Shares of Nio Inc – ADR (NYSE: NIO) are trading lower Friday morning as China reportedly announced it will tighten its management of electric vehicle exports. Here’s what investors need to know.

What To Know: According to a Bloomberg report, China plans to tighten its management of the world’s largest car market by requiring its automakers to secure permits for exporting electric vehicles.

The new rule, which takes effect on January 1, 2026, would require an export license for all EVs. China’s Ministry of Commerce announced that this measure is intended to foster the industry’s “healthy development”. This policy aligns the EV sector with regulations already in place for other vehicles and motorbikes that require export permits.

Read Also: Nio Stock Is Trading Higher Wednesday: What’s Happening?

According to Friday’s Bloomberg report, Europe remains the top market for Chinese electric vehicle exports, even with tariffs from the European Union. From January to July 2025, companies like Nio, BYD and XPeng shipped over $19 billion in electric vehicles, a value similar to that of the same timeframe a year prior.

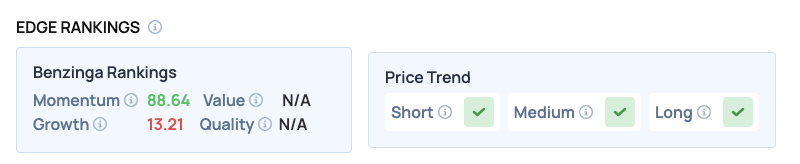

Benzinga Edge Rankings: Benzinga Edge stock rankings give you four critical scores to help you identify the strongest and weakest stocks to buy and sell.

NIO Price Action: NIO shares were down 6.16% at $7.00 at the time of publication Friday, according to Benzinga Pro. Over the past month, NIO has gained about 7.8% versus a 2.1% rise in the S&P 500 and is up roughly 59% year-to-date compared to the index’s 11.7% gain. The stock is trading near its 52-week high of $7.71.

Technical Momentum: The stock is trading well above its 50-day moving average of $5.63, suggesting a potential support level, while the 100-day and 200-day moving averages at $4.68 and $4.47 respectively indicate a longer-term bullish trend. Resistance may be encountered near the recent high of $7.37.

How To Buy NIO Stock

By now you're likely curious about how to participate in the market for NIO – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of NIO, which is trading at $7 as of publishing time, $100 would buy you 14.31 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock