Nvidia Corp.‘s (NASDAQ:NVDA) blockbuster third-quarter earnings on Nov. 19 delivered a rebuke to the mounting chorus of AI bubble warnings, igniting a swift “risk-on” rally that rippled across disparate asset classes.

Check out NVDA’s stock price here.

NVDA Earnings Defy AI Bubble Chorus

This broad market reprieve defied dire predictions from a cadre of experts who have likened the AI frenzy to the dot-com debacle. OpenAI CEO Sam Altman warned in August that investors are “overexcited,” echoing Bridgewater’s founder Ray Dalio, who sees parallels to 1990s excesses.

Legendary investor Mark Mobius forecasted a 40% stock plunge in November, citing frothy valuations and unchecked spending, while Apollo’s Torsten Slok deemed today’s AI hype “bigger than the internet bubble.”

Even JPMorgan’s Jamie Dimon and the IMF flagged overinvestment risks, with 95% of AI pilots failing ROI per recent analyses.

Nvidia’s blowout, however, underscored sustained hyperscaler demand—Microsoft Corp. (NASDAQ:MSFT), Meta Platforms Inc. (NASDAQ:META), and Amazon.com Inc. (NASDAQ:AMZN) doubling down on capex, validating Huang’s dismissal of “a lot of talk about an AI bubble.”

Results Ignite Rebound In ‘Risk-On’ Assets

The earnings catalyzed gains far beyond tech peers. Crypto assets, battered by AI skepticism, rebounded sharply: Bitcoin climbed 1.97% to $92,608.46, Ethereum added 0.33% to reach $3,035.46, as investors rotated into high-beta plays.

Small-cap proxies like the Russell 1000 rose 0.34% to 3,620.03 points, signaling relief for growth stocks caught in the crossfire.

Even non-tech heavyweights joined the surge—the Dow Jones Industrial Average, more anchored in industrials, gained 0.10% to end at 46,138.77 points—while gold ticked up to $4,070.54 per ounce.

The U.S. dollar index strengthened 0.05% to the 100.2820 level.

Bulls Push Back On Burry’s Depreciation Narrative

Social media buzz on X amplified the counter-narrative, particularly targeting Michael Burry‘s bearish thesis.

The “Big Short” icon, who de-registered his Scion fund after shorting Nvidia, alleged that hyperscalers inflate earnings by overstating GPU useful lives at 5-6 years, versus a true 2-3 year cycle, thereby masking depreciation fraud amid rapid chip obsolescence.

Post-earnings, Nvidia CFO Colette Kress fired back, revealing A100 GPUs from May 2020 remain at “100% utilization” in November 2025, thanks to software upgrades like CUDA that extend hardware viability.

Nvidia Outperforms Nasdaq In 2025

Shares of NVDA have risen 34.86% year-to-date, whereas the Nasdaq Composite and Nasdaq 100 indices have returned 17.03% and 17.47%, respectively.

NVDA closed 2.85% higher at $186.52 apiece on Wednesday and jumped 5.08% in after-hours. It was up 27.85% over the year.

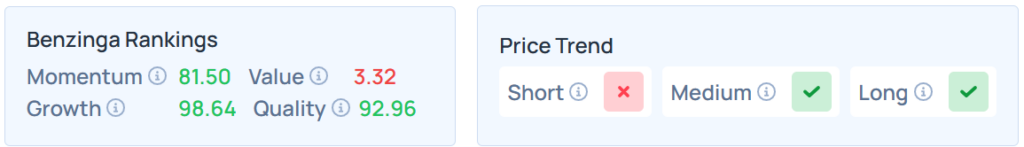

It maintained a stronger price trend over the medium and long terms and a weak trend in the short term, with a poor value ranking. Additional performance details, as per Benzinga Edge’s Stock Rankings is available here.

The futures of the S&P 500, Nasdaq 100, and Dow Jones indices were trading higher on Thursday, after advancing on Wednesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: JRdes / Shutterstock.com