In what was most likely his final address as Federal Reserve chair at the annual Jackson Hole Symposium, Jerome Powell triggered a market rally with his remarks that a “shifting balance of risks may warrant adjusting our policy stance.”

The comments are a lot less dovish than the "the time has come for policy to adjust” remark that Powell made at the Symposium last year, which was followed by a big 50-basis-points rate cut in September. However, despite the “may” in this year’s remarks, the commentary was more dovish than expected as minutes from the July Fed meeting, released just a few days before the Symposium, showed that the Fed was still worried about inflation.

Powell’s comments were enough to catapult the Dow Jones Industrial Average Index ($DOWI) and the S&P 500 Index ($SPX) to record highs on Friday. With Powell’s speech perhaps the most important event of last week, Nvidia’s (NVDA) earnings are slated to be the most important event of this week.

Nvidia’s earnings hold a lot of sway over broader markets, and especially tech stocks. The upcoming earnings that are scheduled for Aug. 27 are even more important now that the artificial intelligence (AI) trade is back in action after a brief hiatus.

Nvidia Q2 Earnings Preview

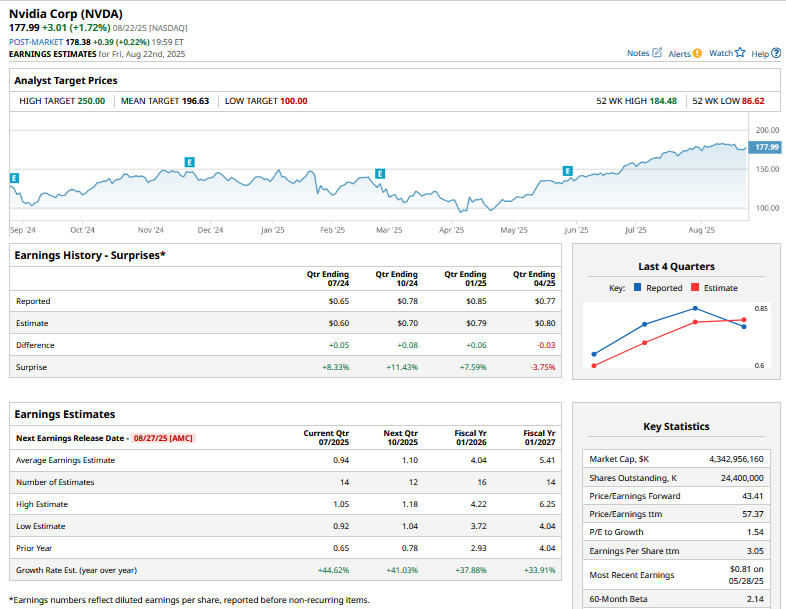

Consensus estimates call for Nvidia’s fiscal Q2 2026 revenues to rise 53.1% year-over-year to nearly $46 billion, $1 billion higher than the midpoint of the company’s guidance. Nvidia’s earnings per share (EPS) are expected to rise 44.6% to $0.94.

Apart from the headline numbers, I will watch out for the following in Nvidia’s Q2 earnings call.

- Q3 Guidance: I will watch out for fiscal Q3 revenue guidance and the overall AI spending environment. While management might not provide any official guidance yet, I will look for comments on the 2026 outlook and whether Nvidia sees the current growth rates continuing next year as well.

- China Business: Nvidia is set to face several questions about its China business. The company has received permission to export its H20 chips to China after agreeing to share 15% of its China revenues with the U.S. government. However, the Chinese government has cautioned local companies against using these chips, which are the most advanced chips that Nvidia is allowed to export to the country. Nvidia might also talk about the new chip, tentatively named B30A, that it is reportedly developing for China. The new chip is said to be based on the company’s Blackwell architecture and would be more powerful than the H20.

Nvidia Stock Forecast

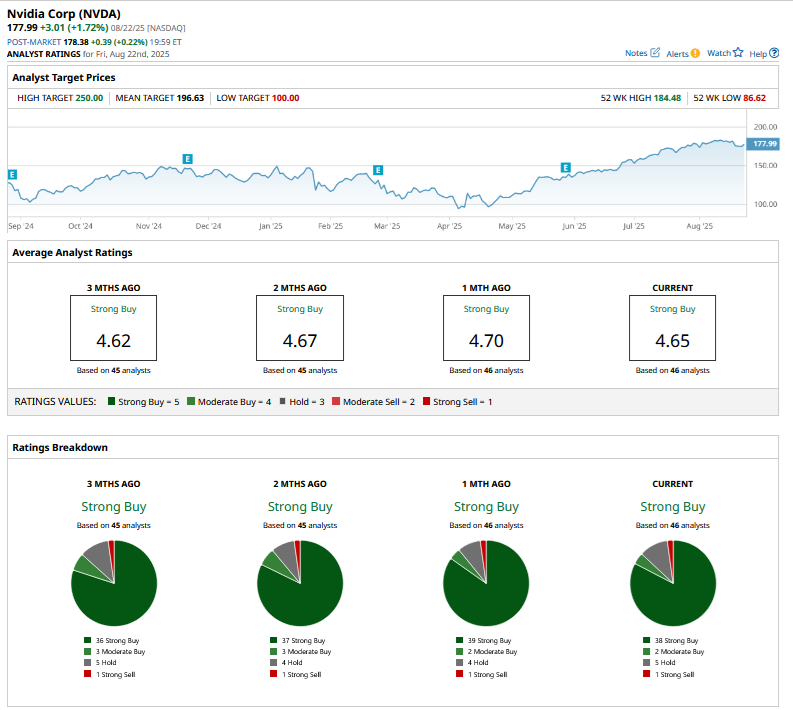

Several brokerages raised Nvidia’s target price last week, a cursory exercise we have seen repeatedly over the last two years as analysts catch up with Nvidia’s price action ahead of its report.

Looking at the most notable target price hikes, Wedbush raised Nvidia’s target price from $175 to $210 while TD Cowen raised its target from $175 to $235. KeyCorp, Evercore ISI, and Morgan Stanley were among the other brokerages that raised Nvidia’s target price last week.

The stock has a consensus rating of “Strong Buy” from analysts, while its mean target price of $196.63 is 10.5% higher than the Aug. 22 closing price. Nvidia’s Street-high target price of $250 is over 40% higher.

Is NVDA Stock a Buy Heading Into the Q2 Earnings?

Nvidia is heading into the Q2 earnings with a YTD gain of 34.9% which is the highest among its “Magnificent 7” peers. Moreover, the stock has more than doubled from its 2025 lows, which it hit amid the tariff chaos in April.

As we prepare for Nvidia’s earnings, the question is not about whether the company will beat consensus estimates, but by what margin. Given the upbeat commentary on AI capex by Big Tech companies like Meta Platforms (META), Alphabet (GOOG), and Amazon (AMZN), I expect Nvidia to post an impressive set of numbers for Q2.

China, however, could be a wild card here as it remains to be seen how the H20 sales ramp up in the country after the ban’s removal. Chinese AI startup DeepSeek, which created waves with its cheap AI model earlier this year, has hinted that its latest AI model will be supported by domestic chips.

That said, despite the uncertainty over Nvidia’s China business, I continue to stay invested in the company and would even consider adding more shares if the stock were to drop further, as the AI mania looks far from over.