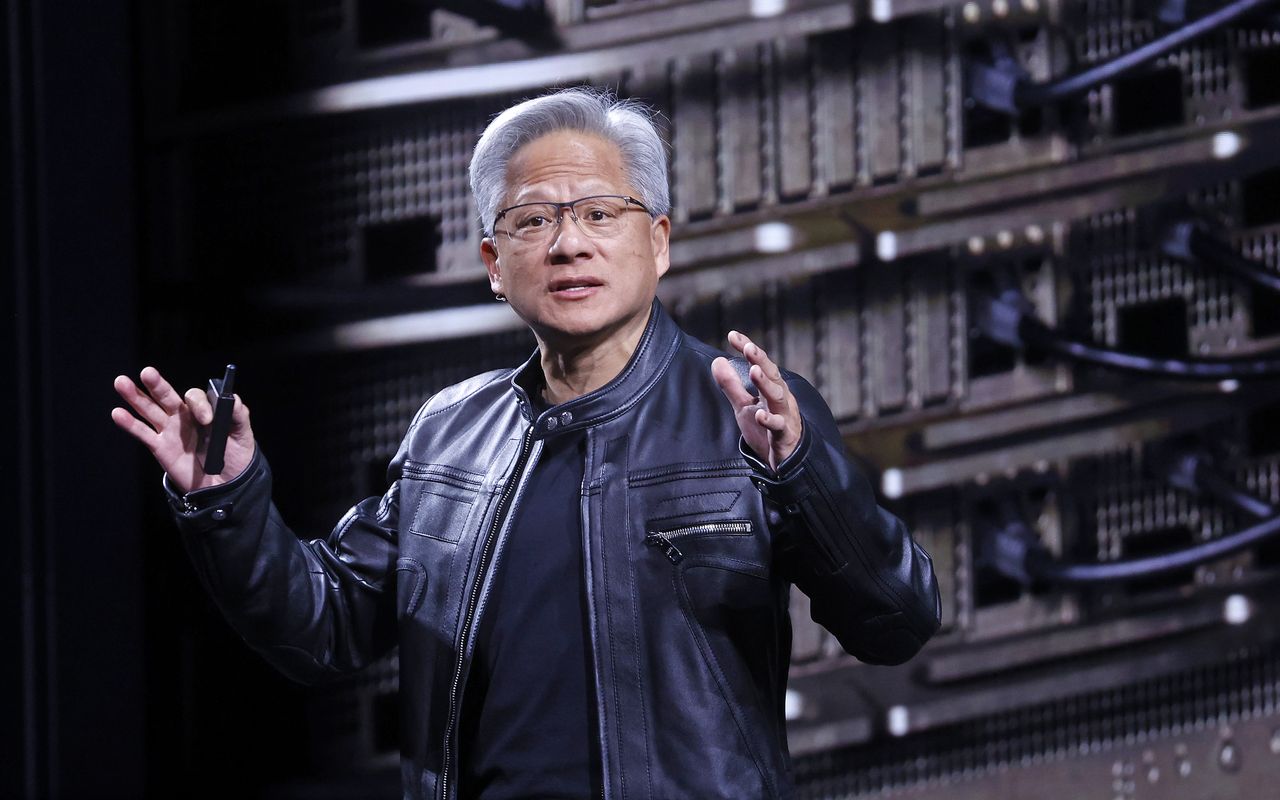

Nvidia CEO Jensen Huang believes OpenAI is on track to become a multi-trillion-dollar company, citing explosive growth and scale as the foundation for what could be the fastest rise to that valuation in the industry’s history. Speaking on the BG2 podcast, Huang said that OpenAI “is likely going to be the next multi-trillion-dollar hyperscaler company.”

His comments come on the heels of a high-stakes infrastructure pact between Nvidia and OpenAI. Earlier this week, the companies announced a letter of intent for up to 10 GW of GPU-powered data centers to be deployed through OpenAI’s preferred cloud partners. Nvidia, in turn, agreed to invest as much as $100 billion in those systems as capacity comes online, making it one of the largest vendor-led bets on AI infrastructure to date.

In doing so, Nvidia is effectively underwriting the next generation of AI growth by ensuring its silicon roadmap stays in sync with OpenAI’s compute ambitions. The deal anchors future demand for Nvidia’s Rubin-class platforms and next-gen networking hardware, while also giving OpenAI early access to systems that may not reach general availability for years.

It also helps to bolster Nvidia’s dominance in the AI supply chain. Major cloud providers, such as Microsoft, Amazon, and Google, have an insatiable appetite for GPU capacity, and Nvidia’s partnership strategy effectively pulls demand forward, locking hyperscalers like them into multi-year commitments while competitors like AMD and Intel are still playing catch-up. Expand the tweet below to see Jensen's explanation of OpenAI's path to a multi-trillion-dollar valuation.

📁 Jensen Huang believes OpenAI is the next trillion-dollar company, and that’s why he’s investing. pic.twitter.com/bwI3ELEa4tSeptember 26, 2025

At 10 GW, OpenAI’s planned footprint and its associated capital expenditure have already pushed the plans into high-risk, high-reward territory. OpenAI recently struck a $6.5 billion expansion deal with CoreWeave, one of Nvidia’s key hosting partners, to help finance the rollout.

Nvidia also holds a stake in CoreWeave, and critics have raised concerns about the concentration of capital, hardware, and access among a small number of companies. However, that doesn’t seem to matter to Huang, who apparently believes that AI’s future will be defined by those who can scale infrastructure the fastest. OpenAI is outpacing even the most aggressive growth curves seen during the rise of cloud computing.

Nvidia’s ability to pre-sell entire generations of high-end GPUs into AI deployments will also have knock-on effects on the wider industry, including gaming card availability and workstation pricing. If OpenAI consumes a significant portion of future Rubin or Rubin Ultra supply, it could widen the gap between data center and consumer release cycles, making it even harder for consumers to obtain timely access to Nvidia’s latest hardware.

For now, though, Huang seems unconcerned. He’s betting $100 billion that OpenAI’s growth definitely isn’t part of a wider AI bubble.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button!