NovaBay Pharmaceuticals Inc. (NYSE:NBY) surged 66.57% in pre-market trading to $1 on Wednesday, following the announcement of major investment and leadership changes that could prevent the company’s liquidation.

Check out how NBY stock is trading here.

$6 Million Investment Saves Company From Dissolution

The California-based biopharmaceutical company announced on Monday, it secured a $6 million securities purchase agreement with private investor David E. Lazar. The company received $3.85 million in the first closing, with the remaining $2.15 million contingent on stockholder approval at the 2025 annual meeting, expected in the fourth quarter.

See Also: Thermo Fisher Positioned As Biopharma’s Partner Of Choice

The investment comes after stockholders authorized the board in April 2025 to liquidate and dissolve the company. This transaction effectively reverses that liquidation path, allowing NBY shares to continue trading.

Leadership Restructure: New CEO Takes Helm

Effective immediately, investor David E. Lazar assumed the role of Chief Executive Officer and board director. Former CEO Justin Hall transitioned to the newly created position of Vice President of Business Development.

Lazar brings “significant capital restructuring and reverse merger expertise” to the biotech firm, according to Hall’s statement. The board unanimously supported the transaction.

Strategic Pivot: Acquisitions and Special Dividend Planned

NovaBay plans to use investment proceeds to pursue strategic investments and acquisitions. The company also expects to declare a special cash dividend to stockholders during the third quarter.

“I look forward to maintaining NovaBay’s public listing and actively exploring strategic opportunities to drive value for our stockholders,” Lazar stated.

Market Performance and Technical Details

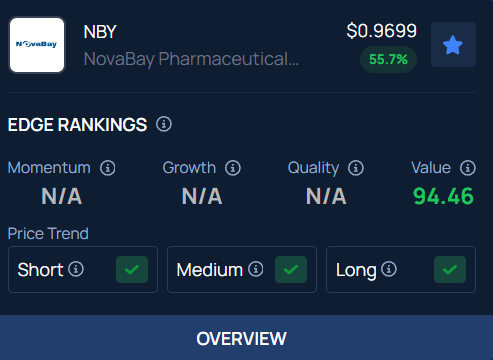

According to Benzinga Pro data, NBY closed regular trading at $0.60, down 3.68% before surging to $0.97 after hours. The stock trades within a 52-week range of $0.44-$1.01, with a market capitalization of $3.51 million and a price-to-earnings ratio of 3.75. Average daily volume of the specialty pharma stands at 46,030 shares.

The transaction involves issuing non-voting convertible Series D and E preferred stock, giving Lazar board nomination rights based on his ownership percentage.

With a strong Value score of 94.46, Benzinga’s Edge Stock Rankings indicate that NBY has a positive price trend across all time frames. Know how its momentum lines up with other well-known names.

Read Next:

Photo:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock