Nvidia Corporation (NASDAQ:NVDA) could potentially guide below Wall Street expectations for the Q3 quarter, despite the anticipation of strong earnings for the July quarter, stated KeyBanc Capital Markets.

China Revenue Risks Loom Amid Export Curbs

KeyBanc Capital Markets, in a recent note, predicted that Nvidia’s Q3 guidance could be lower than the consensus due to uncertainties in China, reported Investing.com. The brokerage noted that Nvidia’s outlook might “exclude direct revenue from China given pending license approvals and uncertainty on timing.” If sales from China were included, it could potentially boost revenues by an additional $2-3 billion, stated KeyBanc.

Check out the current price of NVDA stock here.

Despite the U.S. easing some restrictions on AI chips, KeyBanc expects Nvidia to remain cautious. The note also pointed out potential hurdles, including a possible 15% tax on AI exports and Chinese government pressure on AI providers to adopt domestically produced AI chips.

That being said, KeyBanc pointed to solid fundamental drivers. “GPU supply grew 40% in F2Q and [is] projected to increase another 20% in F3Q” with the ramp of Nvidia’s Blackwell (B200). The upcoming Blackwell Ultra (B300), scheduled to start shipping in the October quarter, could account for half of total Blackwell deliveries.

KeyBanc reaffirmed its Overweight rating on Nvidia and increased the price target to $215 from $190.

Nvidia Charts Its Way Through Geopolitics

However, Daniel Newman, CEO of Futurum Group, dismissed the idea that China can move on without Nvidia Corporation, calling it “next level nonsense.” Newman stated, “$NVDA looks to be advancing efforts to bring the B30, a ‘China Ready’ Blackwell to market.”

Despite the challenges in China, Nvidia has been navigating the geopolitical maze, with its GPUs at the center of the Silicon Silk Road, trading in silicon and threading its GPUs through the geopolitical maze of China’s firewalls and Saudi Arabia’s data palaces.

Nvidia is scheduled to report its results on August 27.

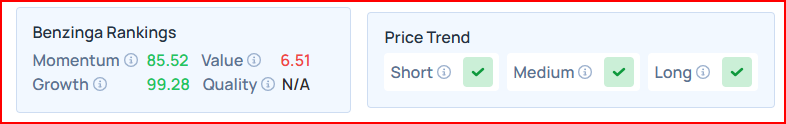

Benzinga’s Edge Rankings place Nvidia in the 86th percentile for momentum and the 99th percentile for growth, reflecting its strong performance. Check the detailed report here.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.