/Nordson%20Corp_%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Nordson Corporation (NDSN) is an Ohio-based precision technology and industrial engineering company. Valued at a market cap of $15.2 billion, it designs, manufactures, and markets highly specialized equipment and systems used to dispense, apply, control, and inspect adhesives, coatings, sealants, biomaterials, polymers, and other fluids across a broad range of end markets, including packaging, electronics, medical, transportation, energy, and consumer products.

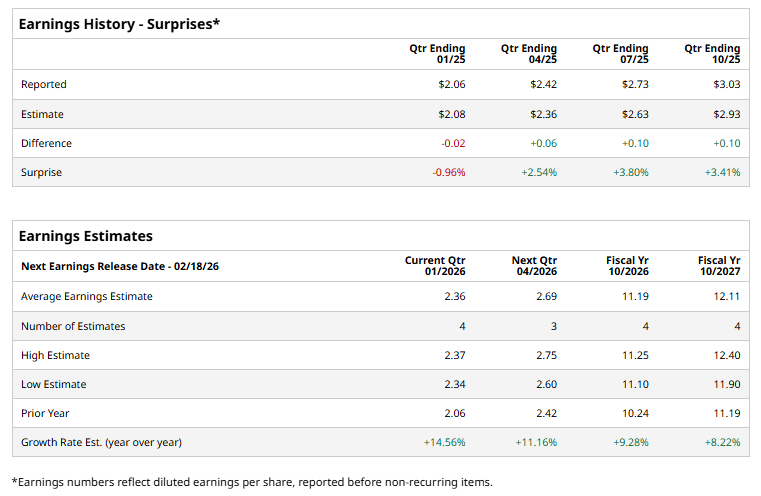

The company is scheduled to announce its fiscal Q1 earnings for 2026 in the near future. Ahead of this event, analysts expect this industrial company to report a profit of $2.36 per share, up 14.6% from $2.06 per share in the year-ago quarter. The company has surpassed Wall Street’s earnings estimates in three of the last four quarters, while missing on another occasion.

For fiscal 2025, analysts expect NDSN to report a profit of $10.19 per share, up 9.3% from $10.24 per share in fiscal 2025. Its EPS is expected to further grow 8.2% year over year to $12.11 in fiscal 2027.

NDSN has soared 27.2% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 16.9% return and the Industrial Select Sector SPDR Fund’s (XLI) 21.9% uptick over the same time period.

On Dec. 10, NDSN shares rose 1.2% after the company released its fiscal 2025 fourth quarter result. It delivered modest growth and stronger profitability, sales rose about 1% year over year to $752 million, while adjusted earnings per share increased to $3.03 up around 9% year over year and ahead of analyst expectations.

Nordson enters fiscal 2026 with a stronger position, reporting about $600 million in backlog, up 5% from the prior year, and projecting full-year sales of $2.83–$2.95 billion with adjusted earnings of $10.80–$11.50 per share. For the first quarter, the company expects sales of $630–$670 million and adjusted EPS of $2.25–$2.45. Management expressed confidence that improving end markets and its Ascend Strategy will support solid growth while continuing disciplined capital deployment through acquisitions, buybacks, dividends, and debt management.

Wall Street analysts are moderately optimistic about NDSN’s stock, with an overall "Moderate Buy" rating. Among 11 analysts covering the stock, six recommend "Strong Buy," and five suggest "Hold.” The mean price target for NDSN is $272.44, indicating an marginal potential upside from the current levels.