Although Netflix (NFLX) stock has risen 40% in 2025, Wall Street remains bullish on the streaming giant's prospects. Last week, Loop Capital upgraded NFLX stock from "Hold" to “Buy,” raising its price target by $200 to $1,350, implying an upside of 12.5%.

The upgrade centers on Netflix's exceptional third-quarter performance as user engagement rose 17%, driven by its robust content portfolio. Loop Capital emphasized that Netflix is on track to achieve a record share of U.S. TV consumption for Q3, a critical metric since the U.S. accounts for more than 40% of total revenue.

In the September quarter, Loop Capital expects revenue to rise 18% year-over-year (YoY) to $11.6 billion, with adjusted earnings per share of $7.11, which is higher than both the company's and consensus estimates. Netflix's expanding operating margins of almost 30% and an EBITDA margin of 68% showcase its leadership position and operational efficiency.

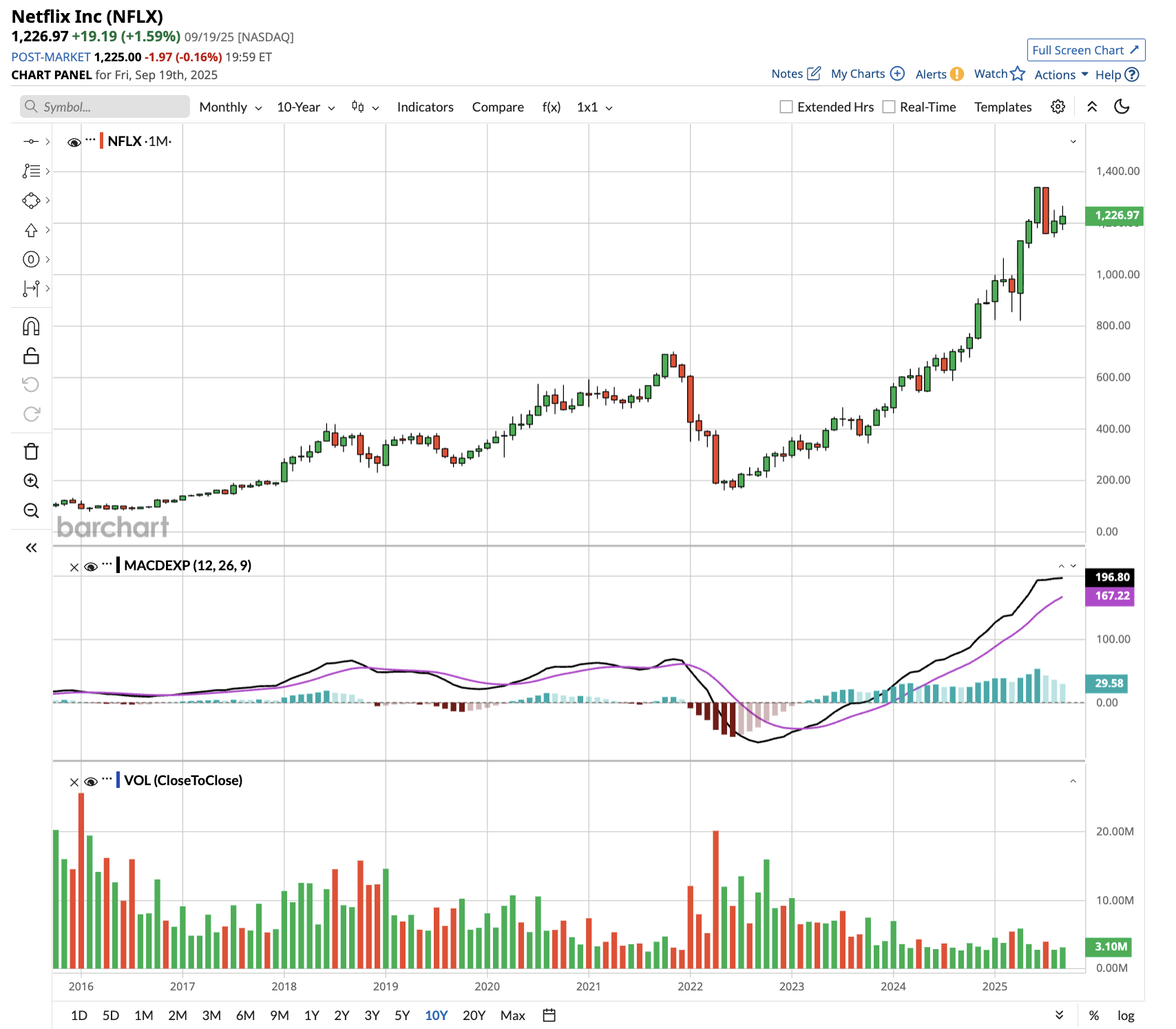

Valued at a market cap of $521 billion, NFLX stock is up over 1,000% over the past decade. Let’s see if NFLX stock is a good buy right now.

Should You Buy, Sell, or Hold Netflix Stock?

Netflix presents a compelling yet nuanced investment case following its strong Q2 results, as management commentary revealed both opportunities and challenges for the streaming behemoth.

The streaming behemoth raised its full-year revenue guidance to $45 billion (at the midpoint estimate) with an operating margin of 30%. Its content investment has increased from $11 billion in 2020 to $16 billion this year, allowing Netflix to improve customer engagement. Recent hits like Squid Game Season 3 and KPop Demon Hunters demonstrate Netflix's ability to create cultural phenomena that extend far beyond viewing metrics.

The advertising tier is gaining traction, with management expecting to roughly double ad revenue in 2025. Netflix's proprietary ad-tech stack rollout across all markets provides enhanced targeting capabilities and easier access for advertisers. Live programming, including NFL games and boxing matches, creates shared cultural moments that drive subscriber acquisition and retention.

Alternatively, Netflix faces intensifying competition for viewing time from free platforms like YouTube. The U.S. viewing share has stagnated despite significant increases in content spending. Per-member engagement growth remains flat when adjusted for changes in household sharing, suggesting the platform may be approaching saturation in core markets.

The company's aggressive international expansion and content localization strategy requires substantial upfront investment with uncertain returns. Rising content costs could pressure margins if engagement growth doesn't accelerate meaningfully.

What Is the Target Price for NFLX Stock?

Analysts tracking NFLX stock forecast revenue to rise from $39 billion in 2024 to $68.6 billion in 2029. During this period, adjusted earnings per share are expected to increase from $19.83 to $52.73.

NFLX stock trades at 42.2 times forward earnings, which is higher than its five-year average of 38.5 times. If the stock is priced at 35x earnings, it should trade around $1,850 in early 2029, indicating an upside potential of 50% from current levels.

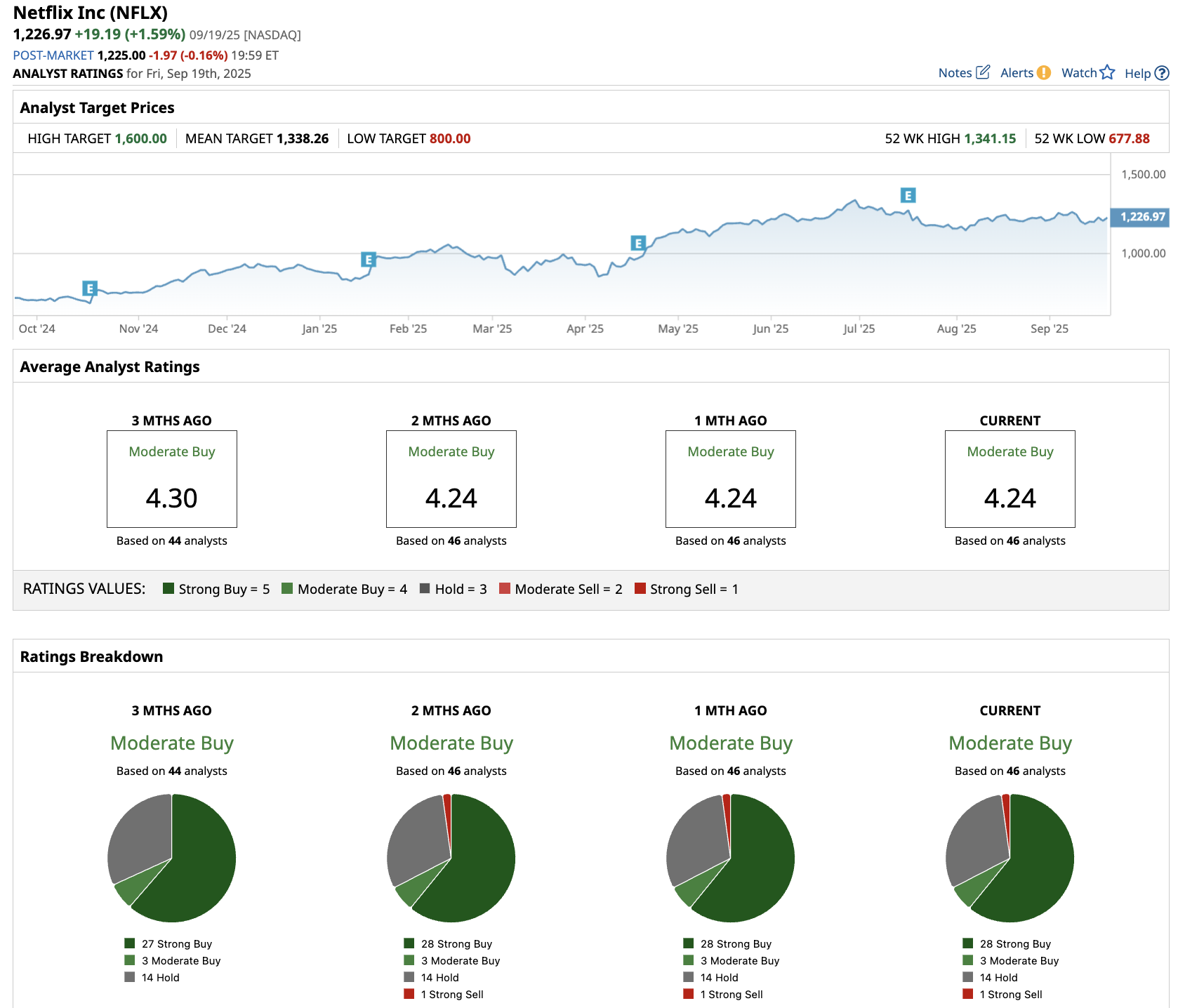

Out of the 46 analysts covering NFLX stock, 28 recommend “Strong Buy,” three recommend “Moderate Buy,” 14 recommend “Hold,” and one recommends “Strong Sell.” The average NFLX stock price target is $1,338, higher than the current price of $1,227.

Netflix remains a high-quality business with durable competitive advantages and strong cash generation. However, the current valuation appears to reflect much of the positive momentum.

Potential investors should wait for better entry points, while existing shareholders can maintain positions given the company's proven ability to navigate competitive challenges and expand globally.