/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

Nvidia (NVDA), the planet’s most valuable company and the only one to command a $4 trillion market cap, is on a dealmaking spree thanks to the bumper cash flows it is generating by selling chips that are powering the global artificial intelligence (AI) revolution. Just this month, the Jensen Huang-led company has announced an investment of up to $100 billion in OpenAI, invested $5 billion in Intel (INTC), and committed to invest 2 billion British pounds in AI startups in the U.K.

The company has also partnered with Alibaba (BABA), through a deal in which the Chinese tech giant, which is developing its own AI chips, will integrate NVDA’s robotics software and physical AI development tools into its cloud platform. While these big deals have made all the noise – and for good reason, given their size – Nvidia has invested in dozens of AI startups. Data from Pitchbook shows that Nvidia participated in investment rounds of over 50 companies in 2024, a number it looks set to beat this year.

Many of these companies are or will be Nvidia’s customers, and the Santa Clara-based company’s investment in them has raised concerns over it basically buying revenue through funding.

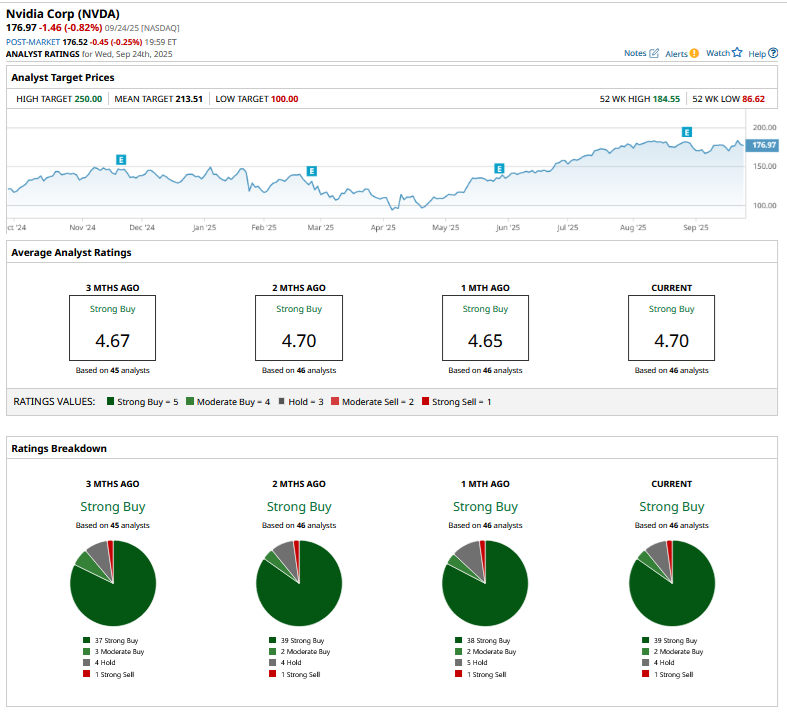

NVDA Stock Forecast: Analysts Raise Target Prices in September

Nvidia’s investment spree is not lost on the analyst community, and several brokerages, including Daiwa, New Street Research, Evercore ISI, Barclays, and Wolfe, have raised their respective target prices this month. D.A. Davidson upgraded NVDA to a “Buy” even though, in what’s been a rarity among sell-side analysts, Citigroup lowered the stock’s target price by $10 to $200.

Is AI Entering Bubble Territory?

Meanwhile, fears of an AI bubble are back on the table given the kind of valuations some AI startups are commanding.

Warnings over AI being a bubble similar to overhyped internet companies during the dot-com days are not new. However, recently, the club echoing these sentiments has registered new members. These include Federal Reserve Chair Jerome Powell, who pointed to “unusually large amounts of economic activity through the AI buildout.” Meta Platforms (META) CEO Mark Zuckerberg, whose company has itself been on an AI investment spree and has poached talent at eye-popping compensation, also recently talked about the possibility of a bubble.

Praetorian Capital has done some number crunching, which shows that the so-called hyperscalers could collectively spend $400 billion on data centers this year, which would depreciate at roughly $40 billion annually. However, where things get ugly is that the depreciation is twice what these companies are expected to get as revenues (not profits) from AI this year.

I believe the concerns over AI entering the bubble zone are not unfounded, as the valuations of some startups are becoming harder to justify. However, the listed space is looking prettier as, unlike the dot-com era companies, today’s tech giants have rock-solid balance sheets with real cash flows and earnings to back up their valuations.

I don’t find valuations in the listed space bloated, and if anything, markets might not be fully pricing in AI monetization for some of the names.

Is NVDA Stock a Buy or a Sell?

The AI infrastructure story is far from over, and Alibaba CEO Eddie Wu predicts that global investment in AI will reach $4 trillion over the next five years. On a similar note, Huang sees global AI infrastructure spending rising to between $3 trillion and $4 trillion by the end of this decade.

The growing AI capex, some of which could actually be fueled by Nvidia’s investments in AI companies, should keep the company’s cash registers ringing for the next few years. One risk for Nvidia is that it has more or less lost out on its China business, as several Chinese companies, including Alibaba, have come up with their own chips. To be sure, it was an outcome that Huang had long been warning about, as U.S. export control restrictions only expedited China’s push for creating and using domestic AI chips.

That said, Nvidia’s ex-China business continues to be on a roll with no signs yet of a demand slowdown. From a valuation perspective, NVDA trades at a forward price-earnings (P/E) multiple of 42.4x, which does not look pricy, especially considering its strong earnings growth, which has and is expected to beat Magnificent 7 peers by a fairly big margin. Overall, I continue to stay invested in NVDA stock despite some signs of exuberance in the broader AI ecosystem and the company’s dim future in China.

On the date of publication, Mohit Oberoi had a position in: NVDA , BABA , TSLA , META . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.