Picture this: You're on the cusp of retirement, and you've just learned about a financial tool that promises to shield your hard-earned savings from taxes until you need them.

This tool is the non-qualified annuity, an insurance contract funded with after-tax money that defers taxes on your income and growth until withdrawn.

Sounds like an easy decision, right?

Hold that thought ...

In a world devoid of pensions, 401(k)s and similar employer-sponsored plans have become many Americans' go-to retirement saving option. These plans offer upfront tax breaks and deferred taxation on earnings, a seemingly ideal combination.

But there's a catch.

Every dollar withdrawn from a tax-deferred account is taxed as ordinary income — the least-favorable type of income tax there is.

An unfortunate surprise for many

Now, let's circle back to non-qualified annuities. By opting for one, you're essentially converting all potential long-term capital gains (which enjoy favorable tax treatment) into ordinary income, thus increasing your tax burden when those gains are withdrawn. It's an unfortunate twist many don't see coming and are unaware of when buying a non-qualified annuity.

Consider this scenario: You're a modern-day retiree with a diverse portfolio of investments — most of which have been saved in tax-deferred accounts, some in tax-preferential accounts and a small amount in tax-free accounts. Adding a non-qualified annuity might seem prudent, especially if you are a tax-sensitive investor. But if your retirement nest egg is already concentrated in tax-deferred accounts, that type of annuity will only make your future tax exposure less diverse.

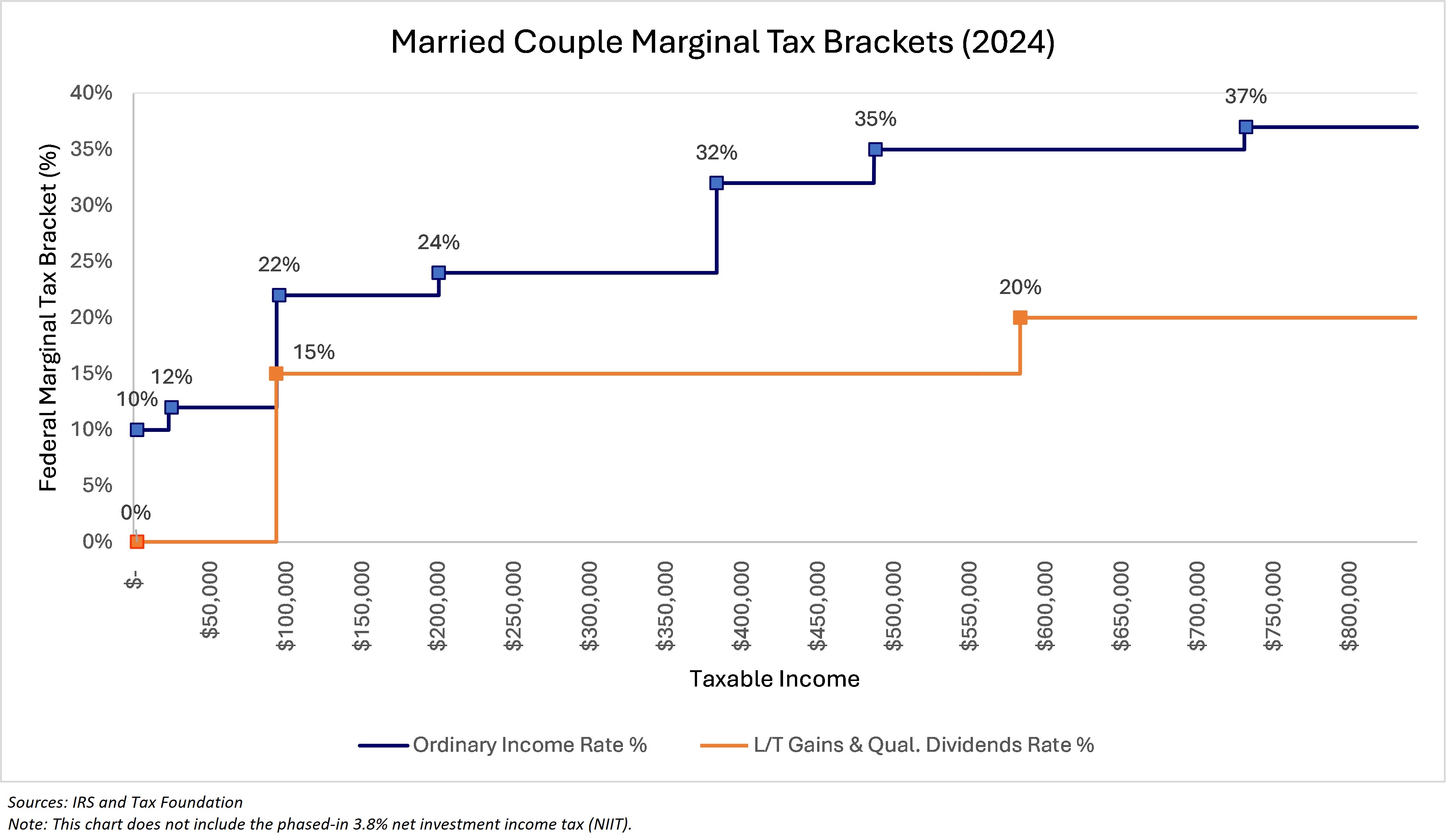

As you can see in the chart below, ordinary income tax rates (blue) are generally higher than tax rates on long-term capital gains and qualified dividends issued by stocks (orange), which is why it is advantageous for today's retirees to preserve their non-tax-deferred assets rather than convert them:

Before jumping into a non-qualified annuity, ask yourself:

How diversified is my tax exposure in retirement? Don't just diversify your investments; diversify your future tax liabilities. On the day you retire, aim to have your savings split into equal thirds among tax-deferred, tax-preferential and tax-free accounts. This lets you choose which accounts to withdraw from each year to achieve the lowest tax rate.

What does my retirement withdrawal plan look like? If you anticipate needing all your savings for retirement expenses, it’s likely advantageous to keep your taxable investment accounts due to their favorable tax treatment rather than shifting that money into another tax-deferred option like a non-qualified annuity.

Will my retirement lifestyle push me into the highest tax brackets? If yes, it would be wise to reconsider piling more money into tax-deferred savings. If not, then the tax-deferred benefits of a non-qualified annuity may fit your situation well.

Do you care about maximizing your financial legacy? Taxable brokerage accounts left to your heirs receive a step-up in basis upon your death. This is a major tax benefit for heirs that adjusts the principal in your account (cost basis) to the fair market value of your investments on the date of your death. In some cases, this can lead to thousands of dollars in capital gains taxes being forgiven. Alternatively, even though it is funded with after-tax dollars, a non-qualified annuity does not receive a “step-up in basis” upon your death. This is a major downfall of the non-qualified annuity, in my opinion.

Based on my experience …

From my experience as a financial adviser, I've found that the retirees who need to withdraw most of their savings to afford their lifestyle in retirement are better off nurturing their after-tax investments in taxable brokerage or tax-free accounts rather than piling more into the tax-deferred bucket. Next to health care costs, income taxes are a retiree's most significant expense. The goal is to minimize your income taxes as much as possible.

Although a non-qualified annuity offers immediate tax relief, it can lead to a higher tax burden in the long run. A wiser approach may be to focus on preserving your non-tax-deferred savings. This doesn't make non-qualified annuities bad financial instruments. It just means the decision to use one in your financial situation requires careful consideration from a variety of perspectives.

Advisory services offered through Wealth Enhancement Advisory Services, LLC, a registered investment advisor and affiliate of Wealth Enhancement Group®.