Streaming giant Netflix Inc. (NASDAQ:NFLX) is seeing renewed strength in subscriber engagement, according to a leading analyst covering the stock.

Check out the current price of NFLX stock here.

What Happened: On Thursday, Alicia Reese, Vice President of equity research at Wedbush Securities, said the company’s retention was “shockingly strong” for the second quarter, while speaking on Bloomberg TV, noting that “quite a few people that came back to the service that had churned out over the last quarter.”

She further notes that despite the recent price hikes, particularly in the “Premium Tier,” user stickiness remains high, which is attributed to the new ad-supported tier, allowing users to downgrade their plans instead of canceling outright.

See Also: Netflix’s Bet On Women’s Boxing Pays Off: Here’s How Many People Watched Taylor Vs. Serrano

Content was cited as a major reason subscribers returned, with the analyst pointing to the recovery in programming volumes following the disruptions caused by last year's SAG-AFTRA strikes.

“Now we're seeing in the second quarter and we should see through the rest of the year, and throughout the following year, really good content, quality content and volume,” she said.

She mentions titles such as Squid Game and WWE programming to make her case. “They had Squid Game that brought back a lot of people,” and WWE was highlighted as a strong retention driver due to its recurring nature and additional content. “There's a lot of shoulder programming around that.”

The company's ad-supported tier was also credited with reducing churn during the quarter. Reese says that with this tier, “you just trade down for a little while when you don't have quite as much to watch or if you're price sensitive.”

While not yet fully accretive globally, the analyst suggested that Netflix’s ad business “has a ways to go,” but adds that it is making strides toward profitability, particularly in North America.

Why It Matters: The company released its second quarter results on Thursday, reporting $11.08 billion, up 16% year-over-year, ahead of consensus estimates at $11.04 billion.

It posted a profit of $7.19 per share, once again beating analyst estimates at $7.06, driven by a strong content slate and subscriber momentum during the quarter.

Price Action: Netflix shares were up 1.91% on Thursday, trading at $1,274.17 per share, and is down 1.21% after hours, after its earnings announcement.

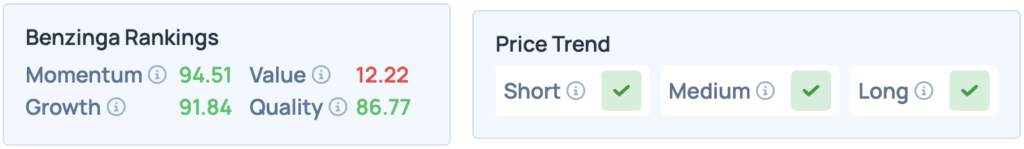

According to Benzinga’s Edge Stock Rankings, Netflix shares score high on Momentum, Growth and Quality, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Shutterstock