Aswath Damodaran, the NYU Stern finance professor widely known as the “Dean of Valuation,” has issued a stark warning regarding the valuations of top tech giants, specifically naming Nvidia Corp. (NASDAQ:NVDA) and Tesla Inc. (NASDAQ:TSLA) as the most irrationally valued companies in the current market.

Nvidia And Tesla Are The Most Irrationally Valued

Speaking on the Prof G Markets podcast on Nov. 14, Damodaran expressed deep skepticism about the current pricing of AI darling Nvidia, which has seen its market capitalization soar past $5 trillion in 2025.

According to Damodaran, the math behind the chipmaker’s stock price simply “does not hold up to scrutiny.”

“You’re looking at the greatest company ever, delivering 80% gross margins in perpetuity on revenues that are going to be a trillion dollars or more,” Damodaran said, breaking down the implausible expectations baked into Nvidia’s stock. “None of those things hold up to any kind of scrutiny.”

Damodaran placed Tesla in the same “irrational” category, though for different reasons. While Nvidia's valuation suffers from mathematical overreach, Damodaran argued that Tesla's problem is fundamental incoherence.

“I'm not even sure what Tesla is as a company anymore,” he noted. “I can't tell you what the story is because I'm not sure Tesla knows what the story is going forward.”

All Big Tech Stocks Will Crash During A Correction

The professor’s bearish outlook extended beyond individual stock picks. He warned that the Magnificent 10 tech stocks—which now account for roughly 40% of the S&P 500’s total market cap—offer “no place to hide” in the event of a correction.

He predicts that any significant downturn in these leaders would ripple through the broader market, damaging index funds and passive investors alike.

Damodaran Calls Alphabet And Amazon As ‘Least Overvalued’

Despite his grim assessment of the leaders, Damodaran identified Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) and Amazon.com Inc. (NASDAQ:AMZN) as the “least overvalued” among the big tech cohort.

He suggested that companies like Amazon have clearer paths to monetizing efficiency without relying solely on the “AI boom” narrative.

For the first time in his career, Damodaran revealed he is moving portions of his own portfolio into cash and even considering collectibles, a move he admitted is drastic for a value investor.

“It’d be difficult to find one that’s undervalued,” he said of the major tech stocks. “There’s nothing cheap.”

What Do NVDA and TSLA’s Rankings Say?

TSLA was trading 0.38% lower in premarket on Tuesday after closing 1.13% higher at $408.92 apiece on Monday. It was up 7.81% year-to-date and 20.72% over the year.

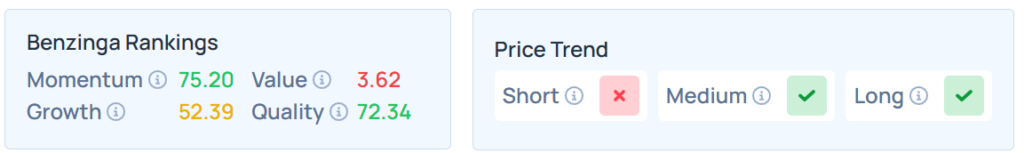

Benzinga’s Edge Stock Rankings indicate that TSLA maintains a stronger price trend over the medium and long terms and a weak trend in the short term, with a poor value ranking. Additional performance details are available here.

NVDA closed 1.88% lower at $186.60 apiece on Monday and declined 0.94% in premarket on Tuesday. It was up 34.91% YTD and 33.14% over the year.

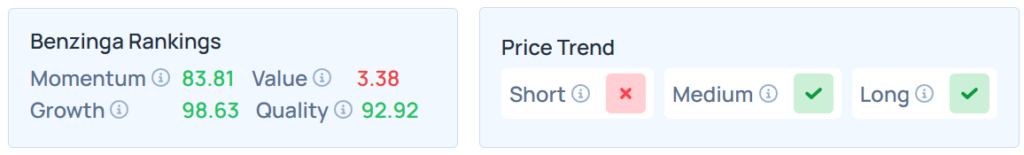

It maintained a stronger price trend over the medium and long terms and a weak trend in the short term, with a poor value ranking. Additional performance details are available here.

The futures of the S&P 500, Nasdaq 100, and Dow Jones Indices were trading lower on Tuesday, after a sharp fall on Monday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock