Chinese electric vehicle (EV) company Nio (NIO) is entering what management refers to as a "new cycle," in which years of investment in innovation, infrastructure, and product development are beginning to yield tangible competitive advantages. Nio's recent second-quarter earnings reflected strong delivery growth, improved financial performance, and significant advances in its multi-brand and technology strategies. This robust recovery has sent its stock up 42.3% year-to-date (YTD), outpacing the overall market gain. Let’s see if NIO stock is a buy, hold, or sell now.

About Nio

Nio is a Chinese EV company that creates, manufactures, and sells smart, premium EVs like SUVs and sedans. It is often referred to as the "Tesla of China" because it caters to the upper end of the market, emphasizing luxury design, technology, and performance. Some of Nio's most well-known EV models include the ES8, ES6, and EC6 (electric SUVs) and the ET7 and ET5 (premium electric sedans). The company has also launched the Envoy brand, which is a more affordable mainstream sub-brand.

What distinguishes Nio is its battery-swapping technology, which allows drivers to replace a depleted battery with a fully charged one in minutes rather than having to recharge.

Deliveries Surge as Multi-Brand Portfolio Gains Traction

During the first quarter, CEO William Li had stated that 2025 would be Nio's "hardest year for products," with the primary focus on achieving profitability through efficiency and scale. And this is what the second quarter revealed. In the second quarter, Nio delivered 72,056 smart EVs, up 25.6% year-on-year (YoY). The Envoy brand has continued to gain traction in the mainstream family market, while the Firefly brand is rapidly gaining share in the high-end small car segment. Firefly has sold over 10,000 units in just three months, making it the best-selling model in its category.

Total revenue increased 9% YoY and 57.9% sequentially to $2.6 billion, boosted by a 2.6% increase in vehicle sales. While the company remains unprofitable, the net loss decreased 1% YoY to $697.2 million.

Multi-Brand Strategy Is Accelerating Growth

Management emphasized that Nio's three-brand strategy, Nio, Envoy, and Firefly, is opening up new user segments, ranging from premium executive sedans to family SUVs and small urban EVs. The launch of the Envoy L90 in late July was a resounding success, with 10,575 units sold in its first full month. Furthermore, strong demand has increased brand visibility for the L60, which saw a massive order intake in August. Nio also emphasized the increasing popularity of its flagship ET9 sedan, which has performed well in the executive luxury segment since deliveries began.

The company's momentum continued, with 21,017 total deliveries in July and a record-breaking 31,305 in August, boosted by the success of newly refreshed 2025 model-year vehicles and strategic launches. Nio now expects Q3 deliveries to be between 87,000 and 91,000, representing a 40.7% to 47.1% increase YoY. At the end of the second quarter, the company held $3.8 billion in cash, cash equivalents, restricted cash, short-term investments, and long-term time deposits.

The company expects to improve financial performance significantly while accelerating market share gains by increasing operational efficiency, expanding infrastructure, and launching new products. With sales momentum building around the ES8, Envoy L90, and Firefly, Nio believes it is well-positioned to lead China’s transition to electrification and deliver its next phase of rapid growth.

Analysts covering Nio expect revenue to increase by 35.8% in 2025, followed by another 39.1% in 2026. Analysts also predict losses to narrow to $0.62 per share by 2026. If Nio continues to grow at its current rate, 2025 could be a turning point for the company. However, considering NIO is a volatile growth stock, it would be wise to watch its momentum over the next few quarters.

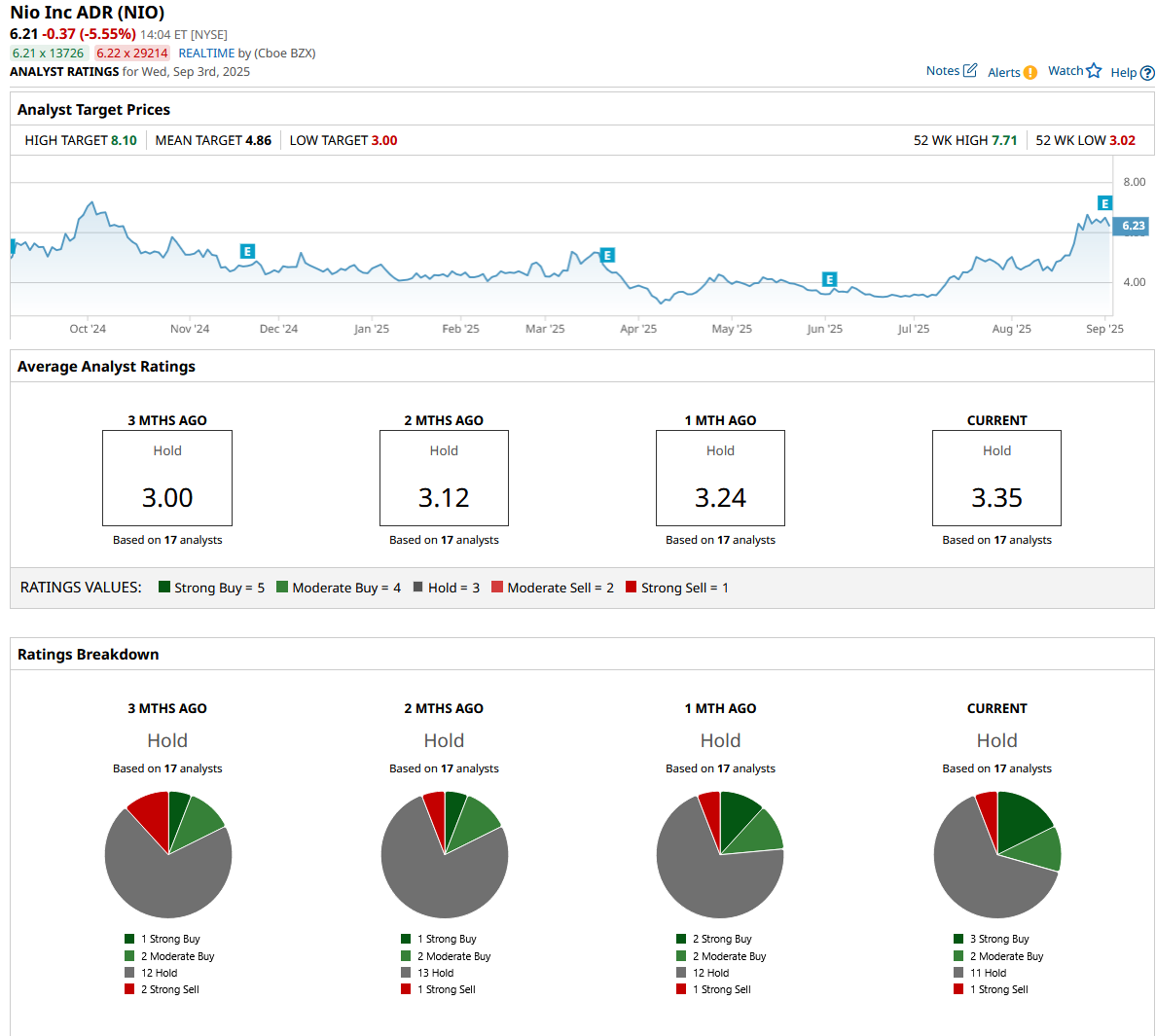

What Is Wall Street Saying About NIO Stock?

Following the Q2 earnings, Bank of America Securities analyst Ming-Hsun Lee reiterated his “Hold” rating on NIO stock, with a target price of $7.10. Lee believes Nio's recent model launches will boost deliveries. However, the analyst believes that much of the upside from higher volumes and narrowing losses may have already been priced into the stock. Lee believes that a neutral stance is still appropriate at this stage, as the company faces challenges in lowering marketing costs and meeting margin targets.

Overall, Wall Street remains cautious with a "Hold" stance. Out of the 17 analysts who cover NIO, three recommend it as a "Strong Buy," two as a "Moderate Buy," 11 say it is a "Hold," and one says it is a "Strong Sell." NIO has surpassed its average price target of $4.86. However, the Street's high target price of $8.10 implies a potential 30.6% gain over the next year.