. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Monday. The SPY was up 0.28% at $663.68, while the QQQ rose 0.46% to $598.73, according to Benzinga Pro data.

Meanwhile, SPDR Dow Jones Industrial Average ETF Trust (NYSE:DIA), tracking the Dow Jones, ended 0.16% higher at $463.04.

The futures of the S&P 500, Dow Jones and Nasdaq 100 indices were mixed on Tuesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock