Following a strong second-quarter earnings report, Wedbush analyst Dan Ives projects a monumental rise in the AI chipmaker Nvidia Corp.‘s (NASDAQ:NVDA) market capitalization, while others, like B2PRIME Group’s Alex Tsepaev, warn of a potential collapse if the artificial intelligence boom fails to deliver on its revolutionary promise.

The Bull Case: A Path to $5 Trillion

Speaking to CNBC, the widely followed tech analyst Ives dismissed the market’s lukewarm reaction to Nvidia's earnings as a “knee jerk.”

He believes the company’s fundamentals are stronger than perceived, noting that even without factoring in sales to China, earnings estimates are likely to climb.

“I think it’s noise… And I think this is a stock going to $5 trillion,” Ives stated, forecasting a significant upside from its current $4.4 trillion market capitalization.

He views the recent financial results as the “validation point” for the AI trade, adding that demand for Nvidia's AI chips is “massive and not slowing down.”

The Bear Case: An AI Bubble?

Offering a more cautious perspective to Benzinga, Tsepaev acknowledged Nvidia’s near-term strength. “Their chips are the workhorses behind AI training and deployment, and demand from data centers and cloud providers is showing no signs of slowing down,” he said.

However, Tsepaev warned that the market might be overlooking a critical risk: the AI revolution has not yet materialized into a “total breakthrough.”

He cautioned that the technology appears to be stagnating, posing a direct threat to Nvidia’s future. “If AI turns out to be just a bubble, it can be a collapse for the whole market, and Nvidia in particular,” Tsepaev warned.

See Also: Nvidia Q2 Earnings Highlights: Double Beat, $60B Share Buyback, Huang Says ‘AI Race Is On’

Nvidia Q2 Earnings Snapshot

The debate follows Nvidia’s latest quarterly report, where it posted revenue of $46.74 billion and adjusted earnings of $1.05 per share, beating Wall Street estimates.

The company’s guidance for the next quarter, which met expectations but did not include contributions from China, may have tempered investor enthusiasm, setting the stage for the divergent outlooks on its long-term trajectory.

Price Action

Nvidia’s shares closed 3.34% lower on Friday. It dropped 2.36% over the last five sessions in the previous week. The stock was up 25.88% year-to-date and 61.21% over the year.

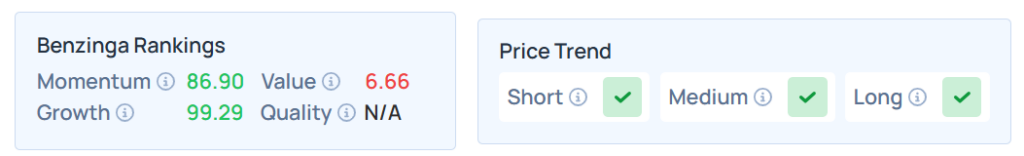

Benzinga’s Edge Stock Rankings indicate that NVDA maintains a stronger price trend in the short, medium, and long terms. However, the stock scores poorly on value and growth rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell on Friday. The SPY was down 0.60% at $645.05, while the QQQ declined 1.16% to $570.40, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Chung-Hao-Lee / Shutterstock