/EV%20charging%205%20by%20Nrqemi%20via%20iStock.jpg)

Nio's (NIO) rise in the electric vehicle (EV) space reads almost like a comeback story. From its Shanghai base, the company set out to redefine mobility with premium electric sedans and SUVs, powered by a multi-brand strategy and ideas once considered science fiction. Over the years, it stretched its vision across Europe and into the Middle East, signaling it was not just chasing the Chinese market but carving a global footprint.

That ambition has started paying off. After years of stock declines, deliveries are climbing, margins are improving, and sentiment is shifting back in its favor. Citi just raised its NIO stock price target to a Street-high of $8.60 and reaffirmed its “Buy” rating, lauding Nio’s battery EV (BEV) strength and pricing strategy as growth accelerators.

Yet, in an increasingly crowded EV race, can Nio sustain this surge? Should investors buckle in for the ride?

About Nio Stock

Founded in 2014, Nio has grown from a bold Shanghai start-up into a recognized force in the global EV race. The company crafts premium sedans and SUVs, blending luxury with innovations like battery swapping and advanced autonomous systems.

With its expanding family of brands — Nio, Onvo, and Firefly — it has moved beyond China, establishing a presence in Europe and the U.S., positioning itself as both a technological pioneer and an ambitious global contender. Its market capitalization currently stands at $15.6 billion.

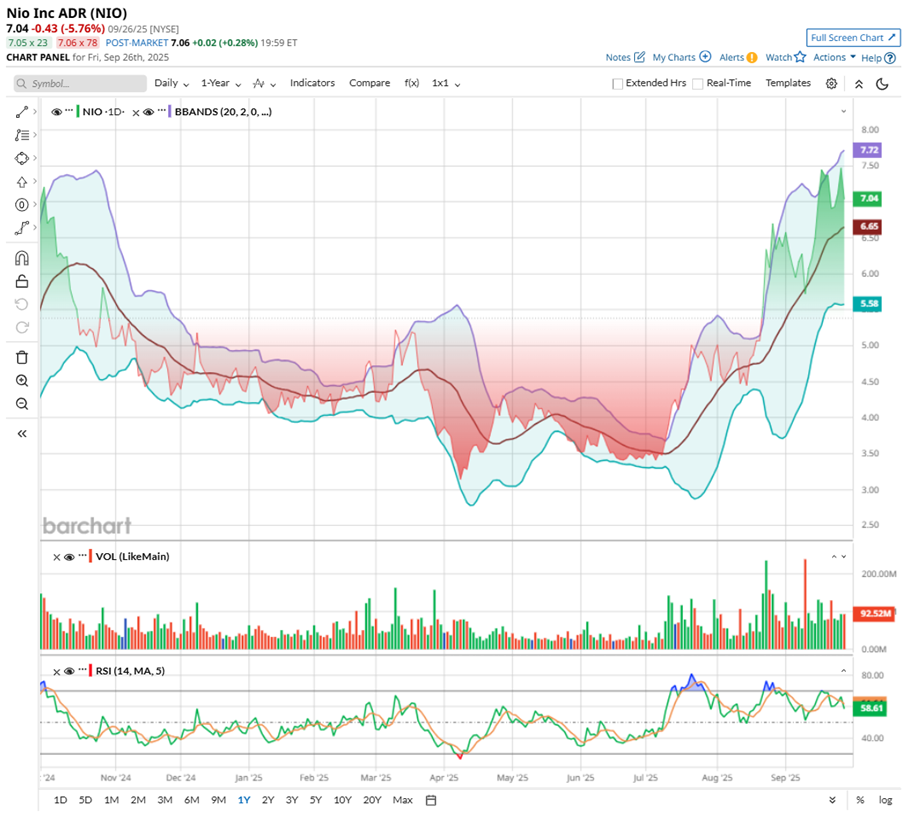

NIO stock has staged a remarkable turnaround in 2025. The stock touched a fresh high of $8.02 on Oct. 2 before seeing a slight pullback. Climbing by 2% over the past five sessions, NIO also remains up 124% in the last three months, 150% over the past six months, and 80% year-to-date (YTD). These gains underscore renewed investor confidence, fueled by record deliveries and stronger sentiment around China’s EV recovery.

Technicals show the stock hugging the upper Bollinger Band near $7.72, signaling strength yet overextension risks. Volume spikes above 90 million in recent sessions highlight heightened trading activity, suggesting confidence behind the rally. Meanwhile, Nio's RSI indicates neutral-to-bullish momentum, neither overbought nor oversold, leaving room for another leg higher if buying pressure persists.

NIO trades at 1.76 times forward sales, a notch above the sector average yet below its historical median. With analysts hinting at solid top-line momentum ahead, the current valuation feels like a sweet spot — premium enough to reflect its growth story, but still offering room for upside as the company continues scaling its EV ambitions.

Nio Posts Mixed Results

Nio’s latest quarter was a mixed bag but far from uninspiring. On Sept. 2, the EV maker posted Q2 2025 earnings results that showcased progress on the ground even as a few numbers came in shy of Street expectations. Revenue rose 9% year-over-year (YOY) to $2.65 billion, though that trailed consensus. Losses narrowed, with an adjusted loss of $0.25 per ADS, slightly beating forecasts.

The real highlight was operations. Nio delivered a record 72,056 vehicles, up 25.6% YOY thanks to momentum across its Nio, Onvo, and Firefly brands.

Margins told a mixed story. Gross margin improved to 10%, while operating losses slimmed nearly 6% YOY to $685.2 million. Vehicle margins slipped to 10.3%, compared to 12.2% last year.

On the brighter side, Nio’s cash reserves swelled to $3.8 billion, bolstering R&D spending. Sequentially, revenue and deliveries accelerated from Q1, while losses narrowed further.

Looking ahead, management guided Q3 deliveries between 87,000 and 91,000 vehicles, up 40.7% to 47.1% YOY. Nio also anticipates revenue to be between $3.05 billion and $3.19 billion, both record-setting forecasts.

August reinforced that optimism. Nio smashed delivery records with 31,305 vehicles, up 55% YOY and nearly 49% higher than July. The Onvo sub-brand stole the show, delivering 16,434 units. The core Nio brand sold 10,525 vehicles while Firefly also set monthly highs, delivering 4,346 units.

Analysts tracking NIO expect the firm's red ink to shrink meaningfully. They forecast a 34% YOY improvement to a loss of $0.99 per share in fiscal 2025, before tightening further with a sharp 72% reduction to a $0.28 per-share loss in fiscal 2026.

What Do Analysts Expect for NIO Stock?

It was not random that Citi raised its target for Nio. Analyst Jeff Chung's call is stitched together from a series of catalysts that tell a bigger story.

First, Chung projects the NEV penetration rate climbing to 65% in Q4, powered by stronger-than-expected BEV sales. Next, the analyst is betting on demand that’s already running hotter than most realize. Nio and its Onvo brand racked up 60,700 orders in a single week in September, smashing the estimated range of 30,000 to 40,000 for the ES8. Nio’s orders-to-sales ratio surged to 4.87 times month-to-date, dwarfing the sector average.

Chung estimates that sales will be 500,000 units in 2026 and 571,000 units in 2027, fueled by surging demand for fresh models such as the L90 and ES8. Margins are also poised to get a lift. Nio’s premium model cycle, underpinned by the ES8’s strength, is expected to deliver gross margins of 13.4% in 2025, 16.8% in 2026, and 18.1% in 2027.

Scale effects and cost discipline are key drivers here. Add in a ramp-up in production and Chung sees Nio turning free-cash-flow positive by the fourth quarter of fiscal 2025 with a net profit margin in sight. That’s why Chung calls it a “30-day upside catalyst watch.”

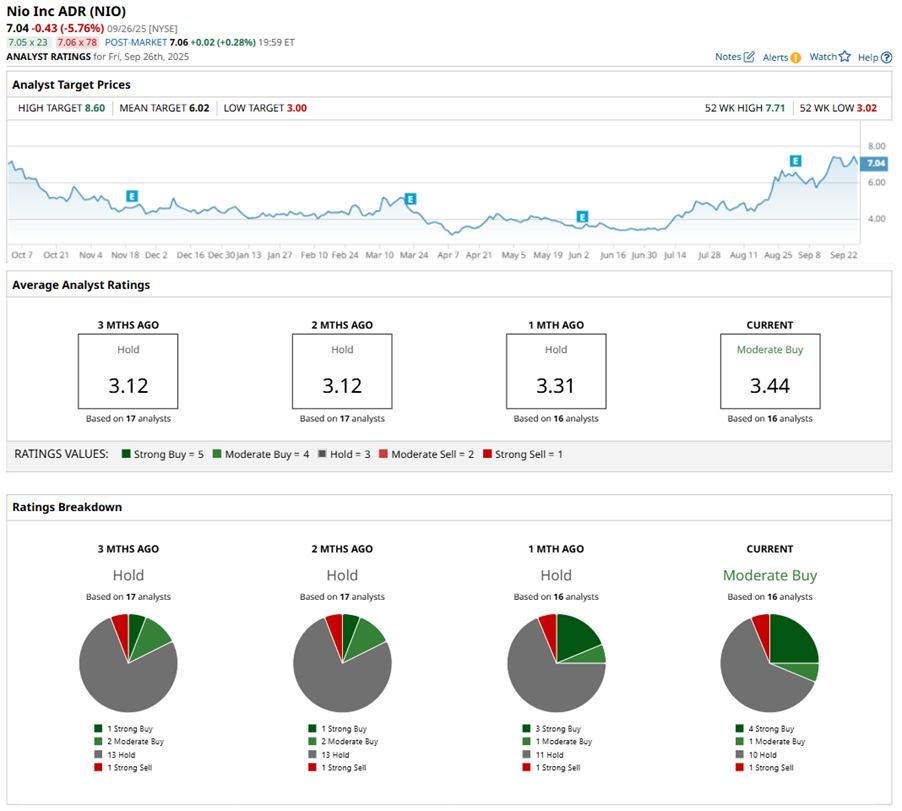

Analyst sentiment around this EV maker has started to shift in an intriguing way. Just a month ago, NIO stock sat with a “Hold” consensus, but momentum has pulled the needle toward a “Moderate Buy” consensus rating. Out of 16 analysts weighing in, four call it a “Strong Buy,” one has a “Moderate Buy" rating, 10 remain cautious with a “Hold" rating, and one provides a “Strong Sell" rating.

While NIO stock is already trading above the mean target of $6.02, Citi’s fresh Street-high target of $8.60 adds more spark, implying a potential 10% rally from here. It is this mix of optimism and restraint that makes Nio’s setup feel like a brewing inflection point.