NextSilicon, an Israeli startup, announced that it is developing a central processor aimed at challenging Intel Corp. (NASDAQ:INTC) and Advanced Micro Devices Inc. (NASDAQ:AMD), while also positioning itself to compete with Nvidia Corp.’s (NASDAQ:NVDA) platforms.

NextSilicon Expands Beyond AI Acceleration

On Wednesday, the startup disclosed plans for a complementary central processing unit leveraging the RISC-V open computing standard.

The company unveiled Arbel, an enterprise-grade RISC-V core built using Taiwan Semiconductor Manufacturing Co.'s (NYSE:TSM) 5nm process.

"Designed from the ground up to stand toe-to-toe with offerings from AMD and Intel," the company said.

Currently, the CPU is still at the test chip stage, while Maverick-2 chips are already in production.

NextSilicon's Maverick-2 Chip Poised To Challenge Nvidia

NextSilicon's flagship chip, the “Maverick-2,” is engineered to accelerate precision scientific computing tasks, including nuclear weapons modeling.

Nvidia once led this space, but as the company shifted its focus toward lower-precision computing for areas like artificial intelligence, startups such as NextSilicon have sought to capitalize on the change, as per Reuters.

The Israeli startup has secured $300 million in funding and its chips are currently under review by U.S. national labs.

James H. Laros III, senior scientist and Vanguard program lead at Sandia National Laboratories, stated that NextSilicon’s "performance results are impressive, showing real promise for advancing our computational capabilities without the overhead of extensive code modification."

Intel Q3 Earnings Preview: Revenue Expected To Slightly Dip

Meanwhile, Intel is preparing to release its third-quarter financial results on Thursday after the market closes.

Analysts project that Intel will report third-quarter revenue of $13.14 billion, slightly below last year's $13.28 billion for the same period, according to Benzinga Pro data.

The company has surpassed revenue expectations for four straight quarters and has beaten estimates in eight of the past ten quarters overall.

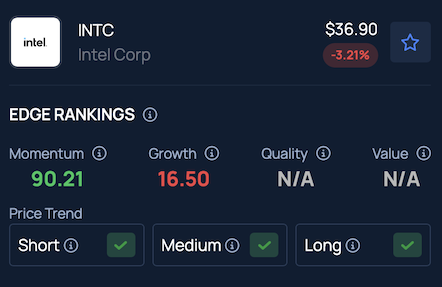

Benzinga’s Edge Stock Rankings show that INTC maintains a strong price trend over short, medium and long-term timeframes. Additional performance details can be found here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock