/Tesla%20car%20charging%20by%20Waldemar%20via%20Unsplash.jpg)

Nio (NIO) is a Shanghai-based leader in the smart electric vehicle (EV) industry. The company designs, develops, and manufactures premium EVs, including sedans and SUVs, featuring advanced features such as battery swapping and autonomous driving technology. It operates innovative brands such as Nio, Onvo, and Firefly.

Founded in 2014, the company has expanded into international markets, including Europe and the United States.

About NIO Stock

NIO stock has experienced robust gains across multiple time frames in 2025. Over the last five days, NIO dipped 6.5%, while advancing 25% in the past month. The six-month performance shows a substantial 48% jump, and year-to-date (YTD), shares have grown by 43.6%. Over the last 52 weeks, NIO returned 52.8%, reflecting sustained investor optimism and strong EV delivery growth.

Nio Posts Mixed Results

Nio’s second-quarter 2025 results reflected strong operational progress, even as some numbers missed analyst forecasts. Revenue reached $2.65 billion, climbing 9% from a year earlier but coming in below consensus estimates by $110 million. Adjusted earnings per share were $0.32 per ADS, a slight beat, while net loss per ADS was $0.32, just under expectations.

The quarter was notable for a delivery record: Nio shipped 72,056 vehicles, up 25.6%, with momentum driven by its expanding lineup, including the Onvo and Firefly brands.

Financially, Nio’s gross margin improved to 10% from 9.7%, and operating losses narrowed by almost 6% to $685.2 million year-over-year (YoY). Vehicle margins slipped to 10.3%, compared to 12.2% in the previous year. Cash flow and reserves saw positive movement, with the company’s cash pile rising to RMB 27.2 billion ($3.8 billion), helping secure investments in R&D, which grew to RMB 3.01 billion ($420 million). Compared to Q1, Nio saw revenue and delivery growth accelerate, while losses continued to shrink.

Looking forward, NIO projects a strong third quarter, guiding for deliveries between 87,000 and 91,000 vehicles and revenue of $3.05–$3.19 billion, which would represent new highs. Management remains optimistic, citing demand for its diverse products and continued improvements across core operations.

With Record Deliveries

China’s electric vehicle market rebounded strongly in August 2025, with Nio emerging as a standout performer. Nio achieved a record 31,305 vehicle deliveries, marking a 55.2% increase compared to August 2024 and nearly 49% higher than July. This surge was largely fueled by its ONVO sub-brand, which delivered 16,434 units—its highest ever—after launching the L90 six-seater SUV. Meanwhile, NIO’s core brand sold 10,525 vehicles, while its newer premium Firefly brand delivered 4,346 units, also setting new monthly highs.

While BYD (BYDDY) led the market with 371,501 units delivered, Nio’s growth was notable among domestic EV players. Other brands like Leapmotor and XPeng (XPEV) also posted impressive delivery records with competitively priced models, though not matching Nio's volumes. Positive investor sentiment followed the surge in Nio’s sales.

In contrast, some competitors faced challenges: Li Auto (LI) experienced a decline partly due to a recent controversy, while Huawei-backed Harmony saw marginal dips in deliveries. Overall, Nio’s August performance reflects its successful product strategy, appealing pricing, and solid execution as it strengthens its position in China's rapidly growing EV market and garners increasing investor interest.

Should You Buy NIO?

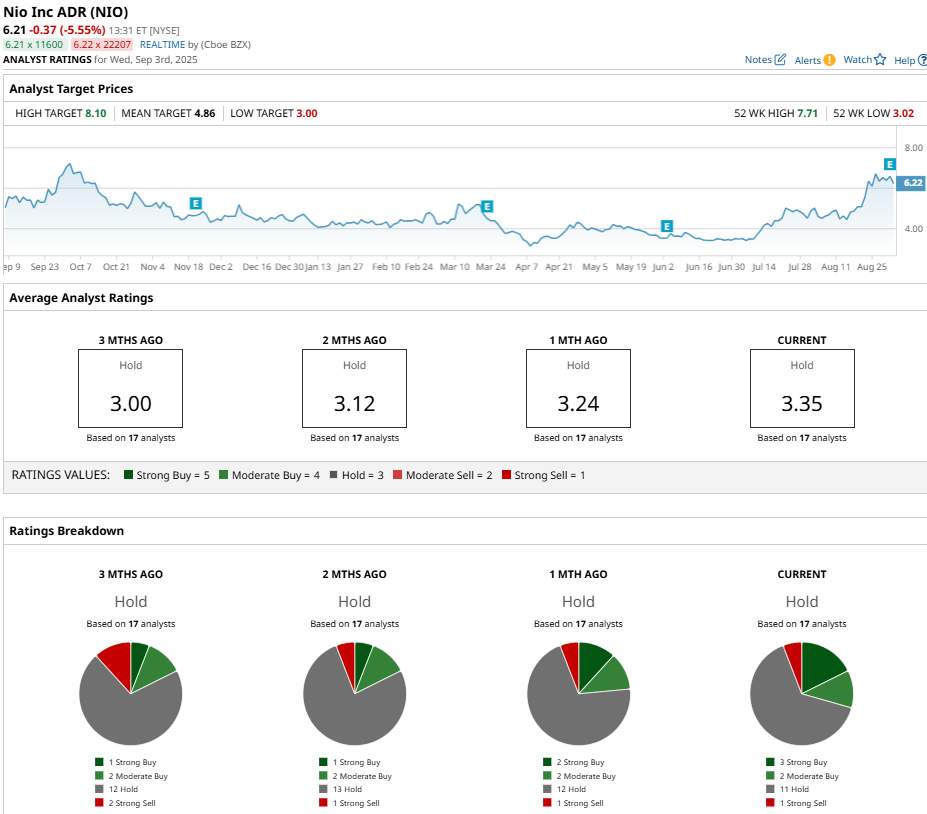

Analysts aren’t very optimistic with the carmaker at present, with a consensus “Hold” rating and a mean price target of $4.86, reflecting a downside potential of 21% from the market rate. The stock has been studied by 17 analysts while receiving three “Strong Buy” ratings, two “Moderate Buy” ratings, 11 “Hold” ratings, and one “Strong Sell” rating from Wall Street.