Newcastle real estate is poised to become more expensive than Melbourne's after the typical house price rocketed beyond $800,000 for the first time last month.

Data from CoreLogic shows the median price of houses and units across Newcastle and Lake Macquarie in September was $771,000, just $4000 behind the Melbourne median.

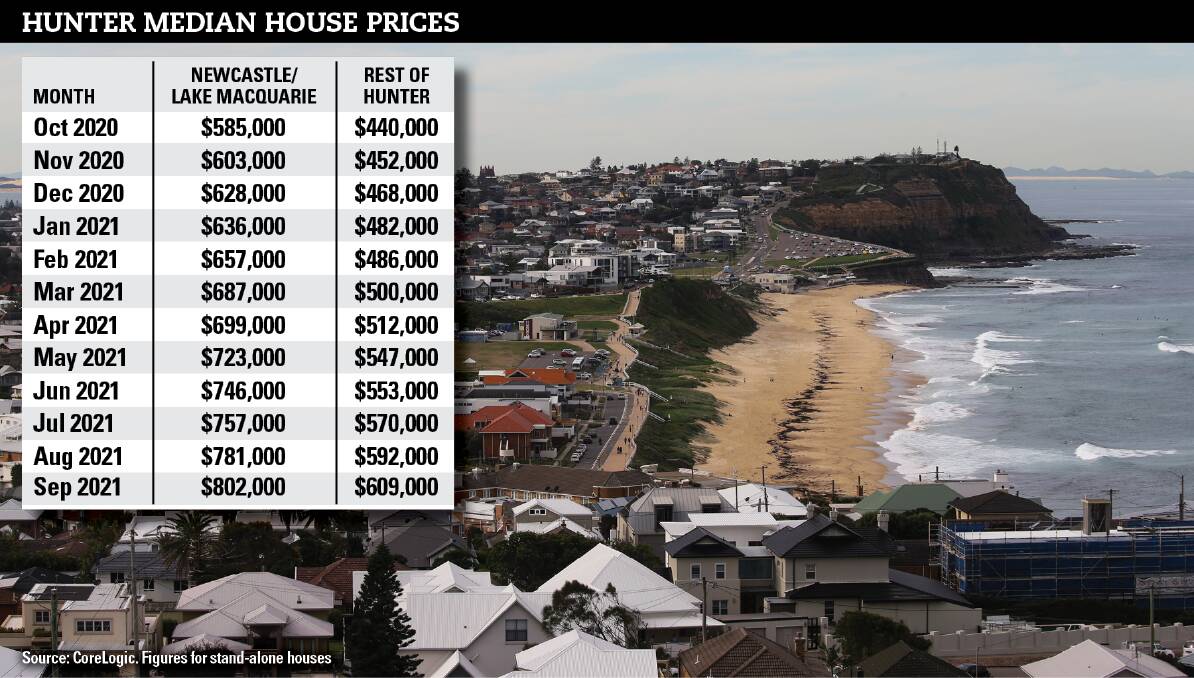

The value of a typical stand-alone house in Newcastle has grown 2.1 per cent in a month and an eye-watering 30 per cent in the past year to now sit at $802,000.

The median house price was $628,000 at the start of the year and passed $700,000 for the first time in May, just four months ago.

The median apartment price jumped 2 per cent in September and 17.8 per cent in a year to $614,000.

The median value of a stand-alone house in Melbourne, $962,000, is still higher than in Newcastle, but the Victorian capital's higher ratio of units brings its overall median to $775,000.

Sydney's median property price is $1.056 million, comprising a median house price of $1.312 million and apartment price of $825,000.

Real estate values in the rest of the Hunter, across the Maitland, Port Stephens, Cessnock, Singleton, Dungog, Muswellbrook and Upper Hunter local government areas, are also continuing to rise sharply to record highs.

The median freestanding house price in these areas surged past $600,000 for the first time to $609,000 and is up 27 per cent in a year.

The monthly property price rises across the Hunter exceeded increases in every state and territory capital except Hobart. Sydney prices rose 1.9 per cent and Melbourne's 0.8 per cent.

CoreLogic research director Tim Lawless believes slowing price growth in most capitals is down to relatively stagnant wages and the end of government stimulus grants, but these factors have not yet put a brake on the Hunter property market.

The Reserve Bank held official interest rates at 0.1 per cent at its monthly board meeting on Tuesday.

It also maintained its view that the cash rate would not increase until inflation consistently reached a target range of two to three per cent no sooner than 2024.

Mr Lawless said record price growth in the past year had made home ownership more challenging for some, even though relatively cheap borrowing will continue into the foreseeable future.

"With housing values rising substantially faster than household incomes, raising a deposit has become more challenging for most cohorts of the market, especially first home buyers," he said.

"Sydney is a prime example where the median house value is now just over $1.3 million.

"In order to raise a 20 per cent deposit, the typical Sydney house buyer would need around $262,300.

"Existing home owners looking to upgrade, downsize or move home may be less impacted as they have had the benefit of equity that has accrued as housing values surged."

The growth in prices means the typical 20 per cent mortgage deposit on a house in Newcastle and Lake Macquarie local government areas is about $160,000, or $120,000 for an apartment.

Mr Lawless said the slowing in first home buyers could be seen in national lending data, where the number of owner occupier first home buyer loans had fallen 20.5 per cent between January and July.

"Over the same period, the number of first home buyers taking out an investment housing loan has increased, albeit from a low base, by 45 per cent, suggesting more first home buyers are choosing to rent-vest as a way of getting their foot in the door."

In the news

- Perrottet 'ready to begin new chapter for NSW

- Lake Macquarie cases surge as Hunter adds 65 COVID infections

- $100,000 stumbling block: Hunter dream home 'not fit for purpose'

- Woman dead, man in serious condition after Tea Gardens crash

- Hunter won't hit vaccine targets by October 11, data shows

- Super Saturday of elections may be on cards for NSW after resignations