/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

In a surprising twist in the artificial intelligence (AI) chip wars, Nvidia (NVDA) CEO Jensen Huang expressed astonishment over rival Advanced Micro Devices’ (AMD) decision to grant OpenAI up to a 10% ownership stake as part of their newly announced multibillion-dollar partnership. Speaking on CNBC’s “Squawk Box,” Huang described the move as “imaginative” and “unique,” but said he was surprised that AMD would “give away 10% of the company before they even built” the next-generation product. The announcement triggered a strong rally in AMD’s stock, while Nvidia shares gained modestly, reflecting investor interest in how this development may affect competitive dynamics.

AMD stock is up 94% year-to-date, while Nvidia is up 44.5%, compared to the broader market gain of 16%. While Nvidia’s dominance remains unshakeable, Huang’s reaction has sparked widespread speculation about what this unusual equity-for-chips strategy means for Nvidia. Let’s find out.

What’s the AMD-OpenAI Deal That Has Ignited the Market?

The agreement between AMD and OpenAI marks one of the most ambitious collaborations yet in the race for AI hardware dominance. Under the deal, OpenAI will purchase up to 6 gigawatts of AMD’s chips, including the upcoming MI450 series, over several years. In exchange, OpenAI will receive warrants for up to 160 million AMD shares, which may amount to around 10% ownership if fully exercised.

Many feel the AMD-OpenAI agreement directly challenges Nvidia’s long-held leadership in the AI semiconductor business. However, Huang was eager to point out the distinctions between AMD’s agreement and Nvidia’s own collaboration with OpenAI. Nvidia revealed plans to invest up to $100 billion in OpenAI over the next decade to deploy Nvidia systems requiring around 10 gigawatts of electricity, or up to 5 million GPUs. Huang also noted that Nvidia’s relationship enables it to sell directly to OpenAI. He recognized that OpenAI will most likely need to raise significant funds — via income, stock, or debt — to meet its commitments.

AMD’s Deal Is Bold, But Nvidia’s Lead Is Structural

AMD’s move displayed ambition and a bold attempt to close the gap with Nvidia. However, if you are seeking the true AI juggernaut, the evidence favors Nvidia. Huang’s statements indicate that Nvidia’s overall strategy of deep ecosystem investments and ongoing technology leadership will keep it at the forefront of the AI revolution.

Nvidia’s Blackwell AI platform and its successor, Rubin, are already enabling a completely new level of AI infrastructure. Blackwell, designed with Nvidia’s groundbreaking NVLink 72 connection, outperforms its predecessor Hopper by an order of magnitude, leading to substantial gains in bandwidth and efficiency. In its most recent fiscal 2026 third quarter, Nvidia reported $46.7 billion in total revenue, up 56% year-over-year. Data center revenue — Nvidia’s largest and fastest-growing segment — also surged 56% year over year, despite geopolitical constraints and export restrictions to China.

Another underappreciated strength is its networking business, which has quietly become a $10 billion annualized revenue stream. Nvidia is investing extensively to increase capacity, accelerate innovation, and support the rollout of Rubin and Blackwell architectures, which will define the next phase of AI computing. Nvidia’s CFO Colette Kress highlighted during the earnings call that the company expects $3 trillion to $4 trillion in AI infrastructure investment globally by the end of the decade.

During CNBC’s “Squawk Box,” Huang also revealed that Nvidia participated in Elon Musk’s AI startup xAI’s recent investment round, which was reportedly targeting $20 billion in new funds, with Nvidia spending roughly $2 billion. In addition to its relationships with OpenAI and xAI, Nvidia is expanding its AI ecosystem by investing in firms such as CoreWeave (CRWV), a leading AI data center operator.

These investments ensure that Nvidia remains years ahead of its competitors in terms of technology, supply chain size, and ecosystem reach.

For the third quarter, management anticipated that the lion’s share of Nvidia’s $7 billion sequential revenue growth would come from data center sales driven primarily by Blackwell systems. While Nvidia continues to offer Hopper (H100 and H200) GPUs, Blackwell is now the company’s primary growth engine, driving both compute and networking revenue streams. Analysts covering Nvidia expect its earnings to increase by 50.6% in fiscal 2026, followed by another 41.5% in fiscal 2027.

While AMD’s collaboration with OpenAI demonstrates both ambition and creativity, it does not shift the AI market’s center of gravity. Nvidia provides a full-stack platform that spans computing, networking, systems, and software. The company’s unmatched integration across these layers gives it a sustainable competitive moat that no rival, including AMD, has yet been able to breach. For investors betting on the long-term AI revolution, Nvidia retains its AI crown.

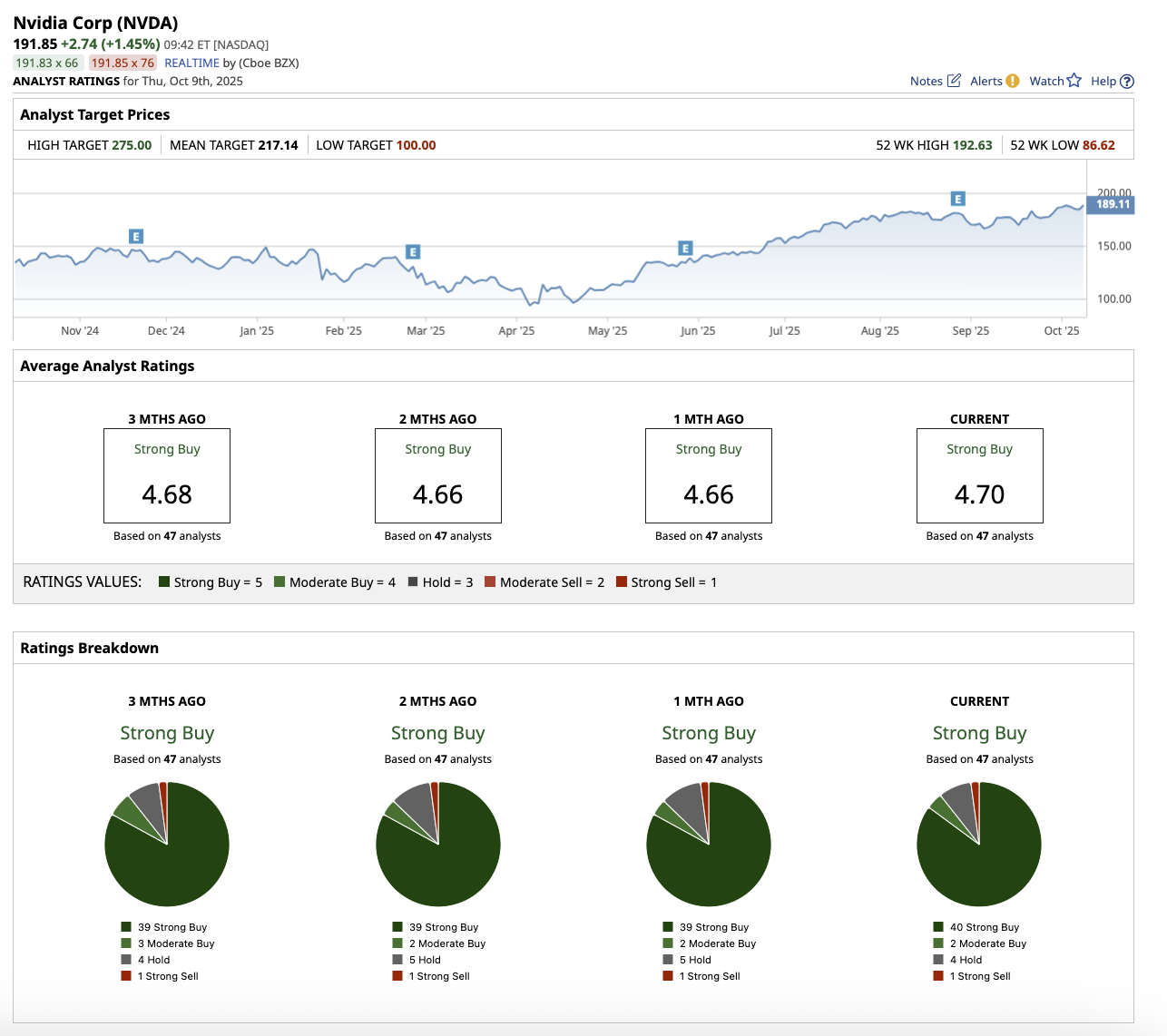

Wall Street Is Still Bullish About Nvidia Stock

Overall, Nvidia maintains its “Strong Buy” rating on Wall Street. Out of the 47 analysts that cover the stock, 40 have a “Strong Buy” recommendation, with two “Moderate Buy” ratings, four “Hold” ratings, and one “Strong Sell” rating. The average target price for Nvidia stock is $217.14, which implies potential upside of 12.5% over the next 12 months. The high price estimate of $275 implies the stock can rally as much as 43% from current levels.