Weight-loss drugmaker Novo Nordisk A/S (NYSE:NVO)’s technical chart is displaying a largely bearish trend amid a profit warning issued by the company tied to its blockbuster obesity drug Wegovy. However, this expert believes that the Danish pharmaceutical giant could have avoided some trouble if it hadn’t ended its partnership with Hims & Hers Health Inc. (NYSE:HIMS).

Check out NVO stock price here.

What Happened: Novo’s stock plunged by 21.83% on Tuesday after the pharma company said that it expects 2025 sales to grow 8%–14%, down from a previous range of 13%–21%.

The firm also cut its operating profit forecast to 10%–16%, from 16%–24%, marking the second guidance cut of the year.

Shay Bolor, the chief market strategist at Futurum Equities, argues that if Novo Nordisk had partnered more effectively with HIMS, rather than ending it, it could have leveraged HIMS' direct-to-customer consumer layer to maintain market dominance.

Bolor’s post comes as Hims & Hers reported an average weight loss of 10.3% among customers using their personalized GLP-1 weight loss plans, with a 75% patient retention rate over six months.

Novo’s technical chart shows that its stock price of $53.94 after a 21.83% decline on Tuesday was below its short and long-term daily simple moving averages.

According to Benzinga Pro, its MACD line was below zero at -1.58, and it trended lower than the signal line at -0.6, which signals a worsening bearish trend as its 26-day exponential moving average was below its 12-day EMA.

However, its relative strength index at 26.39 was in the oversold zone, indicating that it could bounce back from those levels.

Why It Matters: Novo Nordisk ended its collaboration with Hims & Hers in June, citing the telehealth company’s alleged violation of laws prohibiting mass sales of compounded drugs under the guise of "personalization" and deceptive marketing practices that compromise patient safety.

According to Reuters, both firms are now battling it out in the courts as they have filed several lawsuits against each other.

Price Action: After the 21.83% drop, Novo shares rose 0.83% in after-hours. On Friday, it was down 3.60% in premarket. The stock was down 38.37% year-to-date and 58.26% over the past year.

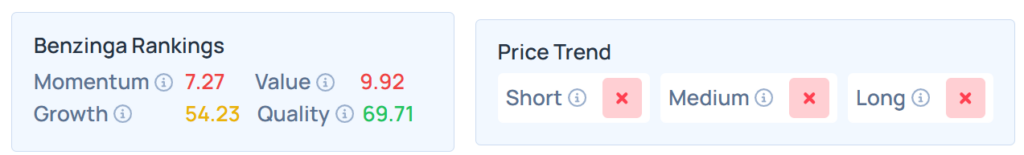

Benzinga's Edge Stock Rankings indicate that NVO maintains a poor momentum across short, medium, and long-term periods. Also, the stock scores poorly on value rankings, but its quality rating remains relatively strong. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Wednesday. The SPY was up 0.12% at $636.02, while the QQQ advanced 0.23% to $568.57, according to Benzinga Pro data.

Read Next:

Photo by Tobias Arhelger via Shutterstock