Chip giant and artificial intelligence (AI) bellwether Nvidia (NVDA) has responded to recent media reports about alleged supply issues for its H100 and H200 chips from the earlier generation Hopper stable. Clearly stating that the company is facing no issues with supply, it addressed the rumors in a post on X (formerly Twitter):

"We've seen erroneous chatter in the media claiming that NVIDIA is supply constrained and 'sold out' of H100/H200. We have more than enough H100/H200 to satisfy every order without delay. The rumor that H20 reduced our supply of either H100/H200 or Blackwell is also categorically false—selling H20 has no impact on our ability to supply other NVIDIA products."

More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

Not that it would have put a dent in the wider growth story of the most valuable company in the world in terms of market cap, Nvidia's clarification leaves its stakeholders further assured that it remains well-positioned to continue to occupy the apex position in the AI megatrend. Further, notwithstanding the recent pullback in the stock due to some perceived issues in its latest earnings, it is still up 27.2% on a YTD basis, outperforming the S&P 500's ($SPX) rise of 9.1% in the same period.

So, with a market cap of $4.2 trillion, can Nvidia add more value to its market cap? I believe it can add much more value. Why? Let's take a closer look.

Suffering From Success

The expectations around Nvidia have skyrocketed in recent years, and remarkably, the company has exceeded them with elan. Thus, any inkling of a dark cloud is leading market participants to hit the “Sell” button on the stock, resulting in ludicrous obituaries about the company's future growth story. But first, let's address what led to the recent correction.

The primary causes for the recent fall in the Nvidia share price were the data center revenue miss, zero chip sales to China during Q2 2025, and the lack of any update regarding sales to China in Q3. Well, let's start with data center revenues, which came in at $41.1 billion in Q2 2025. This was just slightly lower than analysts' expectations of $41.3 billion. Overall, it was still up 5% from the previous quarter and an impressive 56% from the previous year.

Coming to the sales issue concerning China, Nvidia is already in active negotiations to develop a new chip for the Asian powerhouse called B30A while continuing sales of its older-generation H20 chips.

Meanwhile, amid all the brouhaha, Nvidia's overall revenue and earnings again surpassed Street expectations, a record that stretches back several quarters. Revenues of $46.7 billion marked a yearly growth of 56%, while earnings of $1.05 per share denoted a growth of 54% from the previous year, exceeding the estimates of $1.01 per share.

Although operating margins witnessed a slight decline from the previous year's 66.4%, they remained at a healthy 64.5%. However, net cash flow from operating activities continued to rise, coming in at $15.4 billion, up from $14.5 billion in the previous year. And with no short-term debt on its books, Nvidia ended the quarter with a cash balance of $56.8 billion, reflecting a solid liquidity position.

Notably, Nvidia has guided for revenues to be in the range of $52.92 billion and $55.08 billion, the midpoint of which would denote a yearly growth of 53.8%. Analysts are expecting a revenue of $53.14 billion.

Thus, Nvidia continues to boast of fundamentals that are the envy of many, with no signs of slowing down. Minor skirmishes aside, Nvidia is expected to further improve its financials in the coming times.

Nvidia Is The Best AI Play (And Not Just That)

Since my last analysis of Nvidia, the stock has remained an attractive investment proposition, with a focus not just on AI but also on frontier technologies such as robotics, which has been described as “Physical AI” by CEO Jensen Huang. In fact, the correction of about 5% has made the stock even more attractive for investors who were awaiting a pullback to get the stock at a lower price.

Meanwhile, beyond the substantial capital investments in artificial intelligence by hyperscale data center operators and Nvidia’s entrenched dominance in the GPU arena, an additional driver of future growth is emerging in the form of the Rubin GPU and the Vera CPU. During the recent earnings call, the company’s chief financial officer confirmed that both products have completed the tape-out stage and are advancing toward mass production, a milestone expected to position them for commercial release in 2026. This development has the potential to create a fresh and significant revenue channel in the coming years.

Further, momentum is also building within Nvidia’s Gaming and AI PC operations. Revenue for this segment rose 49% year-over-year (YoY) to reach $4.3 billion, a surge largely attributed to the rapid uptake of the new GeForce RTX 5060, which has become one of the fastest-growing x60 series GPUs in the company’s history. Smaller divisions also recorded strong performances. Professional Visualization posted a 32% rise in sales, climbing to $601 million, while Automotive and Robotics revenue advanced 69% to $586 million.

Finally, the company is additionally working to expand its footprint in the enterprise sector through developments in agentic AI and robotics. The progression of agentic AI is opening new commercial opportunities, with RTX PRO servers poised to become a multibillion-dollar business line. These servers are already being deployed by corporations such as Hitachi (HTHIY) and Disney (DIS) for applications including simulations and digital twin technologies. In robotics, the Jetson Thor platform is positioned to deliver dramatic improvements in AI processing at the edge, supported by a developer base exceeding two million and strategic relationships with partners such as Amazon (AMZN) Robotics.

Analyst Opinions on NVDA Stock

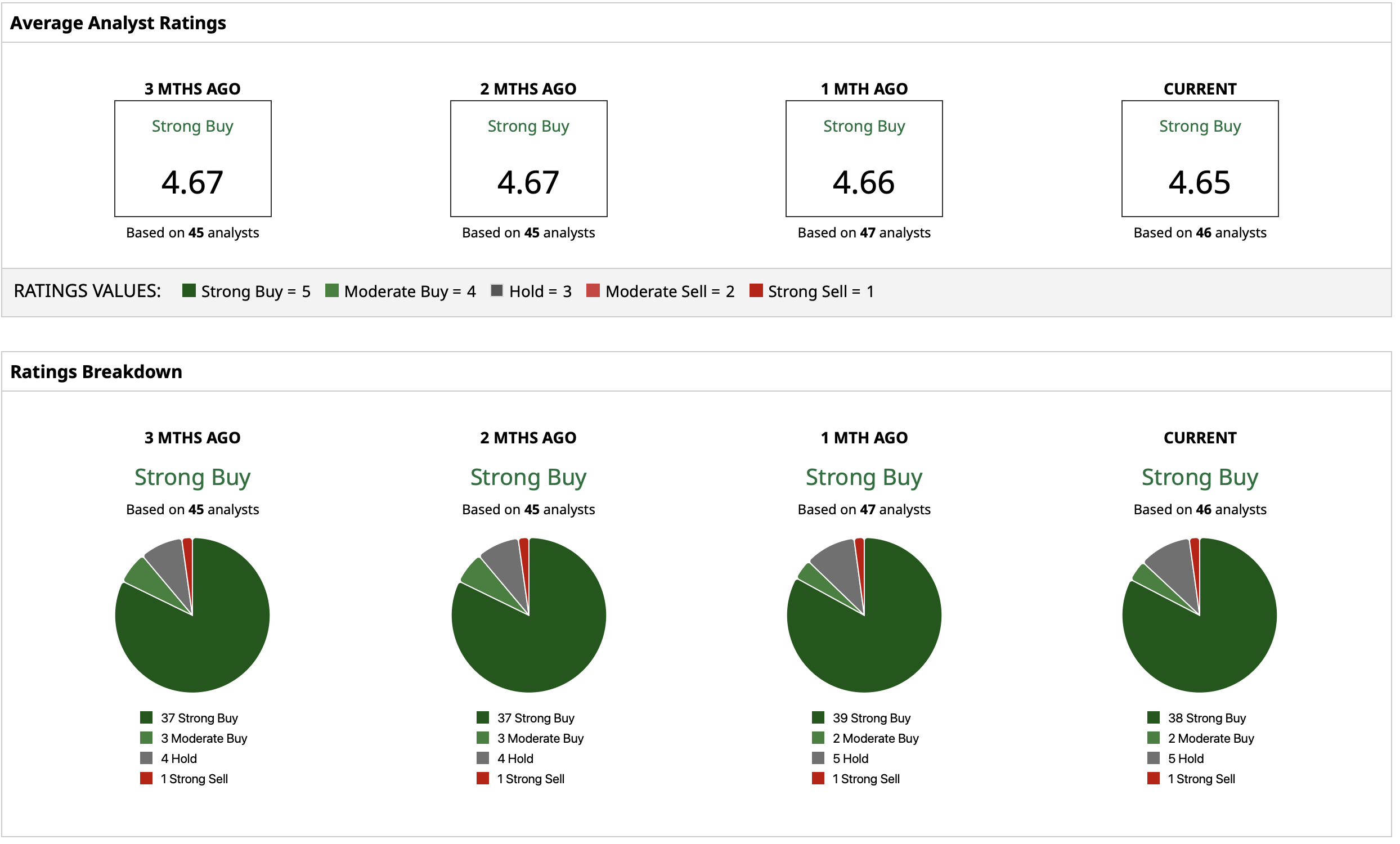

Thus, analysts remain bullish about the NVDA stock, assigning it a rating of “Strong Buy” with a mean target price of $210.49. This indicates upside potential of about 23.3% from current levels. Out of 46 analysts covering the stock, 38 have a “Strong Buy” rating, two have a “Moderate Buy” rating, five have a “Hold” rating, and one has a “Strong Sell” rating.