/Northern%20Trust%20Corp_%20magnified%20by-Casimito%20PT%20via%20Shutterstock.jpg)

Chicago, Illinois-based Northern Trust Corporation (NTRS) operates as a holding company, providing wealth management, asset servicing, asset management, and banking solutions for organizations, families, and individuals worldwide. With a market cap of $25.1 billion, the company operates through Asset Servicing and Wealth Management segments.

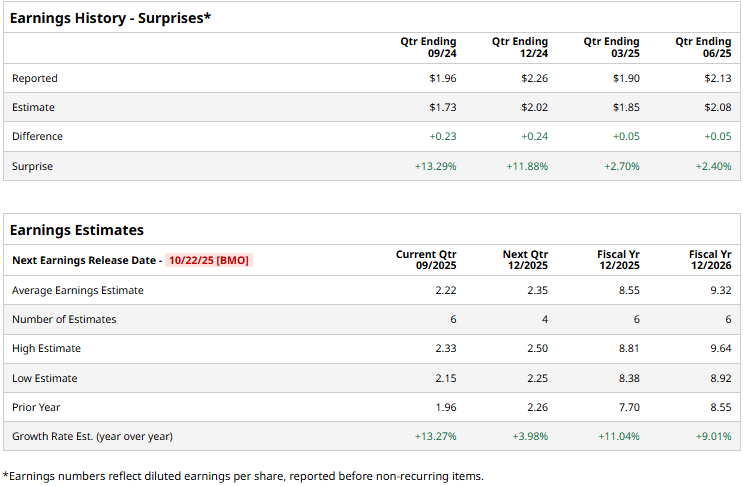

The financial services provider is gearing up to announce its third-quarter results before the market opens on Wednesday, Oct. 22. Ahead of the event, analysts expect NTRS to deliver a profit of $2.13 per share, up 13.3% from $1.96 per share reported in the year-ago quarter. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect NTRS to deliver an EPS of $8.55, up 11% from $7.70 in 2024. In fiscal 2026, its earnings are expected to grow 9% year-over-year to $9.32 per share.

NTRS stock prices have soared 50.7% over the past 52 weeks, notably outperforming the S&P 500 Index’s ($SPX) 17.6% gains and the Financial Select Sector SPDR Fund’s (XLF) 18.2% surge during the same time frame.

Despite reporting better-than-expected financials, Northern Trust’s stock prices declined 1.8% in the trading session following the release of its Q2 results on Jul. 23. The company reported a notable growth in trust, investment, and other servicing fees, along with a 16% surge in net interest income. However, its other non-interest income experienced a significant plunge. Overall, its topline for the quarter dropped 26.4% year-over-year to $2 billion, but surpassed the Street expectations. Meanwhile, its EPS increased 12.1% year-over-year to $2.13, exceeding the consensus estimates by 2.4%.

Analysts remain cautious about the stock’s prospects. NTRS maintains a consensus “Hold” rating overall. Of the 16 analysts covering the stock, opinions include two “Strong Buys,” one “Moderate Buy,” nine “Holds,” one “Moderate Sell,” and three “Strong Sells.” As of writing, the stock is trading above its mean price target of $132.46.