With a powerful collection of some of Wall Street’s most esteemed backers behind the challenger bank, Nubank’s December 2021 IPO was a watershed moment across the whole of the fintech landscape. After its first full quarter as a public company, it’s clear that the performance of NU is going to play a major role in whether other firms follow suit.

Already we’ve seen other key players in the world of fintech scaling back their IPO plans as Nubank initially experienced mixed fortunes in its floatation. After initially angling for a Q1 2022 IPO, US fintech Chime shelved its plans to go public. Meanwhile, other major challenger banks like Revolut have expressed no desire whatsoever to launch an IPO at this stage in its lifecycle.

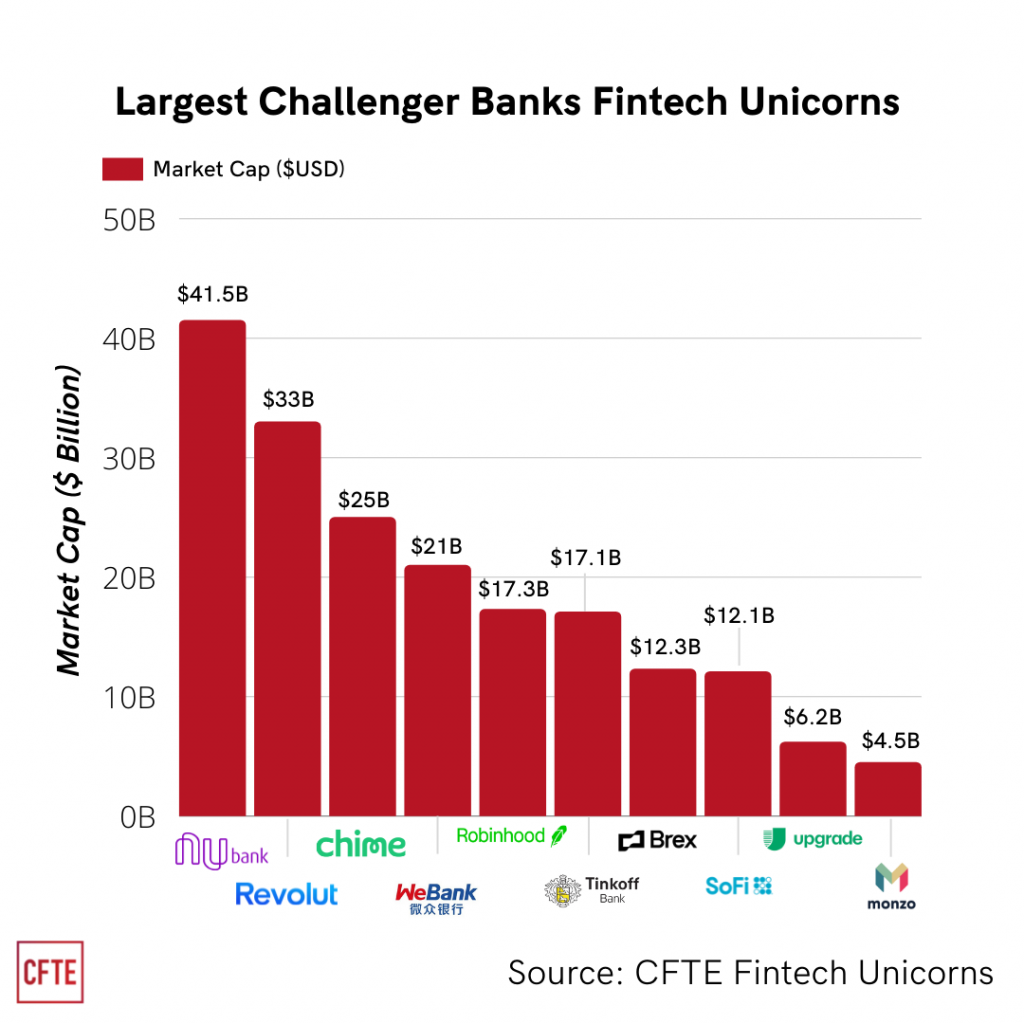

(Image: CFTE)

As we can see from the image above, Nubank is a fully-fledged market leader among successful fintech firms.

Such is the scale of optimism surrounding Nubank, that when Nu Holdings Ltd (NYSE:NU) went public, shares were bought up by some of Wall Street’s biggest names. Legendary investors like Warren Buffett, Cathie Wood, Chase Coleman, Baillie Gifford, and Frank Sands to name a few all flocked to purchase shares.

Despite the furore that welcomed the arrival of Nu Holdings to the New York Stock Exchange, the fintech has endured a difficult start to life as a public company. At the time of writing, the stock sits 23.43% adrift of its opening price. Subsequently, the stock’s market cap has dipped to around $37 billion USD as a result.

In the wake of the Covid-19 pandemic, fintech was one of the most exciting technological developments to rapidly gather momentum. As opposed to traditional institutions, these more advanced and agile financial services were able to allow users to open accounts and hold digital cards and wallets without having to endure stringent application processes, whilst open banking services meant that account holders could seamlessly move their finances into stocks and shares investments and even cryptocurrency holdings in a matter of seconds.

Although competitors like Chime have pulled the plug on plans for an IPO in the wake of Nubank’s stock market performance, optimism remains high for the fintech and the wider industry.

“Nubank shares have fallen against the background of a market correction, also the company bears the economic risks of its region (which is very much exposed to devaluation, rate hikes),” explains Maxim Manturov, head of investment advice at Freedom Finance Europe.

“Chime, in spite of its valuation, may show a different dynamic, also everything will depend on the market situation. For example, Nubank shares were trading above the IPO price before the market correction.”

Manturov’s comments highlight a key consideration to be made when looking at Nubank’s stock market performance so far. The challenger bank listed at a time when rising inflation rates had begun to lead to large-scale tech stock sell-offs.

Cause for Investor Optimism

Nubank reported that its customer accounts grew by 62% to 53.9 million people in 2021, helping to deliver a 224% boost in sales on an FX neutral basis. The Brazilian fintech’s adjusted net income of $3.2 million should also be greeted as positive news amidst a challenging market. Furthermore, deposits accelerated 86% to $9.7 billion.

“Strong set of maiden results from the world’s largest digital bank following its Buffet-backed IPO at the end of last year,” reported Kevin T. Carter, founder of EMQQ. “Nubank’s NPLs (non-performing loans) continue to far outperform the industry. That’s exactly what analysts want to see. An ability to take market share from digitally shy incumbents but to do so profitably and with the right risk management protocols in place.”

Furthermore, in March, Nubank welcomed new central bank rules for digital banks that the company believed would bring lower capital requirements than initially expected in 2023 and 2024. The challenger bank’s announcement on the matter lifted its shares towards an upward trend of 33.39% growth.

The recent news coming out of Nubank is overwhelmingly favourable, which indicates that the company has been adversely impacted by wider market sell-offs and investor uncertainty.

2022 has played host to an exceptionally volatile market as factors relating to the pandemic, record-breaking inflation rates, and geopolitical tensions in Europe have all conspired to spook investors - particularly those who hold tech-based shares.

However, with the likes of Buffett and Wood placing their names amidst a long line of reputable backers, institutional interest in Nubank is high. The challenger bank’s business model serves a strong purpose among Latin America’s unbanked communities by giving users unprecedented access to banking services and remittances.

With its strong business model in mind, it’s likely that recent market volatility will have only aided the stock in presenting a buying opportunity for investors. With a sprawling customer base and unrivalled financial tools in its region, Nubank is likely to emerge as a glowing example for fintech startups to follow.