Merrillville, Indiana-based NiSource Inc. (NI) is an energy holding company that operates as a regulated natural gas and electric utility company. Valued at $18.9 billion by market cap, the company provides natural gas to approximately 2.4 million residential, commercial, and industrial customers, and also generates, transmits, and distributes electricity to approximately 0.5 million customers in various counties in northern Indiana. The leading natural gas distribution company is expected to announce its fiscal second-quarter earnings for 2025 on Wednesday, Aug. 6.

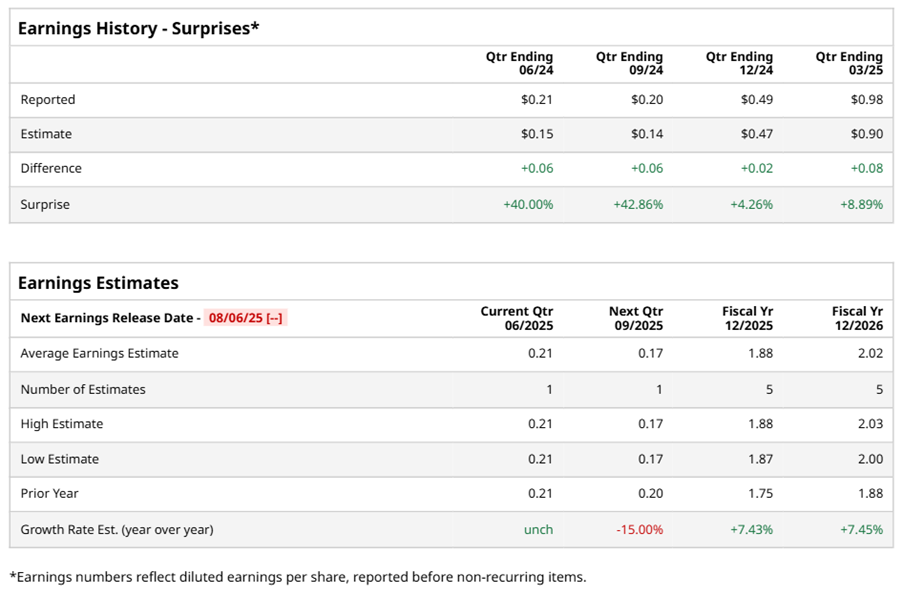

Ahead of the event, analysts expect NI to report a profit of $0.21 per share on a diluted basis, unchanged from the same quarter last year. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect NI to report EPS of $1.88, representing a 7.4% increase from $1.75 in fiscal 2024. Its EPS is expected to rise 7.5% year-over-year to $2.02 in fiscal 2026.

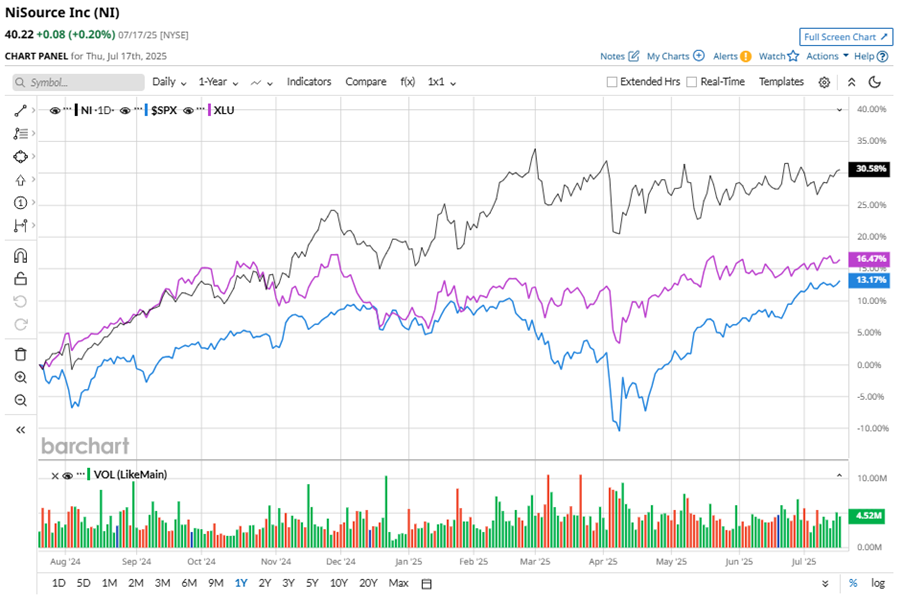

NI stock has outperformed the S&P 500 Index’s ($SPX) 12.7% gains over the past 52 weeks, with shares up 31.1% during this period. Similarly, it outperformed the Utilities Select Sector SPDR Fund’s (XLU) 17.5% gains over the same time frame.

NiSource's strong performance is attributed to strategic investments in modernizing its infrastructure, resulting in improved service reliability. The addition of clean assets to the company's portfolio has further boosted its overall performance. With planned regulated investments, NiSource is poised to enhance the reliability and safety of its services, providing efficient electric and natural gas services to a growing customer base.

On May 7, NI shares closed up 2.9% after the company reported its Q1 results. Its adjusted EPS of $0.98 beat Wall Street expectations of $0.90. NI expects full-year adjusted EPS in the range of $1.85 to $1.89.

Analysts’ consensus opinion on NI stock is bullish, with an overall “Strong Buy” rating. Out of 15 analysts covering the stock, 14 advise a “Strong Buy” rating, and one suggests a “Hold.” NI’s average analyst price target is $43.28, indicating a potential upside of 7.6% from the current levels.