Shares of Chinese electric vehicle maker Nio Inc – ADR (NYSE:NIO) are trading sharply lower Friday afternoon, caught in a broad market downturn ignited by concerns of a renewed trade war between the U.S. and China. Here’s what investors need to know.

What To Know: The sell-off followed a social media post from President Donald Trump, who stated he is considering a "massive increase of Tariffs on Chinese products" and other countermeasures. The President's post cited what he described as China's "hostile" move to monopolize rare earths and other key elements.

The fears of escalating trade tensions rattled Wall Street, sending major U.S. indexes tumbling. The pain was particularly acute for U.S.-listed Chinese companies. Nio was not alone among its peers, as other prominent Chinese ADRs like Alibaba Group Holding Ltd – ADR (NYSE:BABA) and PDD Holdings Inc – ADR (NASDAQ:PDD) also saw significant declines. The potential for new tariffs casts a shadow of uncertainty over companies like Nio, which are highly sensitive to geopolitical and trade-related risks.

Read Also: Nio To Enter Armenia Market With Fresh Approach

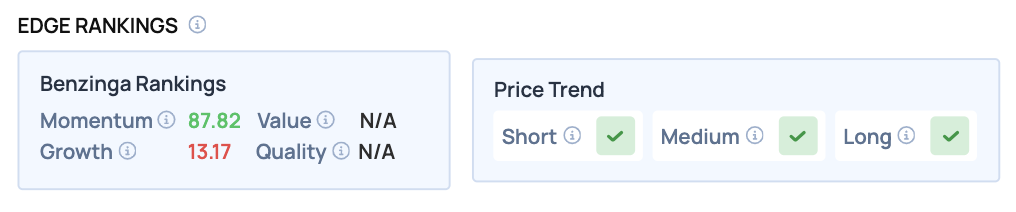

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, NIO boasts a strong Momentum score of 87.82, though its Growth score is a low 13.17.

NIO Price Action: Nio shares were down 8.91% at $6.79 at the time of publication Friday, according to Benzinga Pro.

How To Buy NIO Stock

By now you're likely curious about how to participate in the market for Nio – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock