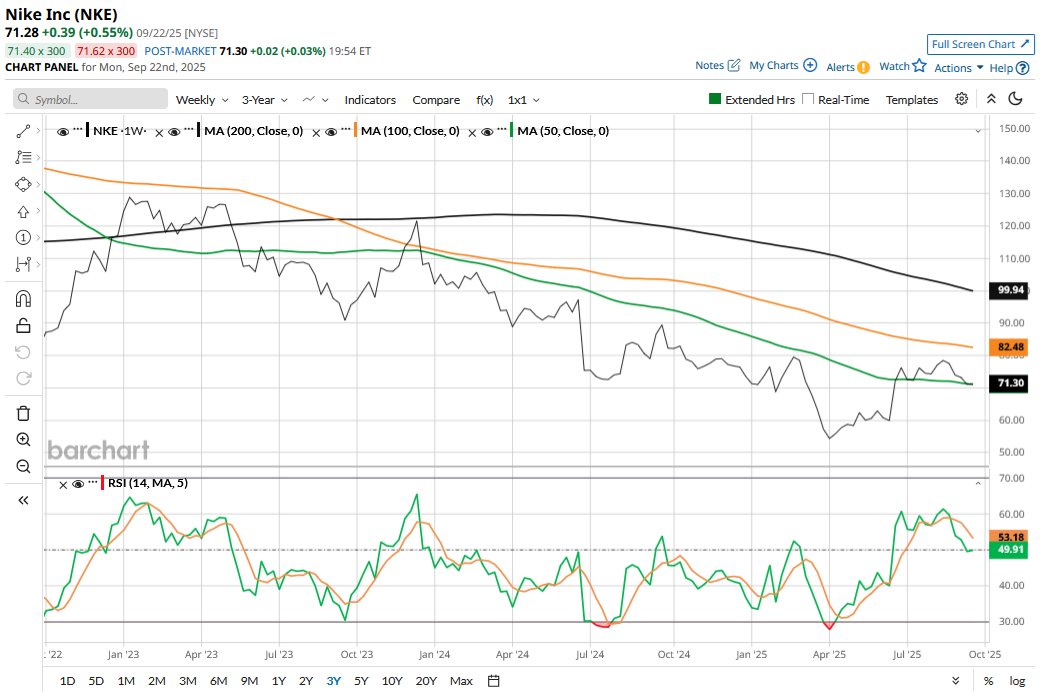

Nike (NKE) stock has underperformed terribly since peaking in late 2021. It has closed in the red for three years and is in the red this year as well. However, the stock has a healthy dividend yield of over 2.2% and is on track to become a Dividend Aristocrat. Let's explore the sustainability of Nike's dividend and examine whether the stock is a buy.

Nike Could Be the Next Dividend Aristocrat

Nike was never known for its dividends for good reasons. The company characterizes itself as a “growth company,” and investors don’t really expect such companies to even match the average S&P 500 Index ($SPX) constituent’s dividend yield, let alone beat it.

However, despite the several headwinds that the sneaker giant is facing, it has increased shareholder payouts, which have catapulted its dividend yield to over 2.2%. In fact, it has increased its dividends for 23 consecutive years, and repeating the feat for two more years will make it a Dividend Aristocrat.

The company’s dividend growth has been an impressive 10.3% over the last five years, while the 10-year CAGR is just over 11%. However, the dividend growth has tapered down, and earlier this year, it increased its dividend by 8%.

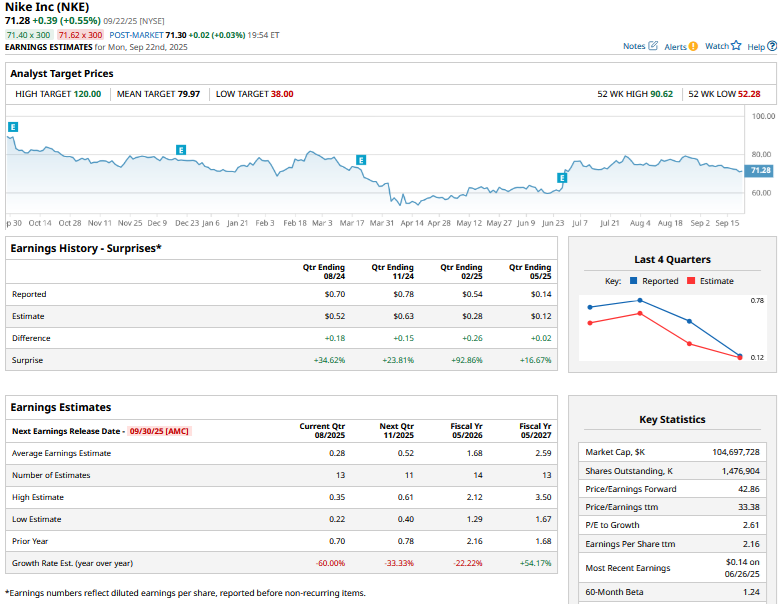

Nike’s earnings have taken a beating amid slowing sales. At the same time, it has been increasing its dividends, which has led to a rise in its payout ratio, which has surged above 70%. The payout multiples are high for comfort, considering the fact that Nike is still looking to invest in its business and is not among those names whose business has saturated, and the best thing they can do with free cash flows is to return them to shareholders. Notably, last fiscal year, Nike’s cash actually decreased as shareholder payouts, capital expenditures, and bond repayments more than offset its operating cash flows.

Will Nike Cut Its Dividend?

Nike increased its dividends over the last two years despite its profits falling. Analysts expect the company’s net income to decline by over 22% in the current fiscal year but are modeling a 54% rise in the next fiscal year.

I expect Nike to increase its dividends modestly when it takes a call on payouts early next year. Companies usually cut dividends when the going gets really tough, as these are perceived as a negative by the market. Nike increased its dividends even during the 2008 Global Financial Crisis and the Covid-19 pandemic in 2020, and while the company is currently facing challenges, these are not as severe as in 2008 and 2020.

NKE Stock Forecast

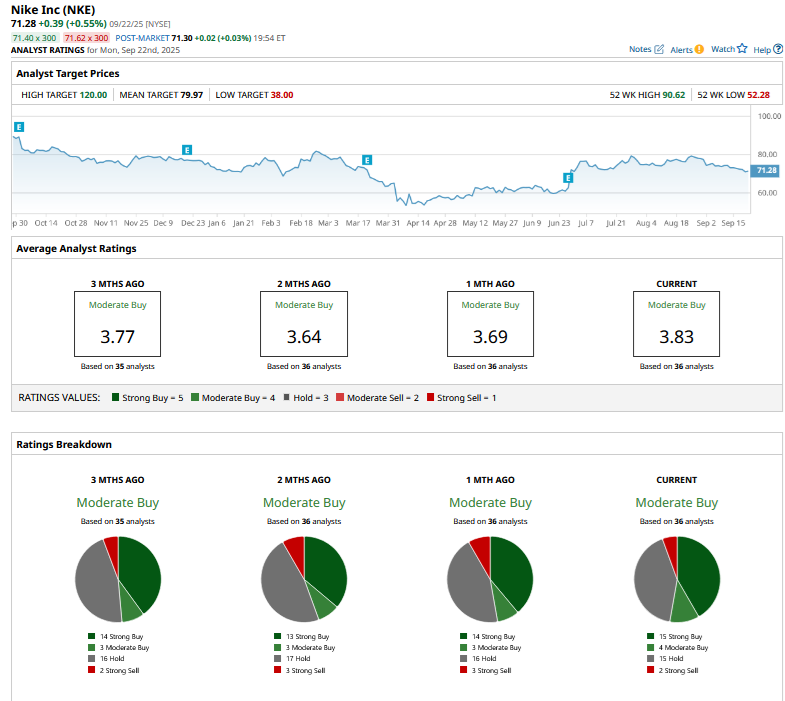

While Nike has a healthy dividend yield, it shouldn’t be the sole reason for buying NKE stock since the bulk of the returns should still come from capital appreciation. Nike’s mean target price is $79.97, which represents a potential upside of around 12% over the next year.

The overall Street sentiment towards NKE is quite somber, though, and of the 36 analysts covering the stock, only 19 rate it as a “Strong Buy” or “Moderate Buy.” 15 analysts rate NKE as a “Hold,” while the remaining two rate it as a “Strong Sell.”

Should You Buy NKE Stock?

Nike was plagued by several factors over the last couple of years. The company slackened on innovation and overplayed its hand by dialing back on third-party sellers. While the pivot to its own channels bore fruit initially during the Covid-19 pandemic, the company lost out to both established brands and newer players who were well stocked at third-party sellers.

Nike has done a course correction and has increased its focus on innovation. The company has also mended relations with wholesalers and has, among others, started selling its products on Amazon (AMZN).

Meanwhile, even as Nike has addressed many of the company-specific issues, the macro environment continues to be challenging. For instance, Nike is facing intense competition in Greater China, where its sales fell by 13% in the last fiscal year, the highest decline for any region. The slowdown only worsened as the year progressed, and Nike’s sales in the region fell by a whopping 21% in the final quarter. China is increasingly becoming a tough market for Nike (or, for that matter, all U.S. brands) as domestic brands like Anta and Li-Ning have gained at the expense of foreign brands.

During the fiscal Q4 2025 earnings call, Nike CEO Elliott Hill admitted that a recovery in “China will take longer due to the unique characteristics of the marketplace.”

The U.S. tariffs have not made life any easier for Nike. While the company said that it would reduce sourcing from China, which accounts for around a sixth of the footwear it imports stateside, to high single digits by the end of this fiscal year, it won’t be able to fully mitigate the tariffs. The tariffs are quite universal, and other sourcing hubs like Vietnam are also subject to tariffs, albeit to a lesser degree than China.

Nike’s near-term valuations continue to look ugly with a forward price-to-earnings (P/E) multiple of 42.8x and a P/E-to-growth (PEG) multiple of 2.61x. However, the Nike story is not about the short-term earnings, which are visibly depressed and not indicative of the company’s long-term earnings potential. Nike is a play on the turnaround, which should help trigger an earnings revival after the intermittent pain. I remain bullish on Nike amid the turnaround, which should start showing results in the coming quarters.