Nio Inc – ADR (NYSE:NIO) stock has jumped 13% in the past month, reflecting growing investor confidence despite broader market concerns. Here’s what investors need to know.

What To Know: Last week, several financial institutions, including Mizuho, UBS and Citigroup, raised their price targets for Nio. This optimism follows the successful launch of the company’s third-generation ES8 SUV at a competitive price point, which analysts believe will boost sales in the coming months.

The positive momentum comes even as Beijing announced plans to tighten EV export regulations starting January 1. While this initially caused a dip in the stock, the market appears to be looking past the near-term regulatory hurdles.

Investors are also weighing the intense competition within the Chinese EV market, where Nio is considered a key player challenging established brands like Tesla Inc.

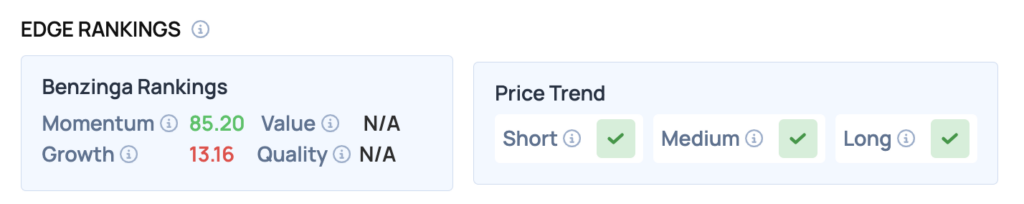

Benzinga Edge Rankings: Reflecting this recent performance, Nio boasts a strong Momentum score of 85.20 according to Benzinga Edge stock rankings.

NIO Price Action: NIO shares were up 4.72% at $7.55 at the time of publication Tuesday, according to Benzinga Pro. Over the past month, NIO has gained about 19.9% versus a 3.9% rise in the S&P 500 and is up roughly 69% year-to-date compared to the index’s 12.3% gain. The stock is trading near its 52-week high of $7.71.

The stock is trading well above its 50-day ($5.74), 100-day ($4.74) and 200-day ($4.49) moving averages, suggesting a strong bullish trend. Immediate support can be observed around the 50-day moving average, while resistance is likely near the recent high of $7.78.

How To Buy NIO Stock

By now you're likely curious about how to participate in the market for Nio – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Nio, which is trading at $7.55 as of publishing time, $100 would buy you 13.25 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock