/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

Nvidia (NVDA) and Intel (INTC) have announced a partnership that could reshape the competitive landscape for Advanced Micro Devices (AMD) in both the data center and PC markets. NVDA and INTC will jointly develop multiple generations of custom products, combining their strengths to accelerate applications across enterprise, hyperscale, and consumer segments.

The collaboration will enable integration between Nvidia’s AI and accelerated computing platforms and Intel’s CPU technologies within the x86 ecosystem. In data centers, Intel will design custom x86 processors specifically for Nvidia, which Nvidia will then incorporate into its AI infrastructure platforms and sell to customers.

On the PC side, Intel will produce system-on-chips (SoCs) that integrate Nvidia’s RTX GPU chiplets with its CPUs. The new x86 RTX SoCs are expected to power next-generation PCs requiring high-performance computing and graphics capabilities.

To strengthen the partnership, Nvidia will also invest $5 billion in Intel stock at $23.28 per share, which will require regulatory approval.

While the development led to a 22.8% rally in Intel stock yesterday, it could bring trouble for AMD as two of its biggest competitors are now working together. However, the immediate impact on AMD could be limited, as product development and adoption will take time. That gives AMD some breathing room to protect its market share with fresh innovations. Still, in the long run, its data center and PC businesses could come under pressure.

AMD’s Current Struggles and Near-Term Outlook

AMD stock has already been under pressure, down roughly 15.3% from its recent 52-week high of $186.65. The pullback reflects softer second-quarter results, where AI-related revenue in its data center business declined. Export restrictions curbing sales of its MI308 accelerators in China, along with customers pausing orders ahead of the MI350 launch, were the main culprits.

Nonetheless, AMD remains on a strong footing. The company entered the second half of 2025 with multiple catalysts that could reaccelerate its growth. Most notably, the MI350 series is now beginning to ramp, a development expected to reaccelerate AI-related revenue in its data center segment. At the same time, AMD’s EPYC server processors and Ryzen chips are seeing robust adoption, providing multiple growth levers beyond GPUs.

AMD’s most recent quarterly results also highlight the strength of its diversified revenue model. Overall revenue rose 32% year-over-year to $7.7 billion, exceeding expectations. The data center segment delivered $3.2 billion in sales, up 14% despite weakness in AI revenue, driven by continued strength in EPYC processors across cloud and enterprise workloads. EPYC has now posted 33 straight quarters of market share gains.

Looking ahead, AMD’s server CPU business is poised to benefit as enterprises accelerate their digital transformation, requiring ever more compute power. On the AI front, AMD is positioning itself for a rebound. The MI350 series is likely to see solid demand, as it delivers high performance. Meanwhile, the development of the MI400 line is advancing quickly, already drawing strong customer interest. The expected acceleration in its AI business, coupled with acquisitions and government partnerships, particularly in sovereign AI initiatives, positions AMD to deliver solid growth.

Here’s What Analysts Recommend for AMD

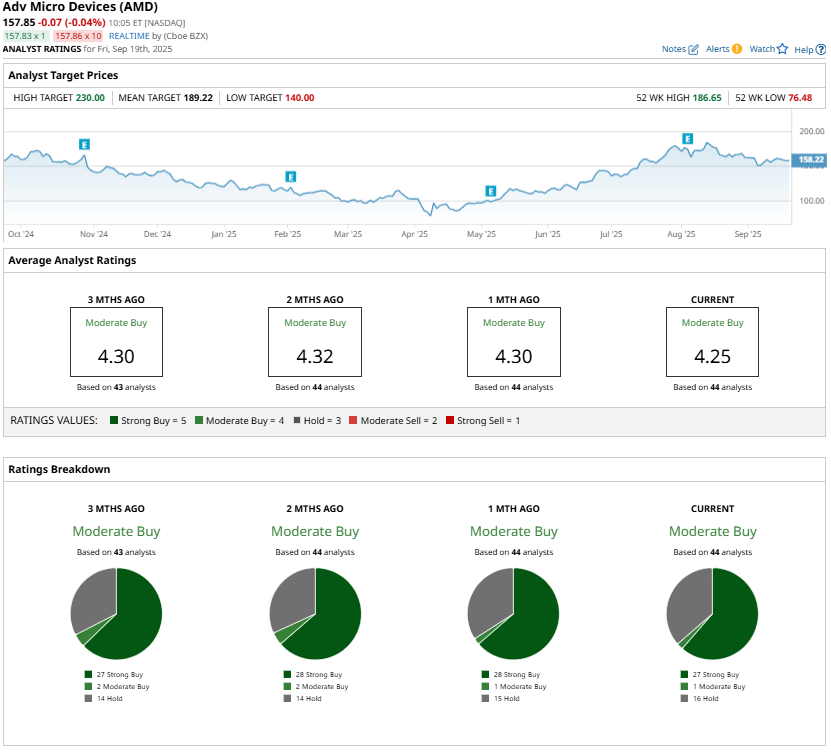

Analysts currently rate AMD as a “Moderate Buy.” The Nvidia-Intel partnership undeniably adds new uncertainty, and investors should expect heightened competitive pressure in the coming years. But AMD’s track record of innovation, strong CPU momentum, and upcoming AI accelerator launches suggest the company is well-positioned to defend and expand its market share.

Conclusion: Trouble for AMD, or an Opportunity for Investors?

Nvidia and Intel joining forces introduces competitive headwinds for AMD, particularly in the data center and PC spaces. However, the recent pullback in AMD shares should be seen as an opportunity. With new products ramping, a diversified growth engine, and a history of execution against challenges, AMD could still thrive.