After a rough stretch in the red throughout the past year, semiconductor testing firm Teradyne (TER) could have a light at the end of the tunnel. Analysts at UBS wrote earlier this summer that the company could potentially a second-source tester for chip industry leader Nvidia (NVDA).

While nothing is confirmed, UBS believes that Nvidia is dual-sourcing its supply chain, which means that as Nvidia scales its Blackwell infrastructure, an opportunity may give this under-the-radar company a major boost.

About Teradyne Stock

Incorporated in 1960 and headquartered in North Reading, Massachusetts, Teradyne provides automated test equipment and advanced robotics systems. With a market capitalization of $18.8 billion, the company offers testing solutions for semiconductors and electronic products. Teradyne is an ATE partner for artificial intelligence (AI) device manufacturers. This means that global companies rely on Teradyne to ensure the quality and performance of their products. Teradyne’s advanced robotics segment offers mobile robots that help in manufacturing and warehouse operations.

The company’s stock has given up gains over the recent past due to its growth stalling. Over the past 52 weeks, the stock has declined by 11%. Teradyne’s shares reached a 52-week high of $144.61 on Jan. 7, but are now down 19% from this high. However, over the past three months, the stock has experienced a resurgence, rising by 45%.

Why Nvidia Could Be the Spark Teradyne Needs?

UBS analysts, led by Timothy Arcuri, wrote in July that they believe Teradyne could see meaningful upside if it secures even a small slice of Nvidia’s business as a second-source testing supplier. The investment bank estimates that landing even a modest 10% share of Nvidia’s business could add several hundred million dollars in annual revenue, no small feat for a company looking to rebound.

What adds to the opportunity is the increased complexity of Nvidia’s Blackwell chips. According to UBS, test times for Blackwell are significantly longer than for its predecessor, Hopper, thanks to its dual compute tile architecture. This means any incremental test wins could translate to even greater revenue potential for Teradyne.

While Teradyne has long been linked to Apple (AAPL), UBS believes investors are beginning to recognize a “broader set of catalysts.” With Nvidia potentially in play, Teradyne could be entering a new phase of relevance in the semiconductor supply chain.

What Do Analysts Think of Teradyne’s Stock?

It's not just UBS seeing promise in Teradyne.

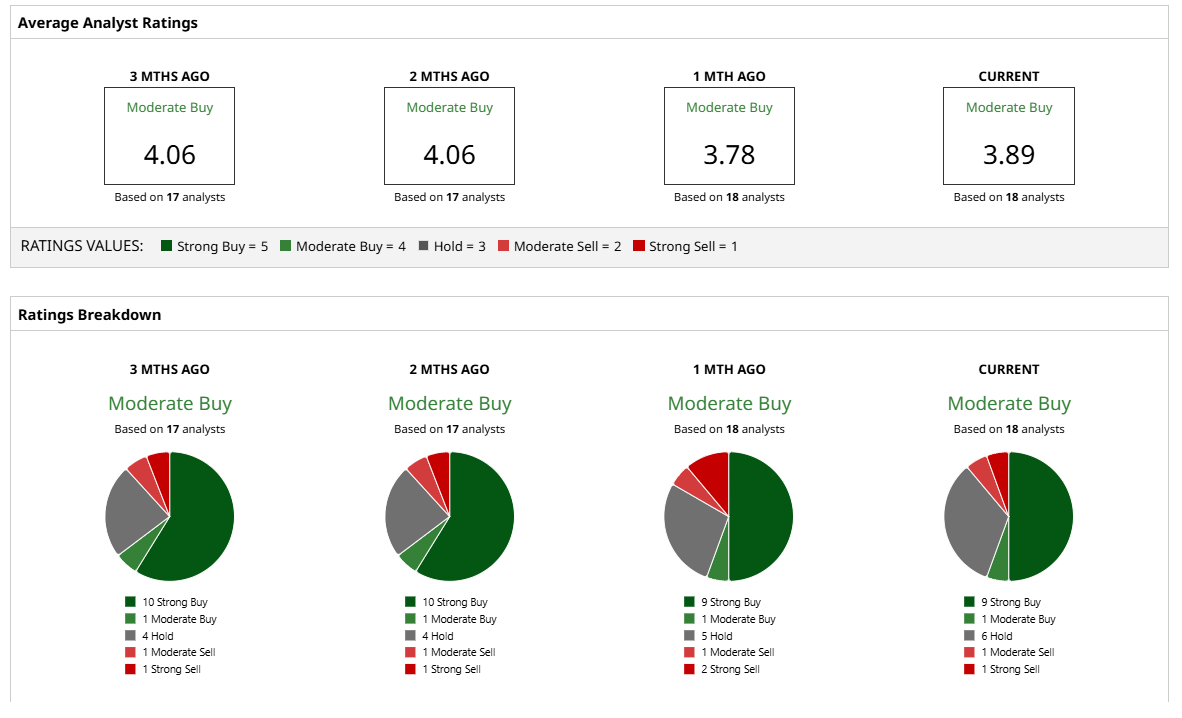

Wall Street analysts are overall optimistic about Teradyne’s prospects, with a consensus “Moderate Buy” rating from analysts overall. Of the 18 analysts rating the stock, nine analysts have rated it a “Strong Buy,” one suggests a “Moderate Buy,” six analysts are playing it safe with a “Hold” rating, one gave a “Moderate Sell” rating, while one suggests “Strong Sell.”

The consensus price target of $117.83 is roughly in line with its current share price. However, the Street-high price target of $133 indicates 13% upside.

While short-term macroeconomic pressures have led to some friction, the overall outlook for Teradyne remains positive, and a potential Nvidia partnership could be a significant tailwind. Therefore, taking a position in the stock may be advantageous in the long term.