Valued at approximately $14 billion by market cap, New York-based News Corporation (NWSA) operates as a global media and information services company that creates and distributes content across various platforms, including newspapers, digital media, book publishing, and subscription video services.

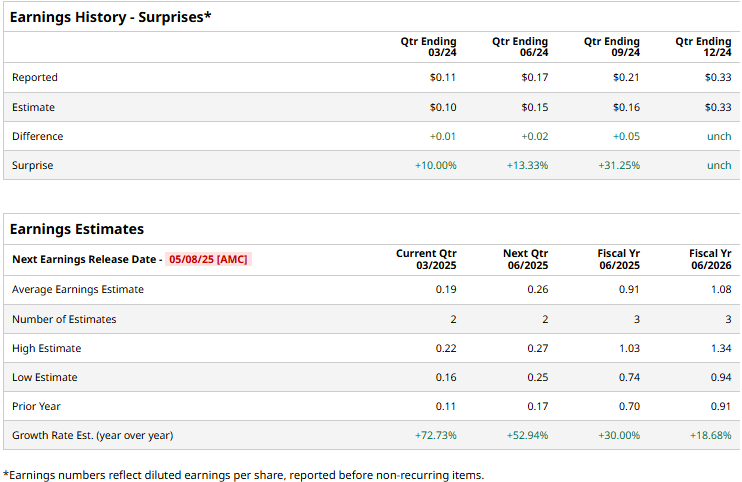

The media giant is gearing up to report its third-quarter results after the markets close on Thursday, May 8. Ahead of the event, analysts expect NWSA to report an adjusted EPS of $0.19, marking a 72.7% increase from $0.11 reported in the year-ago quarter. Furthermore, the company met or surpassed the Street’s bottom-line expectations in each of the past four quarters.

For the full fiscal 2025, NWSA is expected to deliver an adjusted EPS of $0.91, marking a 30% increase from $0.70 reported in fiscal 2024. While in fiscal 2026, its earnings are expected to further surge 18.7% year-over-year to $1.08 per share.

NWSA stock gained 12.1% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 9.4% gains, while lagging behind the Communication Services Select Sector SPDR ETF Fund’s (XLC) 21% surge during the same time frame.

News Corp.’s stock experienced a marginal drop in the trading session after the release of its Q2 results on Feb. 5. Driven by revenue growth in its Digital Real Estate Services, Book Publishing and Dow Jones segments, the company’s overall topline increased 4.8% year-over-year to more than $2.2 billion, which surpassed the consensus estimates by 1.9%. Meanwhile, the company’s earnings also experienced a significant boost; its adjusted EBITDA for the quarter surged 19.5% year-over-year to $478 million. Its adjusted EPS jumped 22.2% year-over-year to $0.33, matching analysts’ projections. Following the initial dip, NWSA stock rebounded 1.9% in the next trading session.

The consensus view on NWSA remains extremely bullish, with a “Strong Buy” rating overall. All nine analysts covering the stock recommend a “Strong Buy” rating on NWSA. Its mean price target of $38 suggests a 40.1% upside potential from current price levels.