Yutaka Suzuki, a senior researcher at the Daiwa Institute of Research, spoke with The Yomiuri Shimbun about recent trends related to shareholder meetings, and the path that Japanese companies should take. The following is an excerpt from the interview.

Institutional investors get tough

The Yomiuri Shimbun: What is your impression of recent shareholder meetings in Japan?

Suzuki: This year's season for stockholder meetings has come to a close. However, the atmosphere of the meetings, which were once referred to as "rubber stamp meetings," has changed to one in which participants freely voice their doubts regarding company proposals. Shareholders have gotten tough, and reject proposals if they have even a small amount of doubt. The number of proposals made by shareholders has increased, and a new, tense relationship between companies and shareholders has emerged.

[At this year's stockholder meetings, a historically high 42 listed companies received independent proposals from shareholders who did not accept the companies' proposals.]

Q: Why has the relationship between companies and shareholders changed?

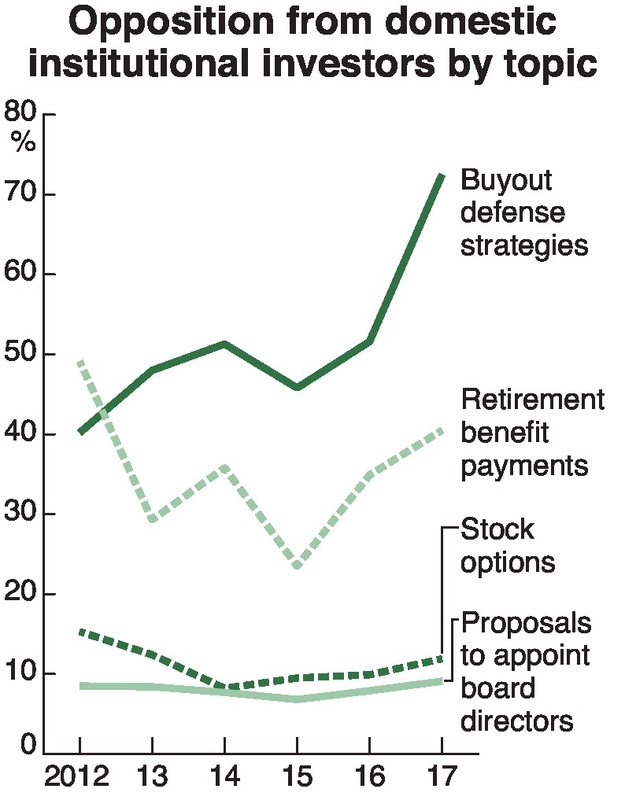

A: There has been a big change in the attitude of institutional investors. In 2017, the Financial Services Agency revised the Stewardship Code, which contains conduct guidelines for institutional investors, asking them to make public whether they supported or opposed companies' proposals at shareholder meetings.

This has made it impossible for institutional investors to make irresponsible decisions. Many of the large investment management firms have created a section to communicate with investment destinations and increased the number of personnel in such sections.

Before, it was rare for institutional investors to oppose proposals on the selection of company board directors, including top management. Even when there was opposition, it was from such perspectives as seeking to maintain the independence of outside directors.

Now, opposition is expressed for reasons such as stagnant performances and inadequate responses to scandals.

In the past, proposals by shareholders were made mainly by organizations whose members became shareholders for specific purposes, such as addressing environmental and labor issues, with electric power and railroad companies often the targets.

These proposals by such organizations had been driven by political purposes. However, they have recently shifted toward demands to disclose executive compensation in detail and requests to separate the role of chairman and chief executive officer. Such issues have become commonplace overseas and acceptable to other shareholders. These changes are also believed to have had an effect on shareholder meetings in Japan.

Changes in 'assertive investors'

Q: What about Japanese companies' attitudes toward foreign shareholders?

A: The attitude toward "assertive shareholders," who are typically foreign and referred to as "activists," has also changed.

In the past, many of them pointed out problems with company management, portraying themselves as standing on the side of justice. I think their proposals were meant to enhance the long-term value of companies primarily, as they are not investors who earned short-term profits. However, their proposals often included self-centered demands, such as "raise dividends" and "dispose of treasury stock."

But many institutional investors today seem to be requesting almost the same things as activists traditionally have. Since the requests are meant to "consider the economic benefits of shareholders," they have naturally attracted the interest of other investors.

Rather than submitting their own proposals as before, assertive investors now sometimes attempt to compromise with companies. Companies, for their part, are accepting parts of shareholders' proposals and reflecting aspects of them in their own proposals.

Concerning proposals by shareholders, past annual meetings tended to focus on who submitted the proposal. Many people used to believe "we can't support what those shareholders said." However, these days it is not "who" but "what is being proposed" that is attracting attention. Details must be scrutinized before a decision is made. This has most likely led to an increase in the acceptance of shareholders' proposals.

The rise of virtual participation

Q: What are the upcoming challenges related to the new type of shareholder meetings?

A: Due to increased opposition to internal company proposals, firms need to consider how to respond when they can't pass proposals, such as nominations for company presidents. If this occurs, the next president would need to be chosen quickly. There are fears that a large number of dissenting votes could cause unexpected turmoil for the management.

It is necessary to consider the influence of voting advisory companies that make suggestions to institutional investors. It is important for companies to have the opportunity to argue against the opinions of voting advisory companies, which have become a major factor for an increasing number of opposing votes at shareholder meetings. Steps in this direction have been made in the United States, but have yet to take place in Japan.

Q: What should Japanese companies learn from precedents in the United States?

A: In the United States, "virtual attendance" at shareholder meetings makes it possible for stockholders who cannot attend in person to monitor proceedings via the internet. Because of the size of the United States, sometimes it's not easy to attend shareholder meetings. In Japan too, it can be a challenge to attend shareholder meetings by using Shinkansen bullet trains.

With virtual meetings, shareholders can ask questions in advance online, which shortens the duration of meetings. At traditional meetings, issues without any particular connection to profits sometimes crop up, such as "customer service is bad." But virtual meetings can ensure questions that are relevant to shareholder returns only are raised. This is something also worth considering in Japan. Shareholder meetings are rare opportunities for management to interact with stockholders. If the trends of pursuing shareholder returns and enhancing company values expand, I think that will shore up the Japanese economy as a result.

-- This interview was conducted by Yomiuri Shimbun Staff Writer Takeshi Kurihara.

-- Yutaka Suzuki / Senior Researcher at Daiwa Institute of Research

Suzuki, 56, earned an MBA from Rochester University. He specializes in research and studies on shareholder behavior, such as pension funds. He assumed his current post in April 2017.

Read more from The Japan News at https://japannews.yomiuri.co.jp/