Among the consumer discretionary stocks in the market, Nike (NKE) remains a closely watched stock for various reasons right now.

Shares of the footwear and apparel maker have been on a choppy ride this year, to say the least. Much of this recent decline, particularly the sharp stock price drop we saw in April, has to do with the new trade barriers put in place by the Trump administration. With more tariffs expected to come and existing tariffs now starting to hit retailers and producers of consumer discretionary items in countries like China, it's clear that margins could be looking a lot different a few quarters from now than they have in the past.

That said, the more recent decline Nike has seen does appear to be tied, at least in part, to comments made by the company's CEO, Elliott Hill. Let's dive into what Hill has to say and why the market appears to be looking outside Nike for other cyclical areas of the market to invest in right now.

Turnaround to Take Time

In an interview with CNBC last week, Elliott Hill touted Nike's progress in achieving some key milestones on its turnaround plan. However, the CEO also indicated it may “take a while” for investors to feel the full impact of the changes being put in place today.

Nike is working toward streamlining its product portfolio and pushing for more online sales. The company is also looking to win back shelf space from competitors and mind share from consumers with various strategic brand initiatives. But in terms of forward growth expectations, Nike's management team doesn't appear to have as much faith in its ability to hit the sort of targets Wall Street had set for the company. That's because Elliott's view is that it could take some time for the company to hit the mid- to high-single-digit levels of revenue growth (as well as margin expansion).

With too many near-term headwinds at play, I do think this cautious approach from the Nike CEO to guidance makes sense. But the market clearly doesn't like what it's hearing, and the thought of waiting out this turnaround period doesn't seem to be that tantalizing of an offer for most market participants given the stock price move we've seen in NKE stock of late.

What Do the Analysts Think?

I'm just one of millions of market participants out there trying to estimate what Nike's future growth rate and earnings prospects are. As such, I'd be the first to say that investors probably shouldn't listen just to me. Wall Street analysts covering Nike are much better attuned to the company's headwinds and tailwinds, and each focuses on modeling out where they see the company's cash flows headed (and therefore its valuation) over time.

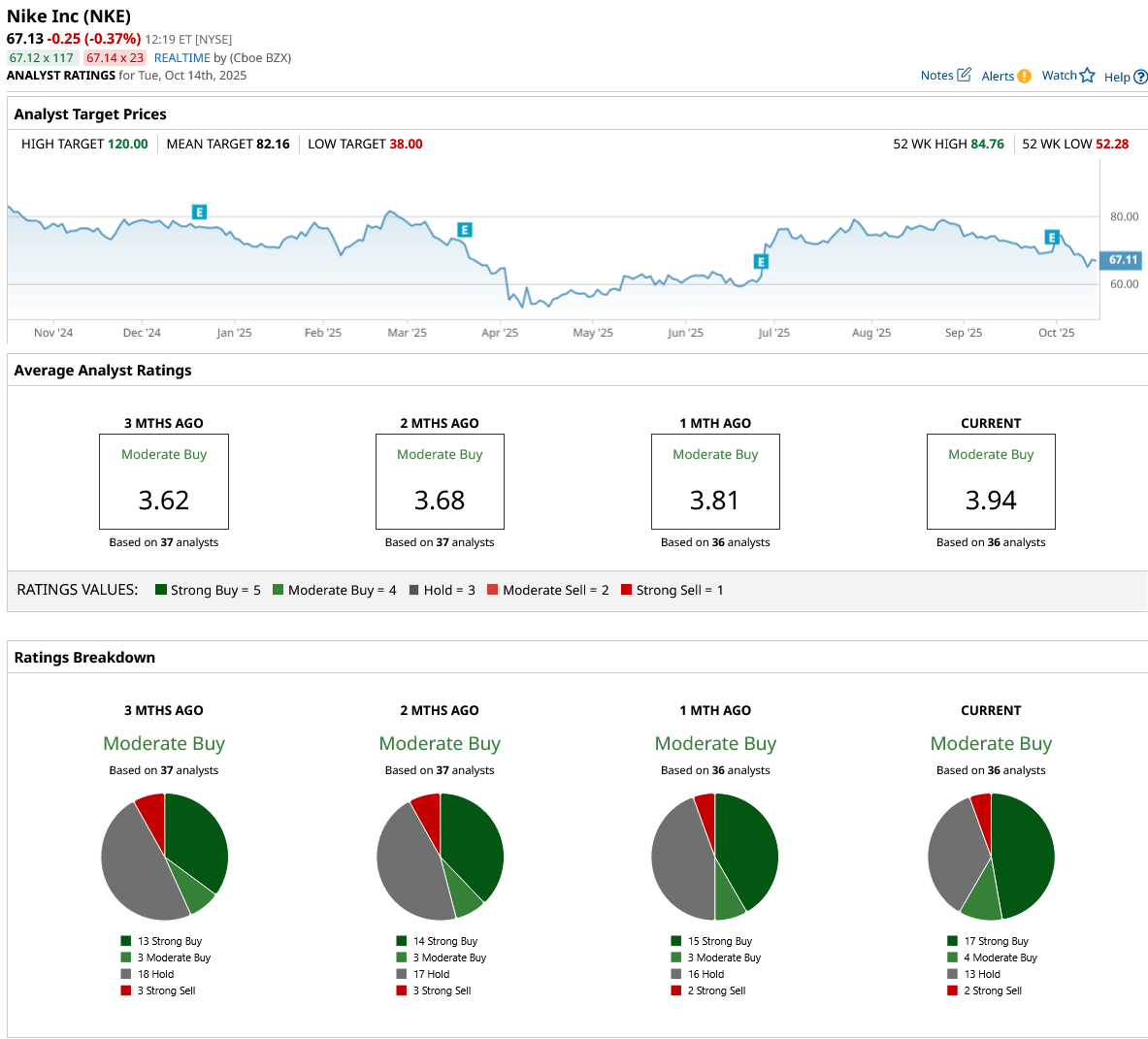

Looking at the analysts' consensus target of around $82 per share for NKE stock, there's clearly some upside potential with this stock. At least, according to analysts.

This consensus upside of around 22% from current levels wouldn't be bad at all for investors looking to hold onto shares over the course of the next year or so. However, this valuation does imply better traction on the company's turnaround efforts, which has been squashed a bit from those recent comments via Elliott Hill.

I'll be curiously watching NKE stock moving forward to see if anything changes on the narrative front. But for now, this does appear to be a tariff-hit consumer discretionary name without much in the way of pending catalysts to justify a buy, at least for now.

.png?w=600)