Shares of Chinese electric vehicle maker Nio Inc (NYSE:NIO) are falling Tuesday. The stock appears to be taking a pause after last week’s rally that sent shares to new 52-week highs. Here’s what investors need to know.

What To Know: The recent investor enthusiasm in Nio followed the company's announcement of record-breaking vehicle deliveries. Nio announced last week that it delivered 34,749 vehicles in September, a 64.1% year-over-year increase, and a record 87,071 vehicles for the third quarter.

The strong sales figures, bolstered by the launch of its new flagship ES8 SUV and growing demand for its affordable ONVO and FIREFLY sub-brands, prompted positive reactions from Wall Street.

Last week, several financial institutions, including Mizuho and UBS, raised their price targets for the EV maker. Tuesday’s pullback may suggest some profit-taking after the stock's 60% year-to-date surge, as investors weigh the company's growth against intense competition in the Chinese EV market and potential regulatory changes.

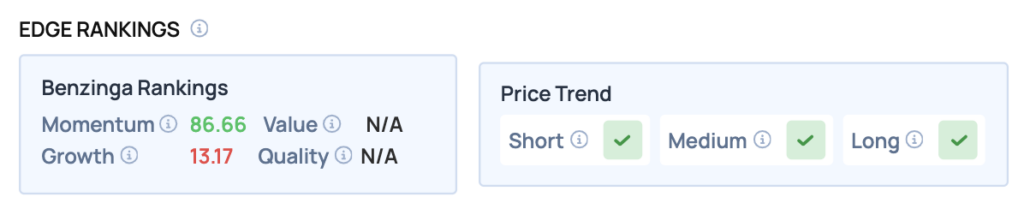

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, Nio currently boasts a strong Momentum score of 86.66, reflecting its recent 52-week high.

NIO Price Action: Nio shares were down 2.37% at $7.41 at the time of publication Tuesday, according to Benzinga Pro. The stock is trading near its 52-week high of $8.02.

Nio stock is trading above its 50-day moving average of $6.03, suggesting a potential support level, while the 100-day and 200-day moving averages at $4.92 and $4.57, respectively, indicate a longer-term bullish trend. Resistance may be encountered near the recent high of $8.02, the upper boundary of the 52-week range.

Read Also: Trump Ignites Metal Stock Frenzy—These Names Could Be Next

How To Buy NIO Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in NIO’s case, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock