/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)

Nvidia (NVDA) announced a massive $100 billion investment commitment in OpenAI on Monday, sending shares up nearly 4% and adding $170 billion to its market capitalization. The landmark partnership involves deploying 10 gigawatts of Nvidia systems for OpenAI's next-generation AI infrastructure, equivalent to 4-5 million GPUs, according to CEO Jensen Huang.

This deal represents a virtuous cycle for Nvidia. OpenAI receives the investment capital and then spends it on Nvidia's chips and systems. With each gigawatt of data center capacity costing $50-60 billion, and $35 billion of that going directly to Nvidia hardware, this partnership essentially guarantees massive future revenue streams. The first phase is scheduled to launch in late 2026, utilizing Nvidia's next-generation Vera Rubin platform.

The partnership reinforces Nvidia's dominance in AI infrastructure. OpenAI's 700 million weekly active users require enormous computing power, and this deal positions Nvidia as the preferred supplier for OpenAI's expansion plans. Management indicated this investment is additive to existing financial guidance, suggesting potential upside to earnings forecasts.

At $4.5 trillion market cap, Nvidia stock trades at a lofty valuation as it remains at the epicenter of the AI megatrend.

Is Nvidia a Good Stock to Buy Right Now?

Nvidia continues its aggressive expansion strategy through strategic investments and acquisitions. In addition to the OpenAI investment, the chipmaker deployed over $6 billion in recent deals that reinforce its dominance in the AI infrastructure market.

Last week, Nvidia acquired Enfibia for $900 million, which addresses a critical bottleneck, as AI systems require massive computational clusters to function effectively. The deal follows Nvidia's pattern of strategic talent acquisitions, similar to moves by Meta (META) and Alphabet (GOOG) (GOOGL), allowing it to avoid regulatory hurdles while securing key personnel and intellectual property.

Nvidia's $5 billion investment in Intel (INTC) marks a notable shift in Silicon Valley's power dynamics. The partnership will see Intel providing x86-based CPUs for Nvidia's AI systems while Nvidia contributes GPU technology to Intel's laptop and PC chips. This collaboration addresses a $50 billion addressable market and positions Nvidia as a major customer of Intel, reversing their historical competitive relationship.

Additionally, the CoreWeave (CRWV) collaboration demonstrates Nvidia's vertical integration strategy, with the cloud provider securing at least $6.3 billion in guaranteed capacity through 2032. This arrangement provides Nvidia with predictable revenue streams while giving CoreWeave access to a critical supply of GPUs.

While Nvidia’s Q2 revenue grew 56% to $46.74 billion, data center sales of $41.1 billion fell short of estimates for the second consecutive quarter. China remains a potential headwind, as H20 chip sales worth $2-5 billion are dependent on geopolitical developments.

Despite near-term challenges, management projects $3-4 trillion in AI infrastructure spending by the end of the decade, supporting Nvidia's aggressive investment thesis. Nvidia’s ability to secure strategic partnerships while maintaining technological leadership positions it well for continued market dominance.

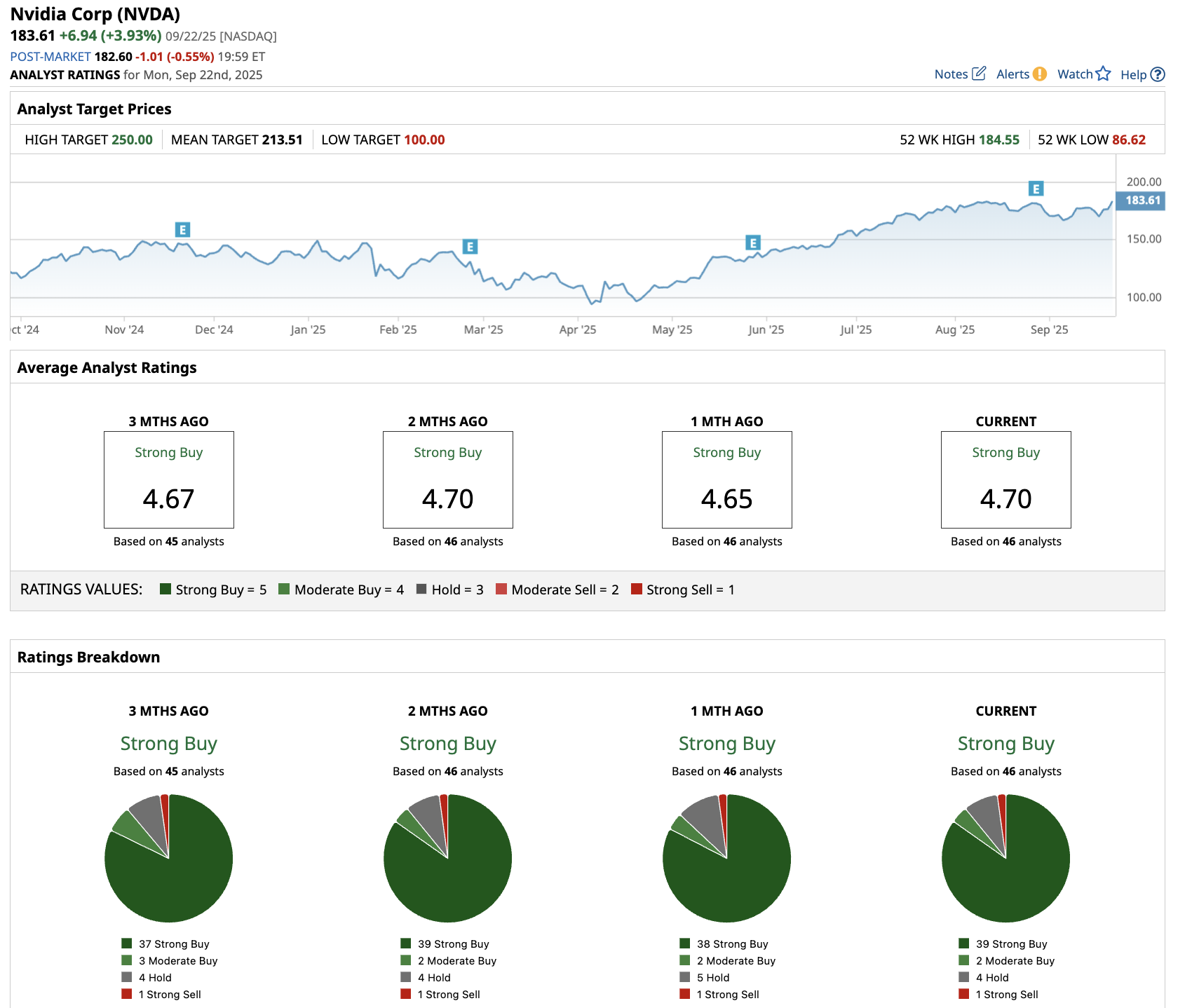

What is the NVDA Stock Price Target?

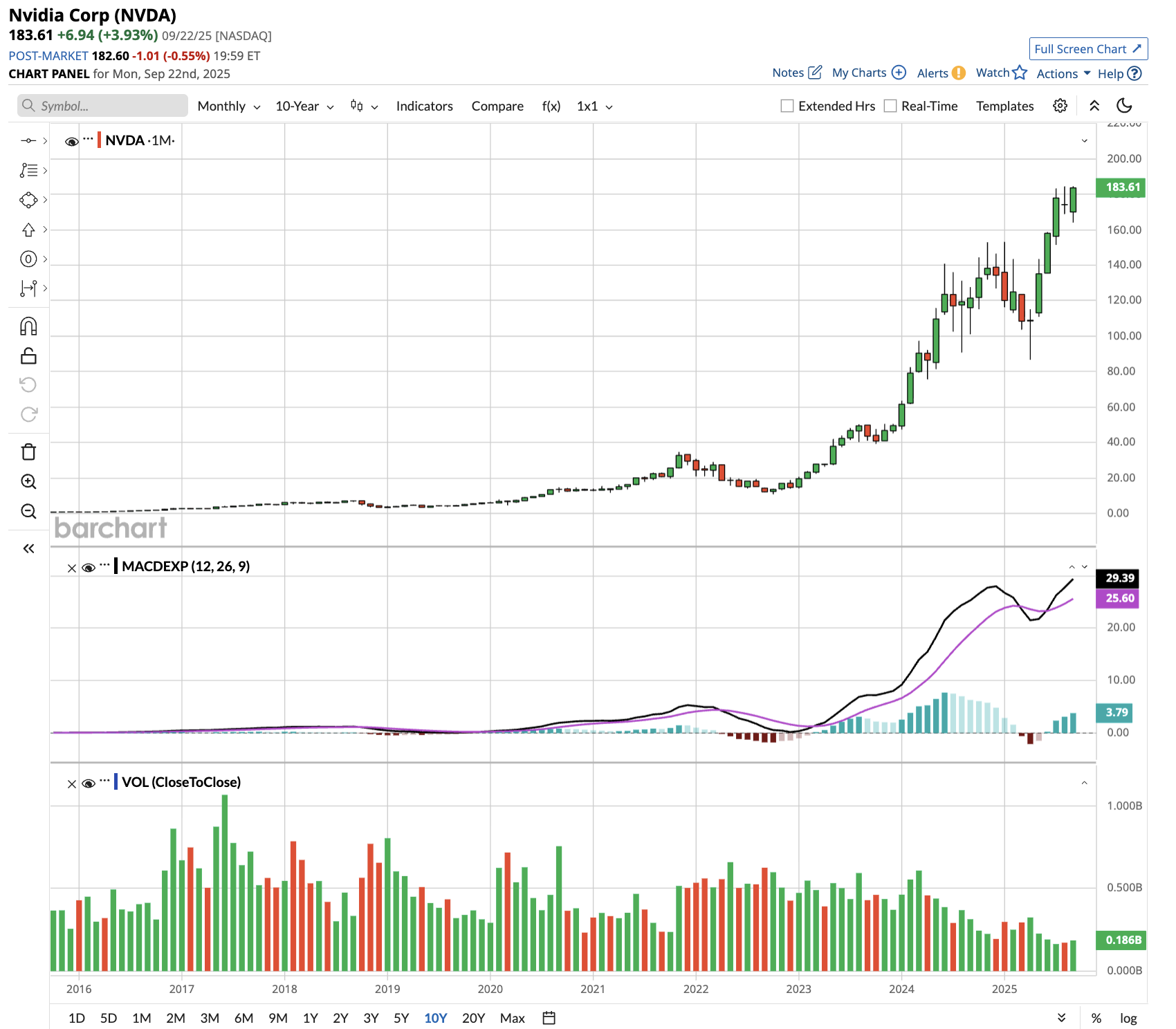

NVDA stock is up 29,000% in the last decade and has generated game-changing wealth for long-term shareholders. Despite its massive size, Nvidia is forecast to increase sales from $130.5 billion in fiscal 2025 (ended in January) to $378 billion in fiscal 2030.

In this period, adjusted earnings are forecast to expand from $2.99 per share to $8.92 per share. Moreover, Wall Street forecasts free cash flow to improve from $61 billion in 2025 to $249 billion in 2030.

NVDA stock trades at a forward FCF multiple of 34x, which is lower than its 10-year average of 38x. If the stock trades at a similar multiple, it could gain 90% over the next four years.

Out of the 46 analysts covering NVDA stock, 39 recommend “Strong Buy,” two recommend “Moderate Buy,” four recommend “Hold,” and one recommends “Strong Sell.” The average NVDA stock price target is $213.51, which is above the current price of $184.